- Saudi Arabia

- /

- Commercial Services

- /

- SASE:1832

Sadr Logistics (TADAWUL:1832) shareholders are up 13% this past week, but still in the red over the last three years

It's nice to see the Sadr Logistics Company (TADAWUL:1832) share price up 13% in a week. But that doesn't change the fact that the returns over the last three years have been less than pleasing. After all, the share price is down 91% in the last three years, significantly under-performing the market. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

While the last three years has been tough for Sadr Logistics shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

Check out our latest analysis for Sadr Logistics

Sadr Logistics isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over three years, Sadr Logistics grew revenue at 16% per year. That's a pretty good rate of top-line growth. So it seems unlikely the 24% share price drop (each year) is entirely about the revenue. More likely, the market was spooked by the cost of that revenue. If you buy into companies that lose money then you always risk losing money yourself. Just don't lose the lesson.

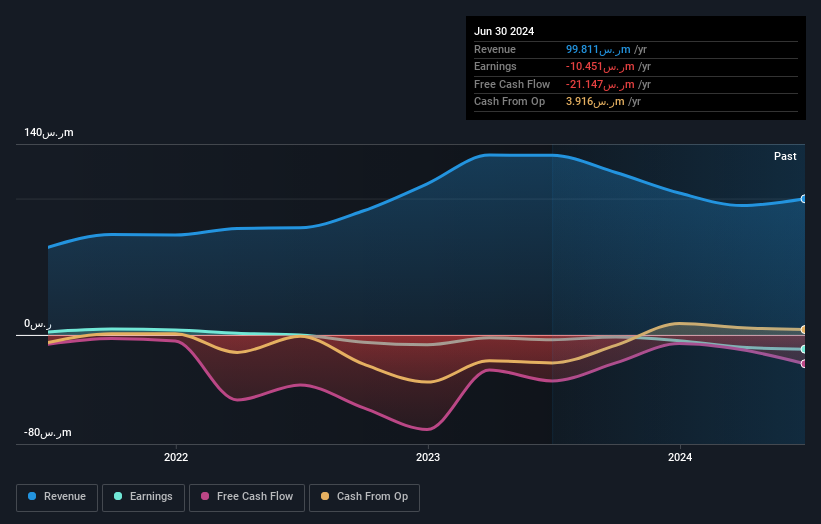

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Sadr Logistics' total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Sadr Logistics shareholders, and that cash payout explains why its total shareholder loss of 46%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

It's good to see that Sadr Logistics has rewarded shareholders with a total shareholder return of 23% in the last twelve months. However, the TSR over five years, coming in at 38% per year, is even more impressive. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for Sadr Logistics you should be aware of.

But note: Sadr Logistics may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:1832

Sadr Logistics

Manufactures and supplies pallets, racking systems, and shelves for storage and handling solutions in Saudi Arabia.

Adequate balance sheet very low.