In a market landscape where large-cap stocks have shown resilience but small-caps like those in the Russell 2000 Index continue to underperform, investors are increasingly on the lookout for hidden opportunities that may offer strong potential amidst volatility. As economic indicators suggest a cooling labor market and impending interest rate cuts by the Federal Reserve, identifying stocks with robust fundamentals and growth prospects becomes crucial.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Chilanga Cement | NA | 12.53% | 25.20% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Transcorp Power | 46.33% | 114.79% | 152.92% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Al Hassan Ghazi Ibrahim Shaker (SASE:1214)

Simply Wall St Value Rating: ★★★★★☆

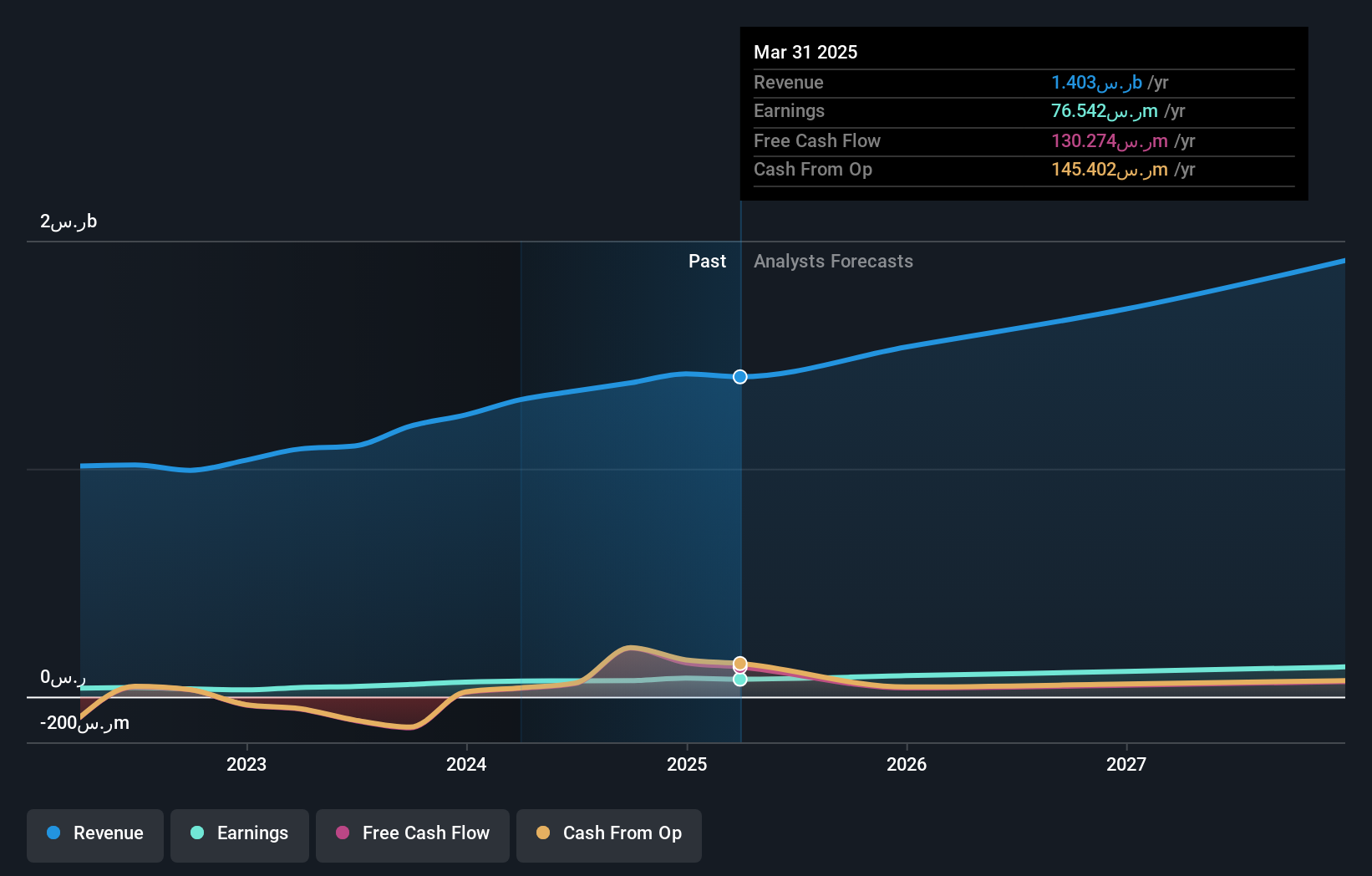

Overview: Al Hassan Ghazi Ibrahim Shaker Company operates in Saudi Arabia and Jordan, focusing on the trading, wholesale, and maintenance of spare parts, electronic equipment, household equipment, and air-conditioners, with a market capitalization of SAR1.56 billion.

Operations: Shaker generates revenue primarily from its HVAC solutions, contributing SAR984.79 million, and home appliances, adding SAR388.45 million to its financials. The company's net profit margin is a key metric to watch for insights into profitability trends over time.

Shaker Company, a smaller player in the trade distribution sector, is showing promising signs. Its earnings growth of 31.5% over the past year outpaced an industry decline of 10.8%, highlighting its competitive edge. The net debt to equity ratio stands at a satisfactory 30.8%, reflecting prudent financial management, while debt levels have decreased from 63% to 43.8% over five years, indicating improved leverage control. Despite these strengths, interest coverage by EBIT remains low at 2.4x, suggesting potential challenges in meeting interest obligations comfortably but with high-quality earnings and free cash flow positivity, Shaker seems poised for steady future growth within its market niche.

Komori (TSE:6349)

Simply Wall St Value Rating: ★★★★★☆

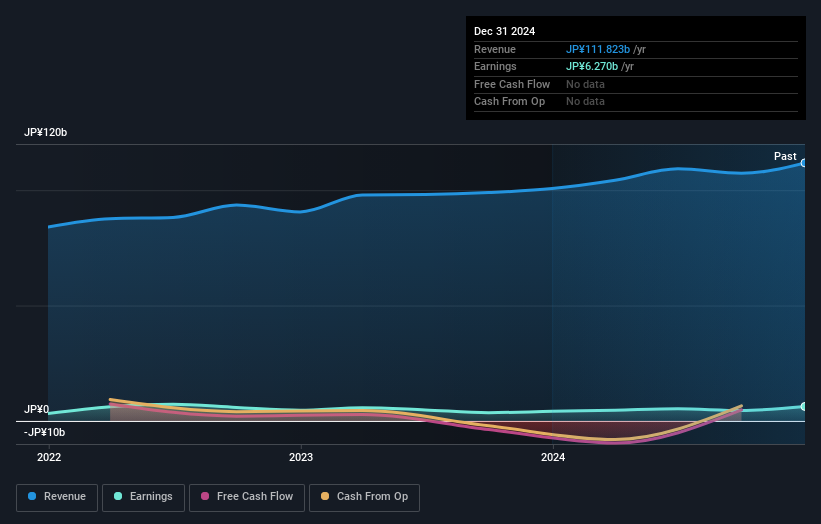

Overview: Komori Corporation is involved in the manufacture, sale, and repair of printing presses across several regions including Japan, North America, Europe, and Greater China with a market capitalization of ¥63.30 billion.

Operations: Komori Corporation's primary revenue streams are from Japan, contributing ¥80.50 billion, followed by Europe and Greater China with ¥22.47 billion and ¥15.72 billion respectively. The company's net profit margin has shown fluctuations over recent periods, reflecting changes in cost structures and market conditions across its operational regions.

Komori, a notable player in the machinery sector, has shown impressive earnings growth of 25.5% over the past year, outpacing the industry's modest 0.9%. Despite an increase in its debt-to-equity ratio from 0.5 to 9.8 over five years, it maintains more cash than total debt, indicating a strong financial position. Trading at a significant discount of 60% below estimated fair value suggests potential for future appreciation. Recent guidance revisions reflect optimism with projected net sales of ¥113 billion and operating profit of ¥6.7 billion for fiscal year ending March 2025, alongside doubling its dividend payout to ¥30 per share from last year’s ¥15 per share.

- Unlock comprehensive insights into our analysis of Komori stock in this health report.

Examine Komori's past performance report to understand how it has performed in the past.

Glory (TSE:6457)

Simply Wall St Value Rating: ★★★★★☆

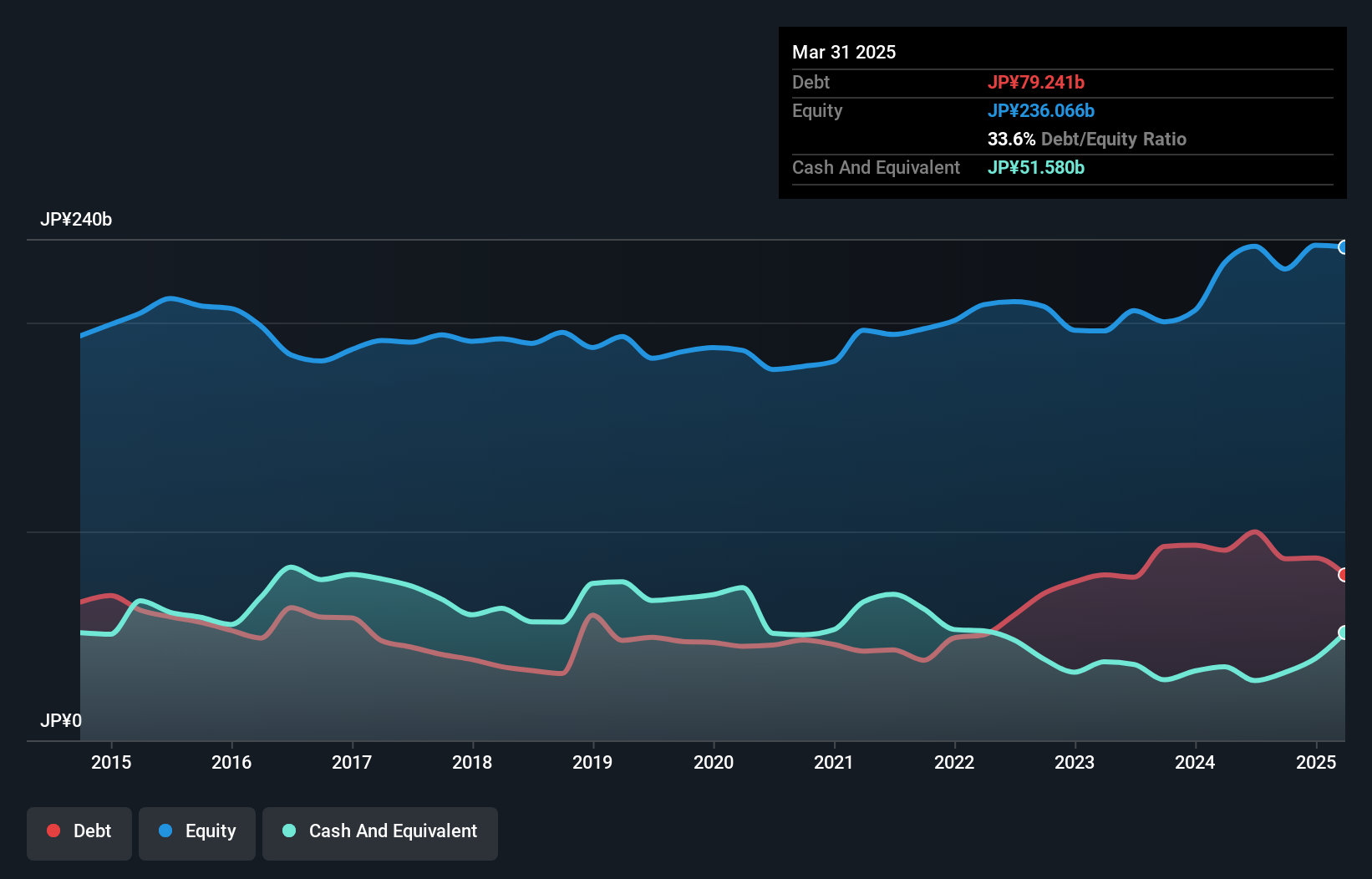

Overview: Glory Ltd. develops and manufactures cash handling machines and systems across Japan, the United States, Europe, and Asia with a market cap of ¥147 billion.

Operations: Glory Ltd. generates revenue primarily from its Overseas Market, contributing ¥202.10 billion, followed by the Distribution/Transportation Market at ¥84.94 billion and the Financial Market at ¥75.34 billion. The Amusement Market adds another ¥30.90 billion to its revenue streams.

Glory seems like a promising opportunity, trading at 47.4% below our fair value estimate and showing high-quality earnings with a significant 479% growth over the past year. The company's debt to equity ratio has increased to 38.5%, yet its interest payments are well covered by EBIT at 25.9x, indicating solid financial health despite potential concerns about rising debt levels. Recently, Glory announced an upward revision in its financial forecast for fiscal year ending March 2025, projecting net sales of ¥362 billion and net income of ¥13 billion, alongside a dividend increase from ¥40 to ¥54 per share.

- Click here and access our complete health analysis report to understand the dynamics of Glory.

Review our historical performance report to gain insights into Glory's's past performance.

Key Takeaways

- Embark on your investment journey to our 4508 Undiscovered Gems With Strong Fundamentals selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6457

Glory

Develops and manufactures cash handling machines and systems in Japan, the United States, Europe, and Asia.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives