- Saudi Arabia

- /

- Commercial Services

- /

- SASE:9540

The recent ر.س83m market cap decrease is likely to have disappointed insiders invested in National Environmental Recycling Company (TADAWUL:9540)

Key Insights

- Significant insider control over National Environmental Recycling implies vested interests in company growth

- The top 3 shareholders own 53% of the company

- Using data from company's past performance alongside ownership research, one can better assess the future performance of a company

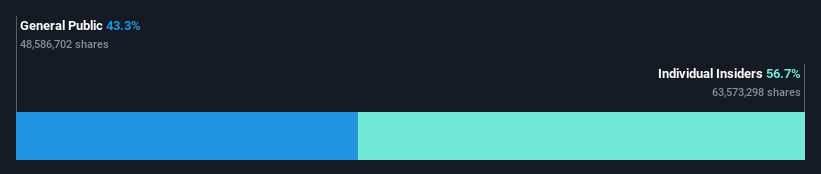

To get a sense of who is truly in control of National Environmental Recycling Company (TADAWUL:9540), it is important to understand the ownership structure of the business. We can see that individual insiders own the lion's share in the company with 57% ownership. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

And following last week's 10% decline in share price, insiders suffered the most losses.

Let's take a closer look to see what the different types of shareholders can tell us about National Environmental Recycling.

See our latest analysis for National Environmental Recycling

What Does The Lack Of Institutional Ownership Tell Us About National Environmental Recycling?

Institutional investors often avoid companies that are too small, too illiquid or too risky for their tastes. But it's unusual to see larger companies without any institutional investors.

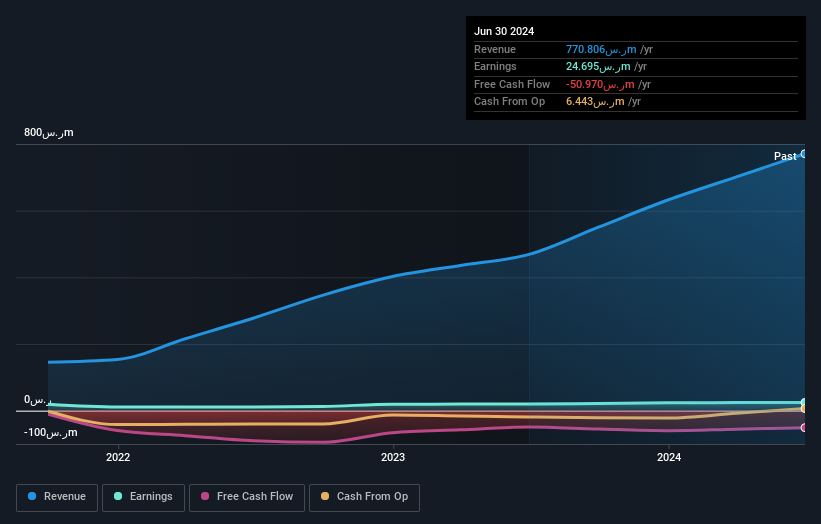

There are multiple explanations for why institutions don't own a stock. The most common is that the company is too small relative to funds under management, so the institution does not bother to look closely at the company. It is also possible that fund managers don't own the stock because they aren't convinced it will perform well. National Environmental Recycling might not have the sort of past performance institutions are looking for, or perhaps they simply have not studied the business closely.

National Environmental Recycling is not owned by hedge funds. Looking at our data, we can see that the largest shareholder is Eyad Abdulaziz Al Nafea with 25% of shares outstanding. In comparison, the second and third largest shareholders hold about 23% and 5.2% of the stock. Furthermore, CEO Nasser Muhammad Al Dueb is the owner of 2.3% of the company's shares.

A more detailed study of the shareholder registry showed us that 3 of the top shareholders have a considerable amount of ownership in the company, via their 53% stake.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of National Environmental Recycling

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our information suggests that insiders own more than half of National Environmental Recycling Company. This gives them effective control of the company. That means they own ر.س407m worth of shares in the ر.س718m company. That's quite meaningful. Most would argue this is a positive, showing strong alignment with shareholders. You can click here to see if those insiders have been buying or selling.

General Public Ownership

With a 43% ownership, the general public, mostly comprising of individual investors, have some degree of sway over National Environmental Recycling. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for National Environmental Recycling you should be aware of, and 1 of them is concerning.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you're looking to trade National Environmental Recycling, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if National Environmental Recycling might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:9540

National Environmental Recycling

National Environmental Recycling Company recycles electronic and electrical equipment in the Kingdom of Saudi Arabia and the United Arab Emirates.

Adequate balance sheet very low.

Market Insights

Community Narratives