- Saudi Arabia

- /

- Trade Distributors

- /

- SASE:1214

Could The Market Be Wrong About Al Hassan Ghazi Ibrahim Shaker Company (TADAWUL:1214) Given Its Attractive Financial Prospects?

Al Hassan Ghazi Ibrahim Shaker (TADAWUL:1214) has had a rough week with its share price down 10%. However, stock prices are usually driven by a company’s financial performance over the long term, which in this case looks quite promising. Particularly, we will be paying attention to Al Hassan Ghazi Ibrahim Shaker's ROE today.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Put another way, it reveals the company's success at turning shareholder investments into profits.

See our latest analysis for Al Hassan Ghazi Ibrahim Shaker

How To Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Al Hassan Ghazi Ibrahim Shaker is:

9.0% = ر.س65m ÷ ر.س718m (Based on the trailing twelve months to December 2023).

The 'return' is the amount earned after tax over the last twelve months. So, this means that for every SAR1 of its shareholder's investments, the company generates a profit of SAR0.09.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Al Hassan Ghazi Ibrahim Shaker's Earnings Growth And 9.0% ROE

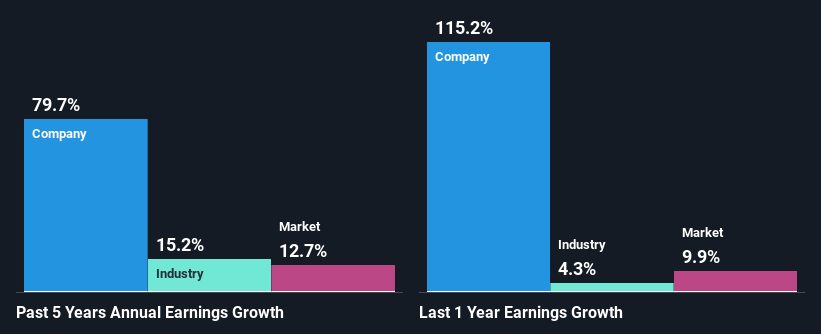

It is hard to argue that Al Hassan Ghazi Ibrahim Shaker's ROE is much good in and of itself. However, the fact that it is higher than the industry average of 7.5% makes us a bit more interested. Particularly, the substantial 80% net income growth seen by Al Hassan Ghazi Ibrahim Shaker over the past five years is impressive . Bear in mind, the company does have a low ROE. It is just that the industry ROE is lower. Hence, there might be some other aspects that are causing earnings to grow. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

As a next step, we compared Al Hassan Ghazi Ibrahim Shaker's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 15%.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Al Hassan Ghazi Ibrahim Shaker's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Al Hassan Ghazi Ibrahim Shaker Using Its Retained Earnings Effectively?

Al Hassan Ghazi Ibrahim Shaker doesn't pay any regular dividends currently which essentially means that it has been reinvesting all of its profits into the business. This definitely contributes to the high earnings growth number that we discussed above.

Conclusion

Overall, we are quite pleased with Al Hassan Ghazi Ibrahim Shaker's performance. Specifically, we like that it has been reinvesting a high portion of its profits at a moderate rate of return, resulting in earnings expansion. Having said that, the company's earnings growth is expected to slow down, as forecasted in the current analyst estimates. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:1214

Al Hassan Ghazi Ibrahim Shaker

Engages in the trading, wholesale, and maintenance of spare parts, electronic equipment, household equipment, and air-conditioners in Saudi Arabia.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026