- Saudi Arabia

- /

- Professional Services

- /

- SASE:1833

None And 2 Other Hidden Gems To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a mix of rising consumer confidence concerns, declining manufacturing orders, and fluctuating stock indices, investors are increasingly on the lookout for opportunities that may not be immediately apparent. In this climate, identifying stocks with strong fundamentals and potential for growth can be crucial, especially when considering small-cap companies that might offer unique advantages in a shifting economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

ZeusLtd (KOSDAQ:A079370)

Simply Wall St Value Rating: ★★★★★★

Overview: Zeus Co., Ltd. offers comprehensive solutions in the semiconductor, robotics, and display sectors both domestically in South Korea and internationally, with a market capitalization of approximately ₩394.91 billion.

Operations: ZeusLtd generates revenue primarily from its Equipment Division, contributing approximately ₩477.92 billion, and Valve segment with around ₩23.54 billion.

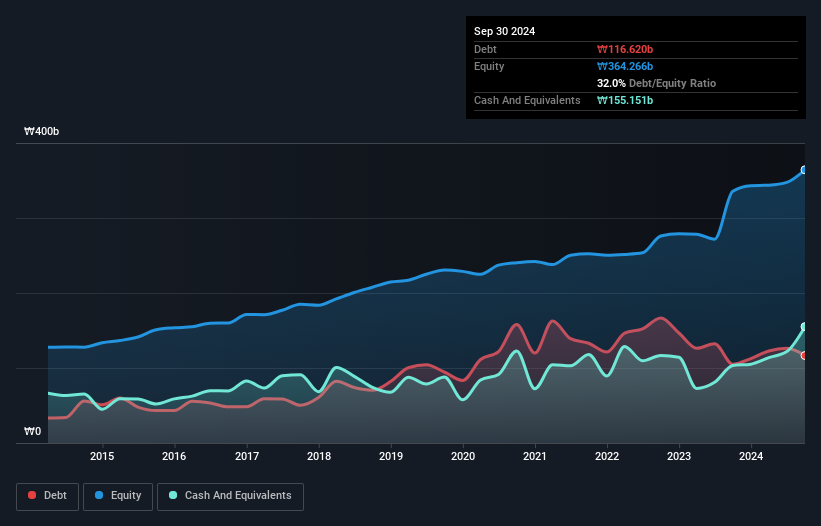

ZeusLtd, a nimble player in the industry, has been making waves with its impressive financial performance. Over the past year, earnings soared by 121%, outpacing the broader semiconductor sector's growth of 7%. The company is trading at a notable 34% below its estimated fair value, presenting an attractive opportunity. Debt management appears robust as their debt-to-equity ratio improved from 41% to 32% over five years. Recent buybacks included repurchasing over 333,000 shares for KRW 4.99 billion, reflecting confidence in its valuation and future prospects. With high-quality earnings and positive free cash flow, ZeusLtd seems well-positioned for continued growth.

- Unlock comprehensive insights into our analysis of ZeusLtd stock in this health report.

Assess ZeusLtd's past performance with our detailed historical performance reports.

SUNIC SYSTEM (KOSDAQ:A171090)

Simply Wall St Value Rating: ★★★★★☆

Overview: SUNIC SYSTEM Co., Ltd. is a Korean company that specializes in the manufacturing and sale of OLED equipment, with a market cap of ₩401.87 billion.

Operations: SUNIC SYSTEM generates revenue primarily from the manufacture and sale of display manufacturing equipment, amounting to ₩99.97 billion.

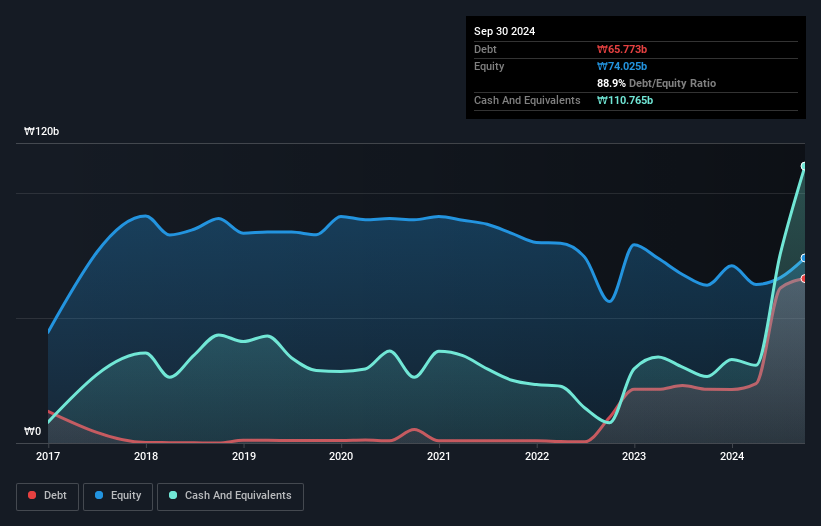

SUNIC SYSTEM, a smaller player in the semiconductor space, has shown remarkable earnings growth of 66.6% over the past year, outpacing the industry average of 7.4%. Despite its debt to equity ratio rising from 1.2% to 88.9% over five years, it holds more cash than total debt and covers interest payments well with an EBIT coverage of 12.4 times. The recent financials reveal a turnaround with Q3 net income at KRW 7,890 million against last year's loss of KRW 4,320 million and basic earnings per share improving to KRW 901 from a loss per share of KRW 501 previously.

- Get an in-depth perspective on SUNIC SYSTEM's performance by reading our health report here.

Evaluate SUNIC SYSTEM's historical performance by accessing our past performance report.

Almawarid Manpower (SASE:1833)

Simply Wall St Value Rating: ★★★★★★

Overview: Almawarid Manpower Company offers professional manpower services to individuals and businesses in Saudi Arabia, with a market capitalization of SAR1.62 billion.

Operations: Almawarid Manpower generates revenue primarily from three segments: Corporate (SAR1.19 billion), Individual (SAR255.28 million), and Hourly (SAR154.09 million).

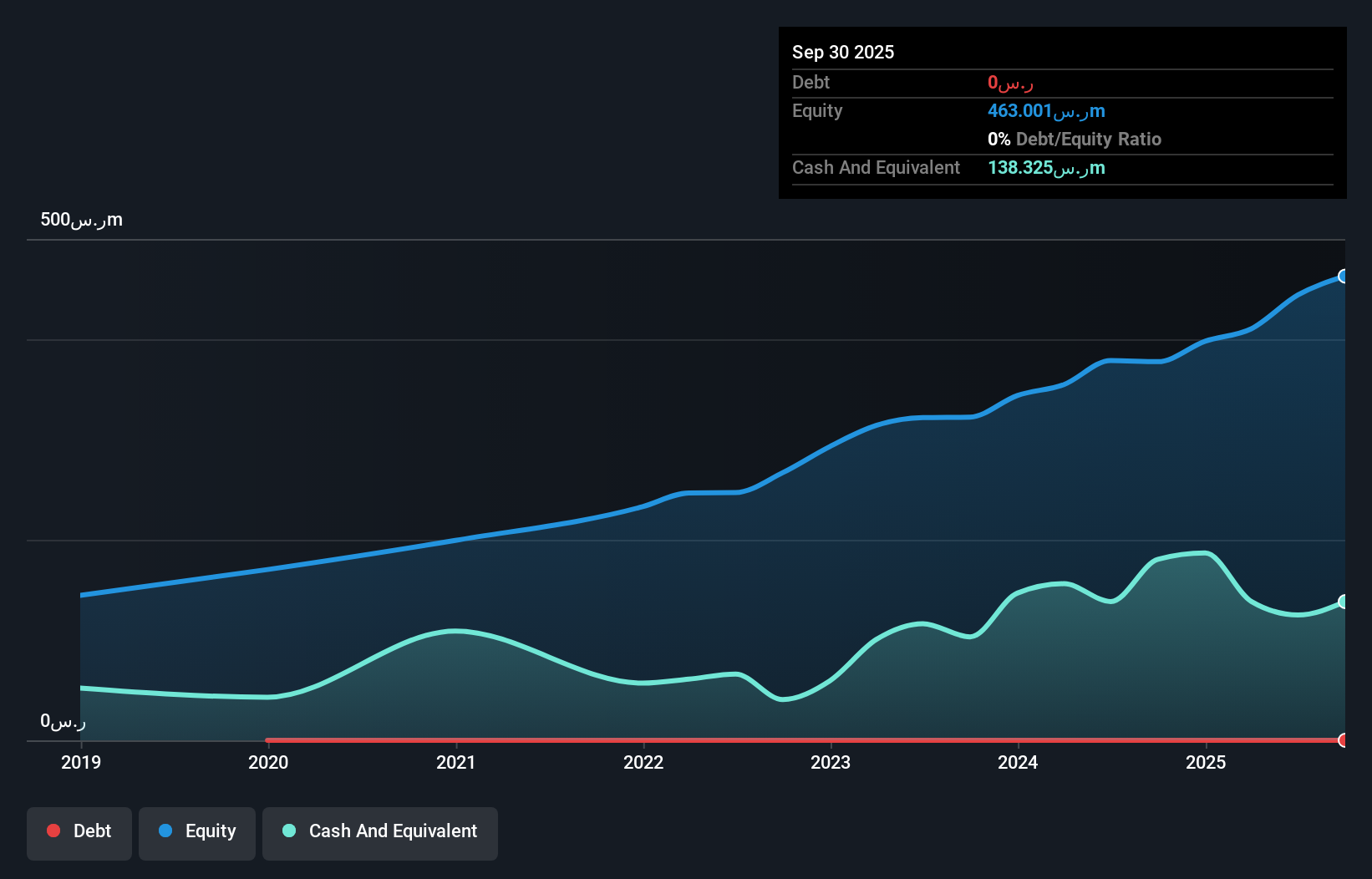

Almawarid Manpower, a smaller player in the manpower industry, has shown mixed financial performance recently. In Q3 2024, sales reached SAR 468.03 million, up from SAR 320.07 million the previous year, yet net income dipped to SAR 17.1 million from SAR 22.93 million. Over nine months ending September 2024, sales were SAR 1.26 billion compared to last year's SAR 919.23 million; however, net income slightly decreased to SAR 66.74 million from SAR 67.54 million previously reported for the same period last year despite being debt-free and trading at a good value relative to peers and industry standards.

- Click to explore a detailed breakdown of our findings in Almawarid Manpower's health report.

Gain insights into Almawarid Manpower's past trends and performance with our Past report.

Seize The Opportunity

- Get an in-depth perspective on all 4638 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:1833

Almawarid Manpower

Provides professional manpower to individuals and businesses in the Kingdom of Saudi Arabia.

Very undervalued with flawless balance sheet.