Undiscovered Gems And 2 More Hidden Opportunities With Strong Potential

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a mixed performance, with U.S. consumer confidence showing signs of decline and major stock indexes seeing moderate gains despite some reversals post-Christmas. As the market navigates these fluctuations, identifying stocks that exhibit strong fundamentals and resilience in challenging economic conditions becomes crucial for investors seeking hidden opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tokyo Tekko | 9.82% | 7.91% | 12.42% | ★★★★★★ |

| Nihon Parkerizing | 0.31% | 2.12% | 6.94% | ★★★★★★ |

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| QuickLtd | 0.62% | 9.82% | 15.64% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| AJIS | 0.79% | 1.12% | -12.92% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 136.00% | 2.73% | 2.17% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Al-Babtain Power and Telecommunications (SASE:2320)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Al-Babtain Power and Telecommunications Company, along with its subsidiaries, manufactures lighting poles and power transmission towers in the United Arab Emirates, Saudi Arabia, and Egypt, with a market cap of SAR2.38 billion.

Operations: The primary revenue streams for Al-Babtain Power and Telecommunications come from the Towers and Metal Structures Sector, generating SAR1.04 billion, followed by the Poles and Lighting Sector at SAR603.33 million. The Solar Energy Sector contributes SAR545.27 million, while the Design, Supply and Installation Sector adds SAR494.02 million to the company's revenue profile.

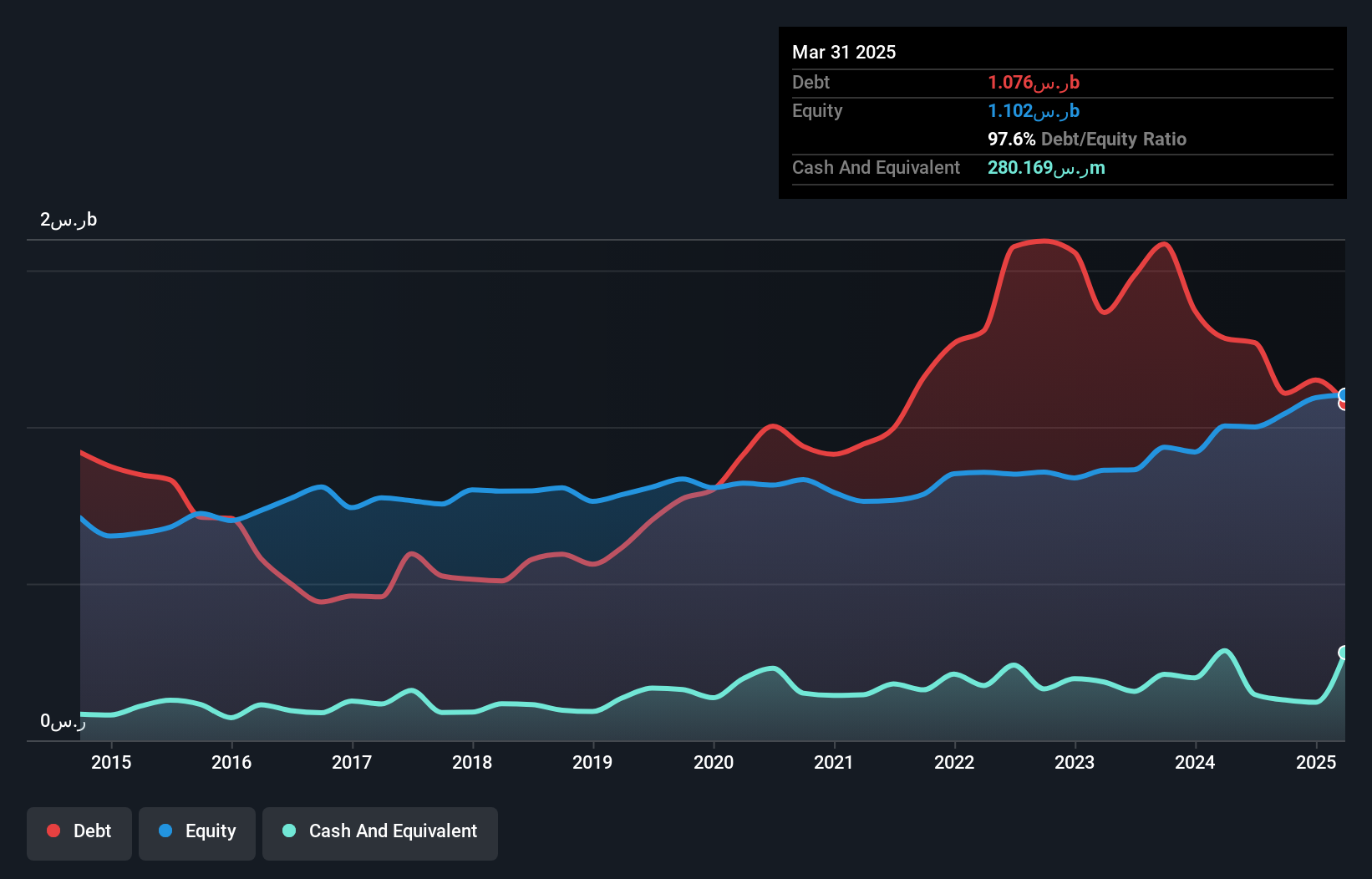

Al-Babtain Power and Telecommunications, a smaller player in its field, showcases promising financial metrics. Its earnings surged by 99% over the past year, significantly outpacing the construction industry's 14%. The company trades at a price-to-earnings ratio of 10.8x, undercutting the South African market's average of 23.3x. Despite this value proposition, Al-Babtain carries a high net debt to equity ratio of 93.8%, which could be concerning for some investors. Recent earnings reports highlighted sales growth to SAR2.13 billion for nine months ending September 2024 and net income rising to SAR180 million from SAR98 million previously.

Sakata INX (TSE:4633)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sakata INX Corporation is engaged in the manufacturing and sale of a range of printing inks and auxiliary agents both in Japan and internationally, with a market capitalization of ¥86.51 billion.

Operations: Sakata INX generates revenue primarily through the sale of printing inks and auxiliary agents. The company's net profit margin is 4.5%, indicating the proportion of revenue that translates into profit after all expenses are accounted for.

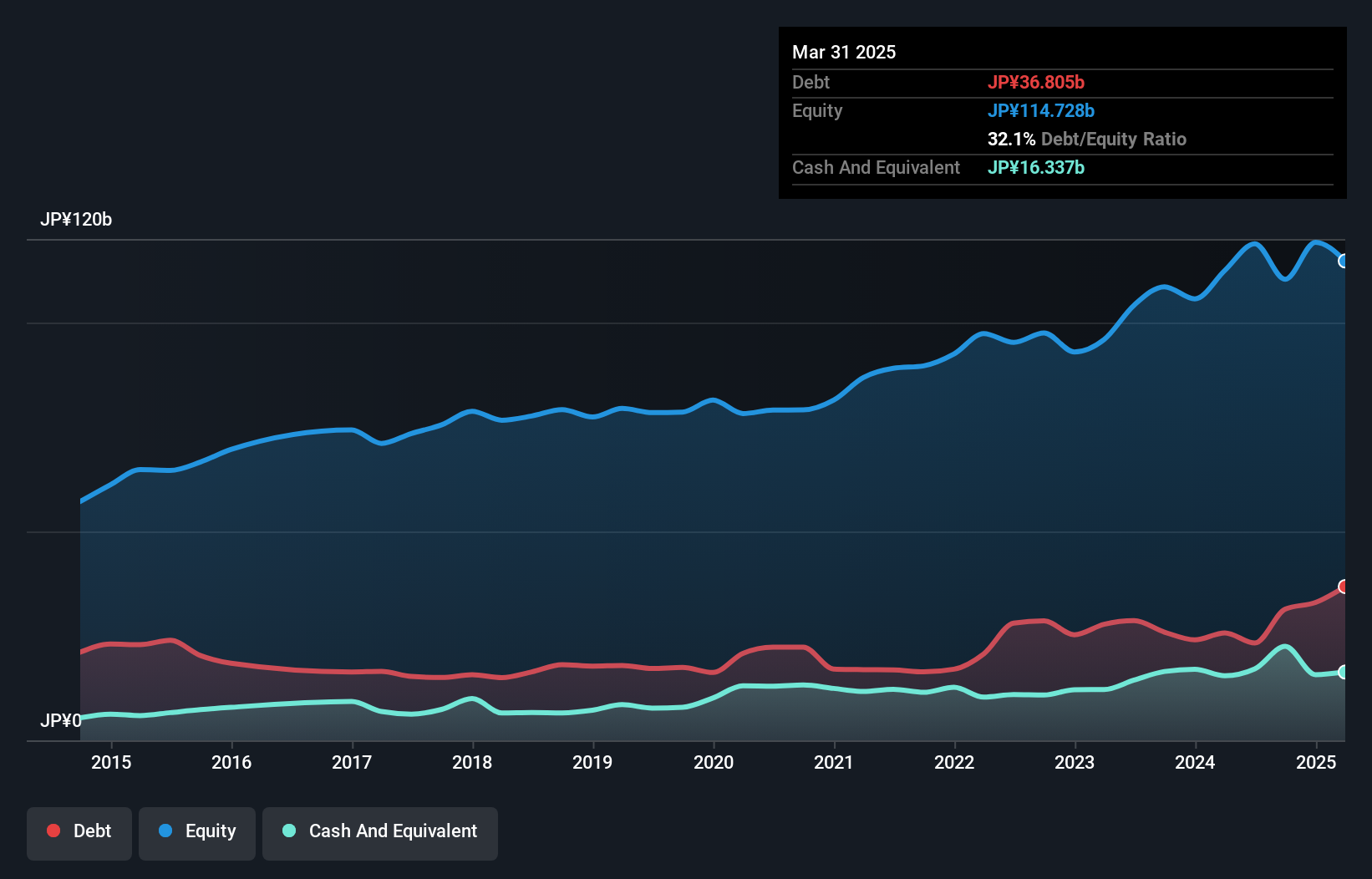

Sakata INX, a notable player in the printing ink industry, is gaining attention for its solid financial footing. Over the past five years, its debt to equity ratio has increased from 22.2% to 28.5%, indicating a moderate rise in leverage but remains manageable with a satisfactory net debt to equity ratio of 8.1%. The company's interest payments are well covered by EBIT at 57 times, reflecting robust earnings quality. Although recent earnings growth of 13.3% slightly lagged behind the chemicals industry average of 14%, Sakata INX trades at an attractive valuation, estimated at nearly 70% below fair value projections.

- Unlock comprehensive insights into our analysis of Sakata INX stock in this health report.

Gain insights into Sakata INX's historical performance by reviewing our past performance report.

ARCS (TSE:9948)

Simply Wall St Value Rating: ★★★★★☆

Overview: ARCS Company Limited operates supermarkets in Japan with a market cap of ¥140.57 billion.

Operations: The company generates revenue primarily through its supermarket operations in Japan. The net profit margin has shown variability, reflecting changes in operational efficiency and cost management over time.

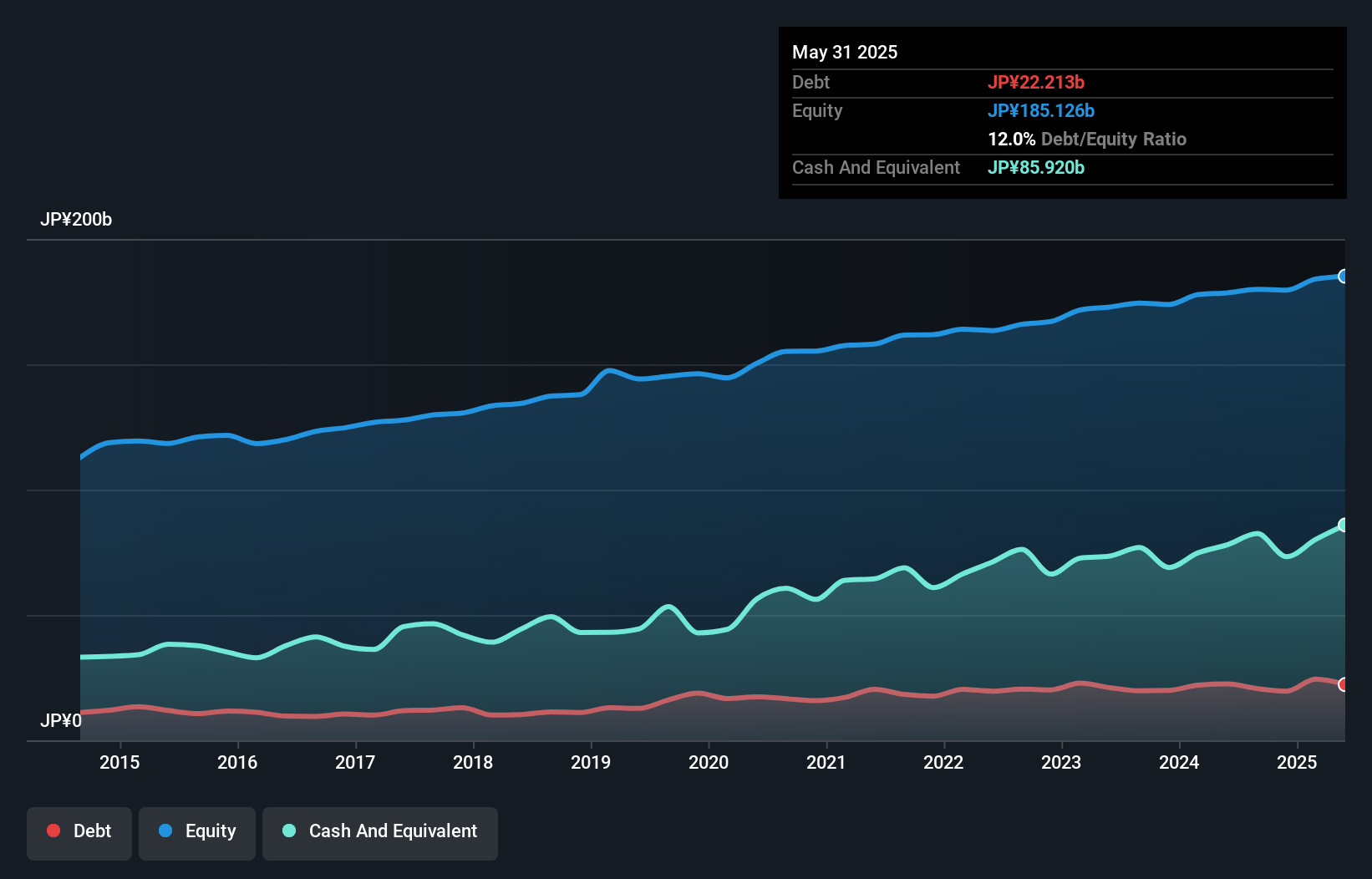

ARCS, a small player in its sector, seems to offer an intriguing mix of value and quality. Trading at 78.4% below estimated fair value, it appears undervalued. Over the past five years, earnings have grown at 3% annually, indicating consistent performance despite not outpacing the industry’s growth rate of 11.8%. The company is profitable with sufficient cash runway and positive free cash flow. While its debt-to-equity ratio has slightly increased from 11.1% to 11.5%, ARCS maintains more cash than total debt, suggesting financial stability. Recent dividend hikes from JPY 29 to JPY 34 per share further enhance shareholder appeal.

- Get an in-depth perspective on ARCS' performance by reading our health report here.

Examine ARCS' past performance report to understand how it has performed in the past.

Summing It All Up

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4629 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4633

Sakata INX

Manufactures and sells various printing inks and auxiliary agents in Japan and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives