- Saudi Arabia

- /

- Electrical

- /

- SASE:2370

After Leaping 26% Middle East Specialized Cables Company (TADAWUL:2370) Shares Are Not Flying Under The Radar

Despite an already strong run, Middle East Specialized Cables Company (TADAWUL:2370) shares have been powering on, with a gain of 26% in the last thirty days. The last month tops off a massive increase of 146% in the last year.

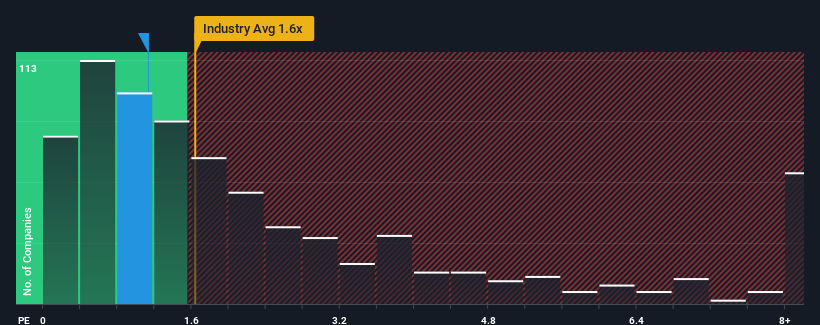

Even after such a large jump in price, it's still not a stretch to say that Middle East Specialized Cables' price-to-sales (or "P/S") ratio of 1.1x right now seems quite "middle-of-the-road" compared to the Electrical industry in Saudi Arabia, where the median P/S ratio is around 1.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Middle East Specialized Cables

What Does Middle East Specialized Cables' P/S Mean For Shareholders?

The revenue growth achieved at Middle East Specialized Cables over the last year would be more than acceptable for most companies. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on Middle East Specialized Cables will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Middle East Specialized Cables, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Middle East Specialized Cables would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 22% last year. The strong recent performance means it was also able to grow revenue by 76% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 19% shows it's about the same on an annualised basis.

In light of this, it's understandable that Middle East Specialized Cables' P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Final Word

Middle East Specialized Cables appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It appears to us that Middle East Specialized Cables maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Middle East Specialized Cables with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Middle East Specialized Cables, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2370

Middle East Specialized Cables

Manufactures and sells fiber optic cables, steel insulated wires and cables, copper insulated wires and cables, and aluminum insulated wires and cables in Saudi Arabia and the United Arab Emirates.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives