- Saudi Arabia

- /

- Commercial Services

- /

- SASE:9540

National Environmental Recycling Company's (TADAWUL:9540) 25% Price Boost Is Out Of Tune With Earnings

Despite an already strong run, National Environmental Recycling Company (TADAWUL:9540) shares have been powering on, with a gain of 25% in the last thirty days. The annual gain comes to 102% following the latest surge, making investors sit up and take notice.

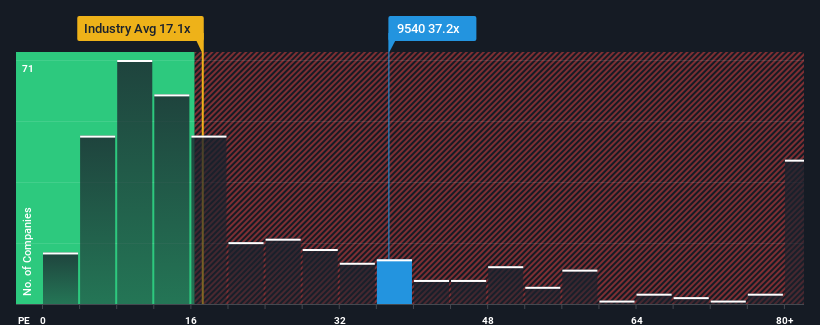

Following the firm bounce in price, given close to half the companies in Saudi Arabia have price-to-earnings ratios (or "P/E's") below 23x, you may consider National Environmental Recycling as a stock to avoid entirely with its 37.2x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Earnings have risen firmly for National Environmental Recycling recently, which is pleasing to see. One possibility is that the P/E is high because investors think this respectable earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for National Environmental Recycling

Is There Enough Growth For National Environmental Recycling?

National Environmental Recycling's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered an exceptional 20% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 9.6% drop in EPS in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 17% shows it's an unpleasant look.

With this information, we find it concerning that National Environmental Recycling is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Final Word

Shares in National Environmental Recycling have built up some good momentum lately, which has really inflated its P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that National Environmental Recycling currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you take the next step, you should know about the 1 warning sign for National Environmental Recycling that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if National Environmental Recycling might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:9540

National Environmental Recycling

National Environmental Recycling Company recycles electronic and electrical equipment in the Kingdom of Saudi Arabia and the United Arab Emirates.

Adequate balance sheet with poor track record.