- Saudi Arabia

- /

- Professional Services

- /

- SASE:1833

Almawarid Manpower Company's (TADAWUL:1833) Shares Leap 26% Yet They're Still Not Telling The Full Story

Almawarid Manpower Company (TADAWUL:1833) shareholders have had their patience rewarded with a 26% share price jump in the last month. Unfortunately, despite the strong performance over the last month, the full year gain of 6.0% isn't as attractive.

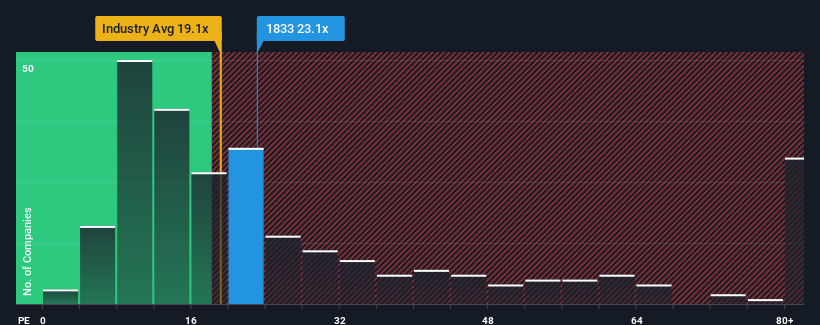

Even after such a large jump in price, there still wouldn't be many who think Almawarid Manpower's price-to-earnings (or "P/E") ratio of 23.1x is worth a mention when the median P/E in Saudi Arabia is similar at about 24x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Almawarid Manpower could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Almawarid Manpower

What Are Growth Metrics Telling Us About The P/E?

Almawarid Manpower's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 5.2%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 58% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 23% per annum over the next three years. That's shaping up to be materially higher than the 15% per year growth forecast for the broader market.

In light of this, it's curious that Almawarid Manpower's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Almawarid Manpower's P/E?

Almawarid Manpower appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Almawarid Manpower currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Almawarid Manpower with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Almawarid Manpower, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:1833

Almawarid Manpower

Provides recruitment services for domestic workers, expatriate labor services, and operates temporary employment agency for domestic services in the Kingdom of Saudi Arabia.

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives