The Middle Eastern stock markets have been experiencing mixed performances, influenced by softer oil prices and evolving expectations around U.S. Federal Reserve rate cuts. In this environment, dividend stocks can offer a measure of stability and income, making them an appealing choice for investors seeking reliable returns amidst market fluctuations.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.41% | ★★★★★★ |

| Saudi Awwal Bank (SASE:1060) | 6.51% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.82% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.76% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.54% | ★★★★★☆ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret (IBSE:GOLTS) | 3.51% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.46% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.40% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.78% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.09% | ★★★★★☆ |

Click here to see the full list of 63 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Ege Profil Ticaret ve Sanayi Anonim Sirketi (IBSE:EGPRO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ege Profil Ticaret ve Sanayi Anonim Sirketi is engaged in the production and sale of plastic pipes, spare parts, and various profiles and plastic goods both in Turkey and internationally, with a market cap of TRY13.83 billion.

Operations: Ege Profil Ticaret ve Sanayi Anonim Sirketi generates revenue through the production and sale of plastic pipes, spare parts, and diverse profiles and plastic products in both domestic and international markets.

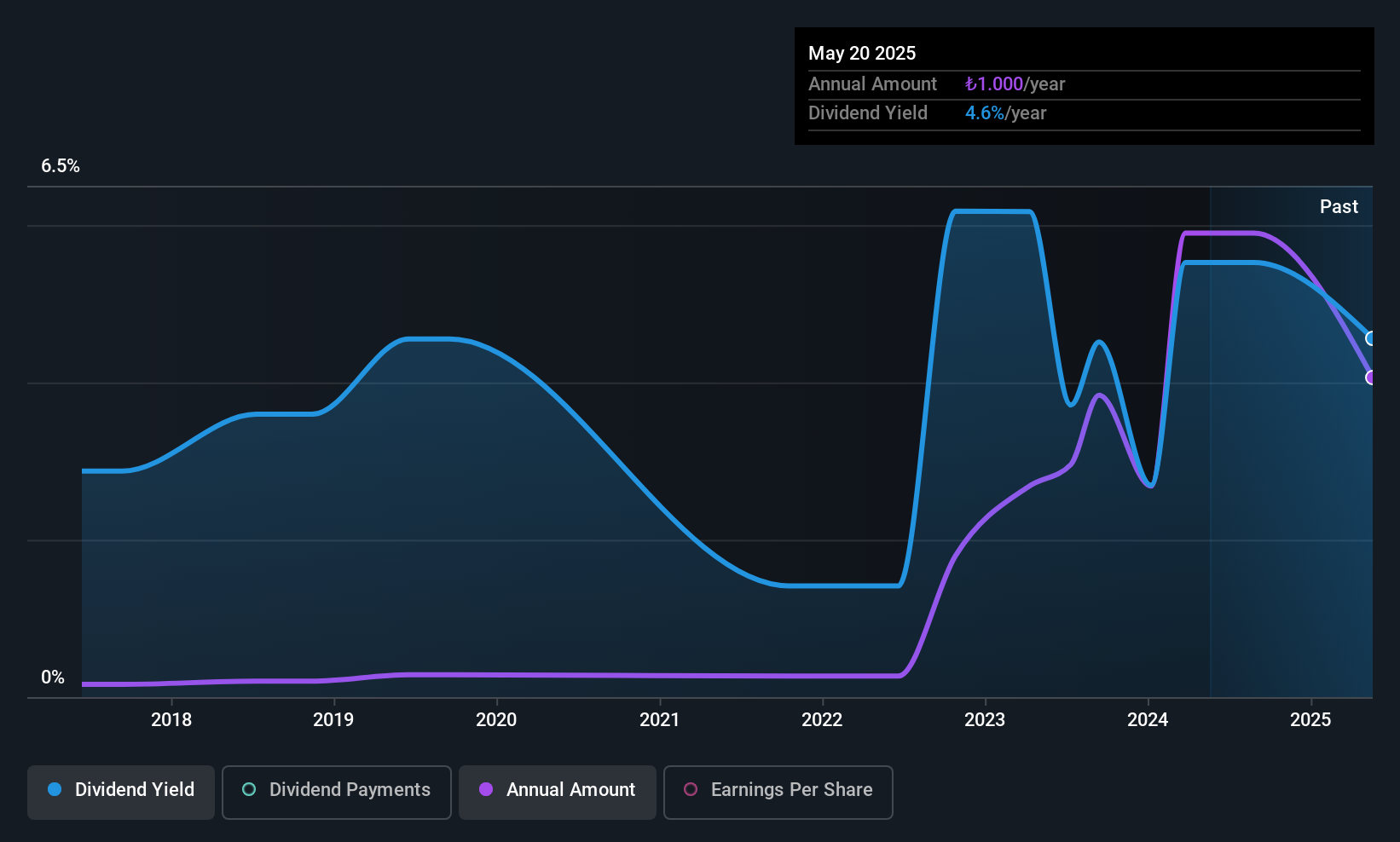

Dividend Yield: 3.9%

Ege Profil Ticaret ve Sanayi Anonim Sirketi's dividend yield of 3.94% ranks in the top 25% of the Turkish market, supported by a reasonable cash payout ratio of 48.5%. However, its dividend history is less stable, with payments being volatile over its nine-year track record. Despite this, earnings growth of 8.9% last year and a P/E ratio below the market average suggest potential value for investors seeking dividends in the Middle East region.

- Unlock comprehensive insights into our analysis of Ege Profil Ticaret ve Sanayi Anonim Sirketi stock in this dividend report.

- The valuation report we've compiled suggests that Ege Profil Ticaret ve Sanayi Anonim Sirketi's current price could be inflated.

Logo Yazilim Sanayi ve Ticaret (IBSE:LOGO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Logo Yazilim Sanayi ve Ticaret A.S. develops and markets software solutions both in Turkey and internationally, with a market cap of TRY15.31 billion.

Operations: Logo Yazilim Sanayi ve Ticaret A.S. generates its revenue primarily from the software industry, amounting to TRY4.48 billion.

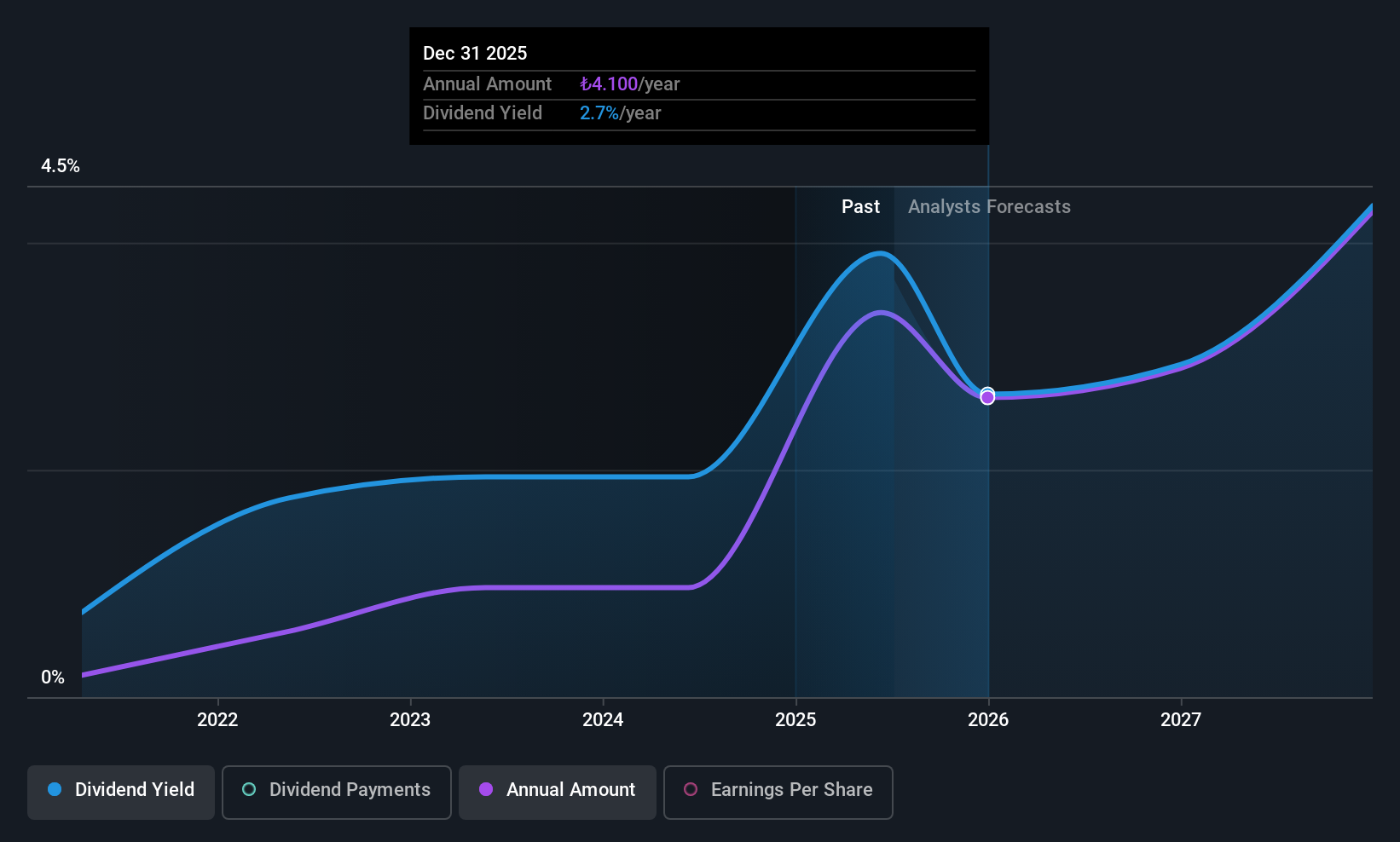

Dividend Yield: 3.3%

Logo Yazilim Sanayi ve Ticaret's dividend yield of 3.27% places it among the top 25% in Turkey, with a payout ratio of 37.8%, indicating dividends are well covered by earnings. Despite only five years of payments, dividends have been stable and reliable. Recent earnings showed robust growth, with net income reaching TRY 1.37 billion for nine months ending September 2025, enhancing its appeal as a dividend stock in the Middle East market.

- Click here and access our complete dividend analysis report to understand the dynamics of Logo Yazilim Sanayi ve Ticaret.

- The analysis detailed in our Logo Yazilim Sanayi ve Ticaret valuation report hints at an deflated share price compared to its estimated value.

Bank Albilad (SASE:1140)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank Albilad, with a market cap of SAR39.84 billion, operates in the Kingdom of Saudi Arabia offering a range of banking products and services through its subsidiaries.

Operations: Bank Albilad generates revenue from several segments, including Retail Banking (SAR2.11 billion), Treasury Sector (SAR1.38 billion), Corporate Banking (SAR2.01 billion), and Investment and Brokerage Services Sector (SAR442.87 million).

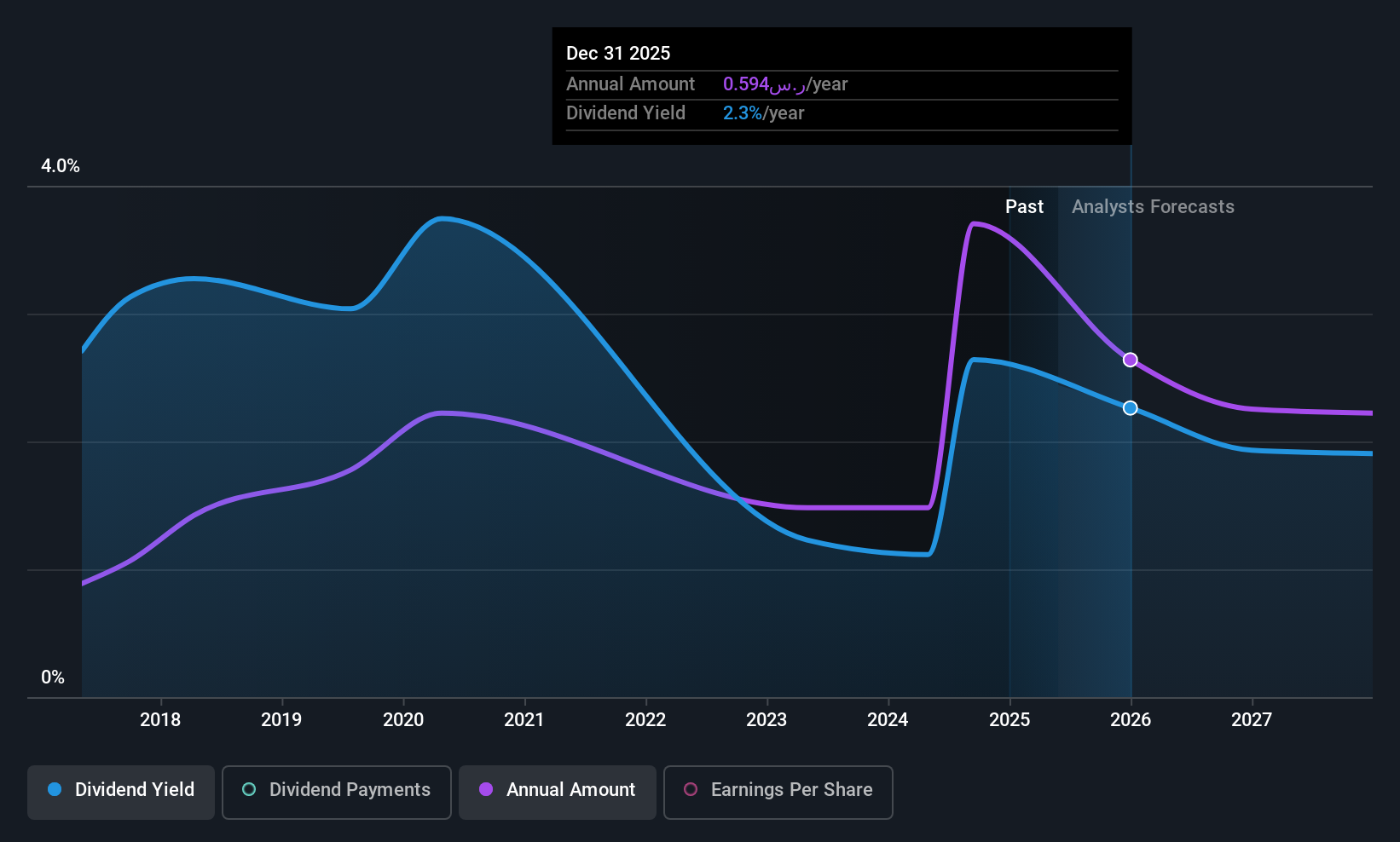

Dividend Yield: 3.1%

Bank Albilad's dividend yield of 3.14% is lower than the top 25% in Saudi Arabia, but its payout ratio of 42.6% suggests dividends are well covered by earnings. Despite a history of volatility, dividends have increased over the past decade. Recent earnings show growth, with net income rising to SAR 766.5 million in Q3 and SAR 2,232.6 million for nine months ending September 2025, reflecting potential for sustained dividend payments amidst revenue growth forecasts.

- Click to explore a detailed breakdown of our findings in Bank Albilad's dividend report.

- Our expertly prepared valuation report Bank Albilad implies its share price may be too high.

Make It Happen

- Unlock our comprehensive list of 63 Top Middle Eastern Dividend Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ege Profil Ticaret ve Sanayi Anonim Sirketi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:EGPRO

Ege Profil Ticaret ve Sanayi Anonim Sirketi

Produces and sells plastic pipes, spare parts, and various profiles and plastic goods in Turkey an internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.