- Saudi Arabia

- /

- Construction

- /

- SASE:2320

Be Wary Of Al-Babtain Power and Telecommunication (TADAWUL:2320) And Its Returns On Capital

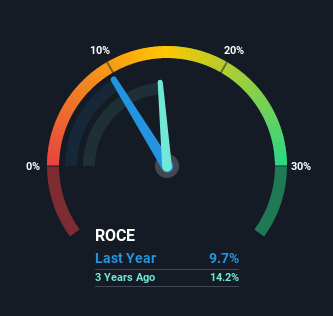

When we're researching a company, it's sometimes hard to find the warning signs, but there are some financial metrics that can help spot trouble early. A business that's potentially in decline often shows two trends, a return on capital employed (ROCE) that's declining, and a base of capital employed that's also declining. This combination can tell you that not only is the company investing less, it's earning less on what it does invest. On that note, looking into Al-Babtain Power and Telecommunication (TADAWUL:2320), we weren't too upbeat about how things were going.

Return On Capital Employed (ROCE): What is it?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on Al-Babtain Power and Telecommunication is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.097 = ر.س103m ÷ (ر.س2.1b - ر.س1.1b) (Based on the trailing twelve months to March 2021).

Thus, Al-Babtain Power and Telecommunication has an ROCE of 9.7%. In absolute terms, that's a low return but it's around the Construction industry average of 8.4%.

Check out our latest analysis for Al-Babtain Power and Telecommunication

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings, revenue and cash flow of Al-Babtain Power and Telecommunication, check out these free graphs here.

The Trend Of ROCE

We are a bit worried about the trend of returns on capital at Al-Babtain Power and Telecommunication. To be more specific, the ROCE was 19% five years ago, but since then it has dropped noticeably. And on the capital employed front, the business is utilizing roughly the same amount of capital as it was back then. Since returns are falling and the business has the same amount of assets employed, this can suggest it's a mature business that hasn't had much growth in the last five years. So because these trends aren't typically conducive to creating a multi-bagger, we wouldn't hold our breath on Al-Babtain Power and Telecommunication becoming one if things continue as they have.

On a side note, Al-Babtain Power and Telecommunication's current liabilities have increased over the last five years to 51% of total assets, effectively distorting the ROCE to some degree. If current liabilities hadn't increased as much as they did, the ROCE could actually be even lower. What this means is that in reality, a rather large portion of the business is being funded by the likes of the company's suppliers or short-term creditors, which can bring some risks of its own.

The Key Takeaway

In summary, it's unfortunate that Al-Babtain Power and Telecommunication is generating lower returns from the same amount of capital. Yet despite these concerning fundamentals, the stock has performed strongly with a 88% return over the last five years, so investors appear very optimistic. In any case, the current underlying trends don't bode well for long term performance so unless they reverse, we'd start looking elsewhere.

Al-Babtain Power and Telecommunication does come with some risks though, we found 3 warning signs in our investment analysis, and 2 of those are concerning...

While Al-Babtain Power and Telecommunication may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:2320

Al-Babtain Power and Telecommunications

Produces lighting poles, power transmission towers and accessories in the United Arab Emirates, Saudi Arabia, and Egyptian Arabic Republic.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives