- Saudi Arabia

- /

- Consumer Durables

- /

- SASE:1213

Many Still Looking Away From Naseej International Trading Company (TADAWUL:1213)

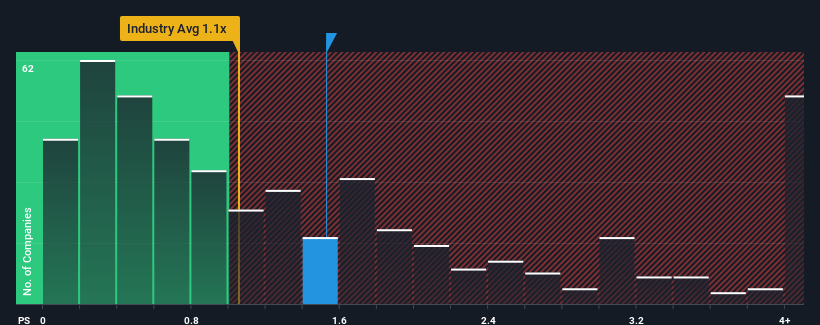

With a median price-to-sales (or "P/S") ratio of close to 1.1x in the Consumer Durables industry in Saudi Arabia, you could be forgiven for feeling indifferent about Naseej International Trading Company's (TADAWUL:1213) P/S ratio of 1.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Naseej International Trading

How Has Naseej International Trading Performed Recently?

The revenue growth achieved at Naseej International Trading over the last year would be more than acceptable for most companies. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Naseej International Trading's earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Naseej International Trading's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 8.4%. Pleasingly, revenue has also lifted 38% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 9.2% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's curious that Naseej International Trading's P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

What Does Naseej International Trading's P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Naseej International Trading currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Naseej International Trading with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Naseej International Trading might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:1213

Naseej International Trading

Together with subsidiaries, engages in the manufacture, import, export, wholesale, and retailing of carpets and rugs in the Kingdom of Saudi Arabia.

Excellent balance sheet and overvalued.

Market Insights

Community Narratives