- United Arab Emirates

- /

- Oil and Gas

- /

- ADX:DANA

Exploring Three Undiscovered Gems In The Middle East Market

Reviewed by Simply Wall St

The Middle East market is currently experiencing mixed performance, with Gulf equities showing modest gains supported by oil strength, while investor caution prevails ahead of crucial U.S. employment data that could influence interest-rate expectations. In this environment, identifying promising stocks involves looking for companies with strong fundamentals and resilience to navigate the uncertainties tied to global economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 1.94% | 16.33% | 21.26% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Dana Gas PJSC (ADX:DANA)

Simply Wall St Value Rating: ★★★★★★

Overview: Dana Gas PJSC operates in the exploration, production, transportation, processing, distribution, marketing, and sale of natural gas and petroleum-related products across the United Arab Emirates, Iraq, and Egypt with a market cap of AED5.27 billion.

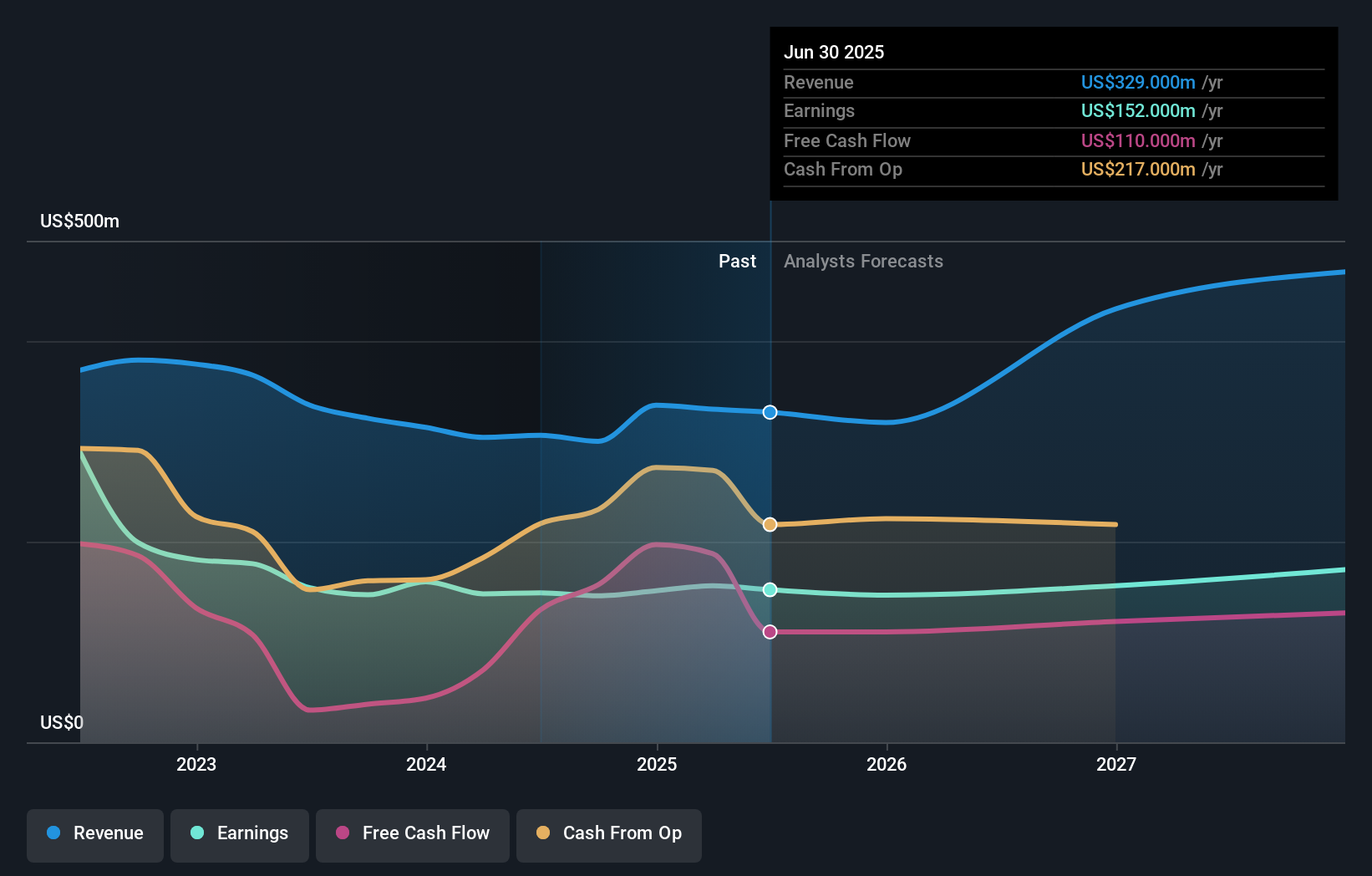

Operations: Dana Gas generates revenue primarily from its Oil & Gas - Integrated segment, amounting to $329 million. The company's financial performance is influenced by its operational activities in the UAE, Iraq, and Egypt.

Dana Gas, a notable player in the Middle East's energy sector, is currently trading at 22.9% below its estimated fair value, highlighting its potential for investors. The company reported earnings growth of 2% over the past year, outpacing the broader oil and gas industry's -8.6% performance. With a net debt to equity ratio of just 1.6%, it maintains a robust financial stance while continuing to generate positive free cash flow. Recent developments include successful results from the Begonia-2 well and ongoing investments aimed at boosting production in Egypt by adding significant gas reserves over two years.

- Take a closer look at Dana Gas PJSC's potential here in our health report.

Assess Dana Gas PJSC's past performance with our detailed historical performance reports.

MIA Teknoloji Anonim Sirketi (IBSE:MIATK)

Simply Wall St Value Rating: ★★★★★☆

Overview: MIA Teknoloji Anonim Sirketi offers software development services to public and private organizations in Turkey, with a market capitalization of TRY20.93 billion.

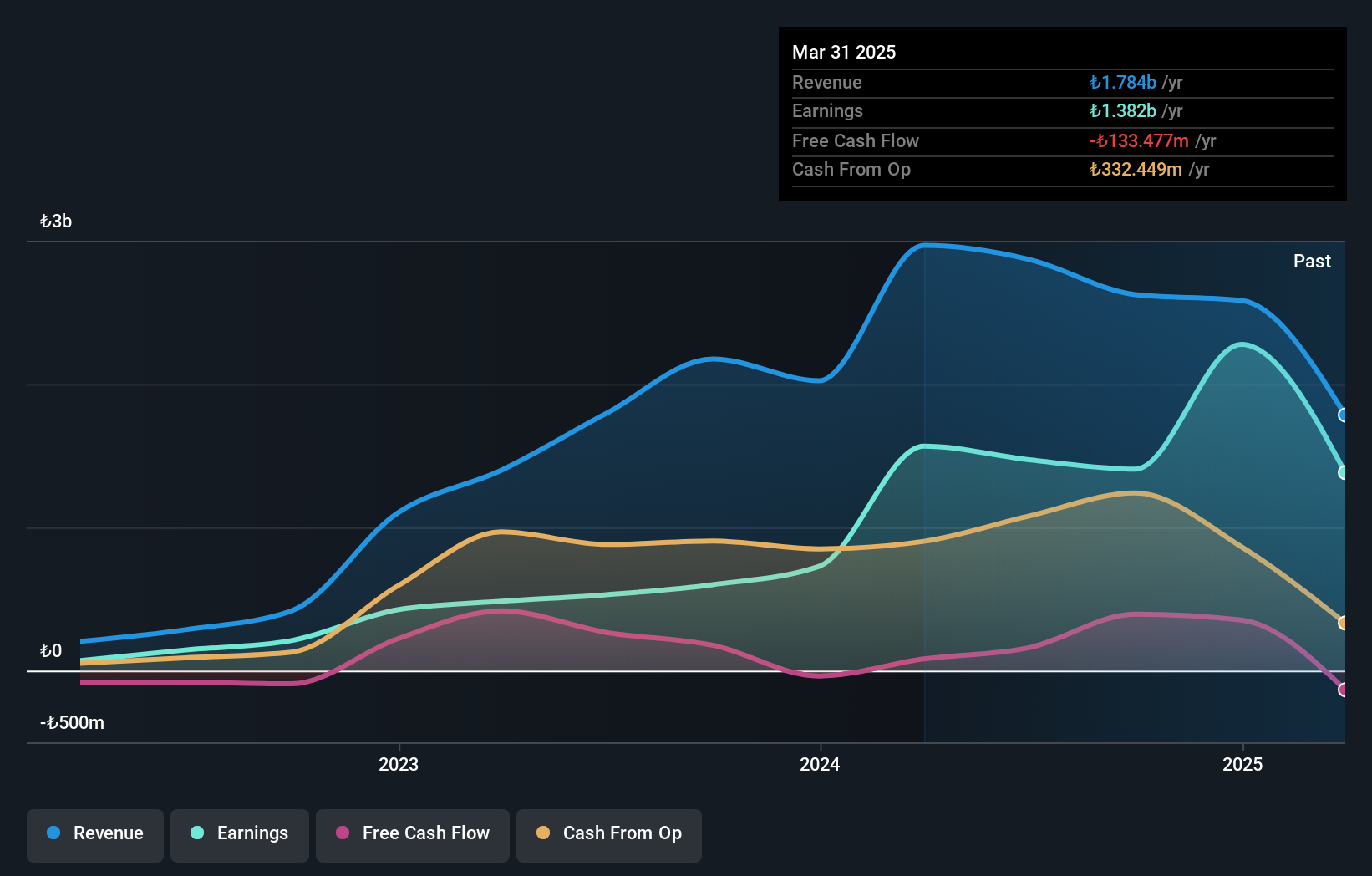

Operations: MIA Teknoloji generates revenue primarily through its software and programming segment, amounting to TRY1.78 billion. The company's financial performance can be further analyzed by examining its net profit margin, which provides insight into profitability trends over time.

MIA Teknoloji, a promising player in the Middle East tech scene, offers an intriguing investment case with its price-to-earnings ratio of 15.1x, notably below the Turkish market average of 22.8x. Despite facing negative earnings growth at -11.8% over the past year compared to the software industry's impressive 243.8%, MIATK's high level of non-cash earnings suggests robust quality in its financial reporting. The company's net debt to equity ratio stands at a satisfactory 2.4%, indicating prudent financial management and adequate interest coverage by profits, although free cash flow remains negative as of recent reports.

- Get an in-depth perspective on MIA Teknoloji Anonim Sirketi's performance by reading our health report here.

Understand MIA Teknoloji Anonim Sirketi's track record by examining our Past report.

Middle East Specialized Cables (SASE:2370)

Simply Wall St Value Rating: ★★★★☆☆

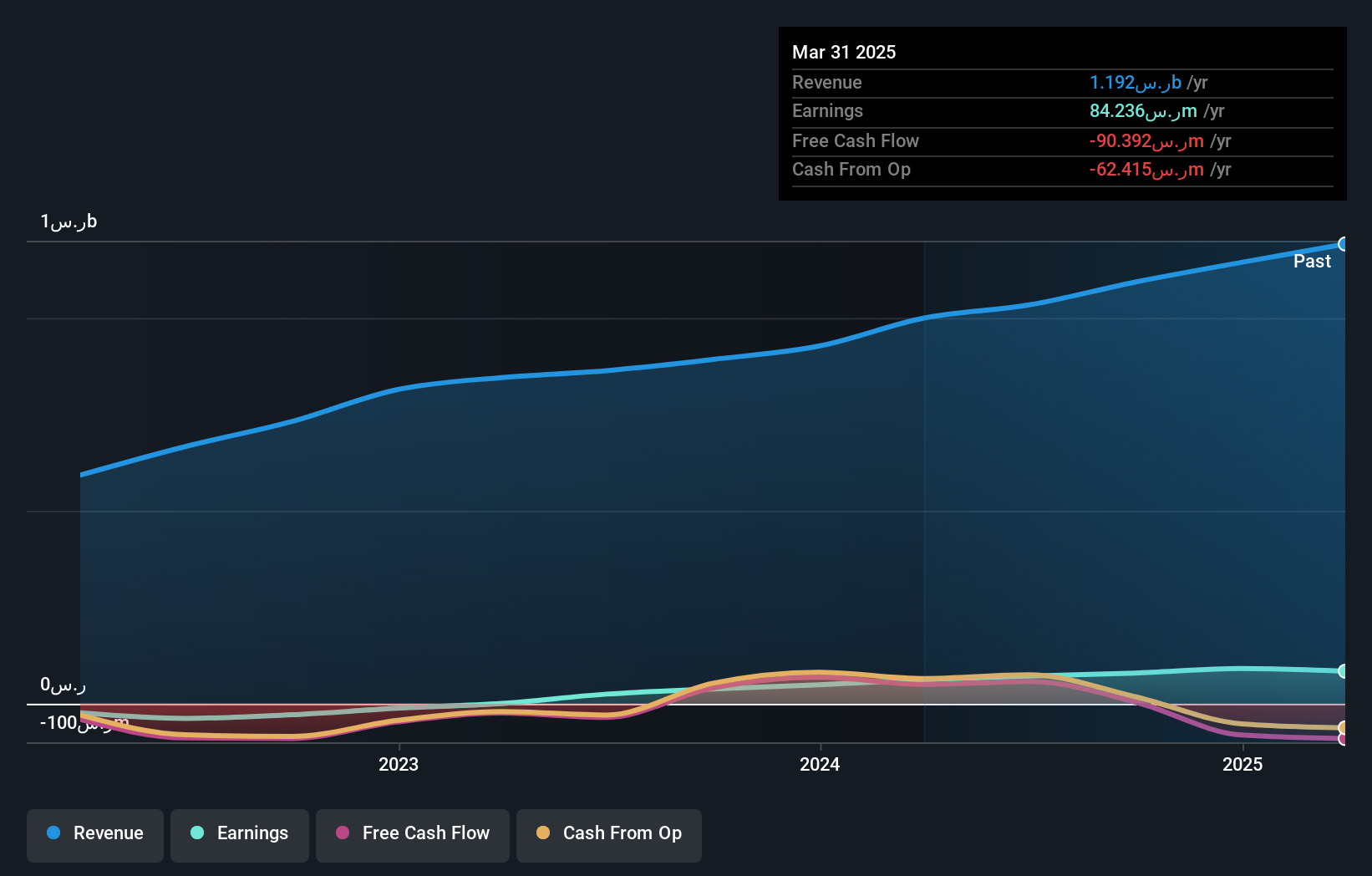

Overview: Middle East Specialized Cables Company, with a market cap of SAR1.19 billion, operates in Saudi Arabia and the United Arab Emirates manufacturing and selling fiber optic cables, steel insulated wires and cables, copper insulated wires and cables, and aluminum insulated wires and cables.

Operations: The company's primary revenue stream is from its Wire & Cable Products segment, generating SAR1.32 billion.

Middle East Specialized Cables, with its recent earnings report, showcases a promising trajectory. Sales for the second quarter surged to SAR 380.92 million from SAR 249.89 million last year, while net income rose to SAR 29.9 million compared to SAR 21.78 million previously. The company's EBIT covers interest payments comfortably at 22.9 times, indicating robust financial health despite a debt-to-equity ratio increase from 27.9% to 44.7% over five years. With a P/E ratio of just 12.9x against the SA market's average of 20.1x and strong non-cash earnings, it presents an intriguing investment opportunity in the region's cable industry landscape.

Key Takeaways

- Click through to start exploring the rest of the 196 Middle Eastern Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:DANA

Dana Gas PJSC

Engages in the exploration, production, ownership, transportation, processing, distribution, marketing, and sale of natural gas and petroleum related products in the United Arab Emirates, Iraq, and Egypt.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives