- Saudi Arabia

- /

- Banks

- /

- SASE:1050

Banque Saudi Fransi (SASE:1050) Reports Q3 Earnings Decline but Projects 9.7% Annual Growth

Reviewed by Simply Wall St

Banque Saudi Fransi (SASE:1050) recently announced its earnings for the third quarter and the nine months ended September 30, 2024, reporting a slight decline in both net interest income and net income compared to the previous year. However, the bank is poised for growth with a forecasted 9.7% annual increase in earnings, driven by strategic product innovations and strong customer relationships. The upcoming earnings call on October 31, 2024, will cover key areas such as operational efficiencies, market expansion strategies, and the impact of economic and regulatory factors.

Navigate through the intricacies of Banque Saudi Fransi with our comprehensive report here.

Unique Capabilities Enhancing Banque Saudi Fransi's Market Position

Banque Saudi Fransi has demonstrated revenue growth, with forecasts predicting a 9.7% annual increase in earnings, surpassing the South African market's 6.7%. This growth is underpinned by strategic product innovations, as highlighted by CFO Yasminah Abbas, who noted the positive market reception of new product lines. The bank's strong customer relationships, emphasized by COO Naresh Bilandani, further solidify its market position, fostering loyalty and repeat business. Additionally, the bank's dividend yield of 6.24% places it among the top 25% of dividend payers in the South African market, reflecting financial stability and investor appeal.

Internal Limitations Hindering Banque Saudi Fransi's Growth

The bank faces challenges, including a Price-To-Earnings Ratio of 9.5x, which is higher than the Asian Banks industry average of 8.7x. CEO Ramzy Darwish has acknowledged operational inefficiencies that need addressing to enhance profitability. The current net profit margin of 50% also marks a decrease from the previous year's 52.8%, indicating pressure on margins. Rising costs, as mentioned by Abbas, further impact profitability, necessitating improved cost management strategies.

Potential Strategies for Leveraging Growth and Competitive Advantage

Opportunities for growth include geographical expansion and technological investments. Darwish's interest in exploring new markets suggests a proactive approach to diversifying revenue streams. Abbas's focus on AI investments indicates a commitment to enhancing operational capabilities and customer engagement. Moreover, ongoing discussions with potential partners, as noted by Bilandani, could extend the bank's reach and capabilities, offering access to new markets and technologies.

Market Volatility Affecting Banque Saudi Fransi's Position

External threats include economic headwinds and regulatory hurdles. Darwish has highlighted the challenges posed by the current economic climate, which requires careful navigation. Abbas's vigilance over regulatory changes underscores the need for compliance and potential operational adjustments. Additionally, supply chain disruptions, as acknowledged by Bilandani, necessitate resilience and adaptability to maintain operational stability.

Conclusion

Banque Saudi Fransi's strategic product innovations and strong customer relationships have positioned it well for a 9.7% annual earnings growth, surpassing the South African market. Internal challenges such as operational inefficiencies and a Price-To-Earnings Ratio of 9.5x, which is higher than the Asian Banks industry average, indicate a need for improved cost management to maintain profitability. The bank's proactive strategies, including geographical expansion and AI investments, suggest a commitment to diversifying revenue streams and enhancing competitive advantage. Despite external economic and regulatory challenges, the bank's financial stability and investor appeal, demonstrated by its top-tier dividend yield, provide a solid foundation for future performance. Its P/E ratio, while higher than the industry average, indicates potential for long-term growth.

Make It Happen

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

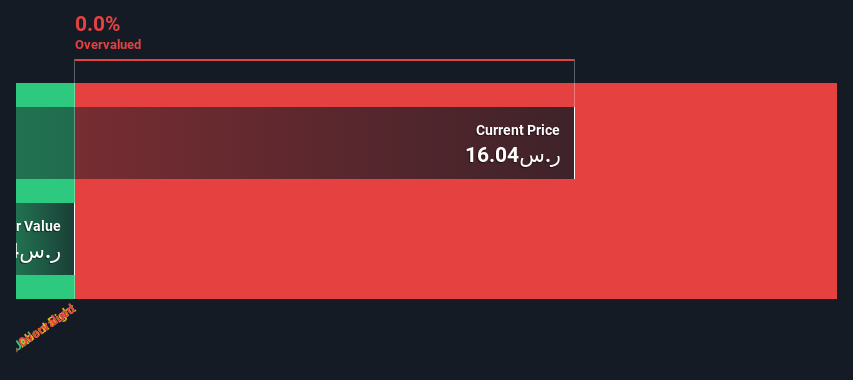

Discover if Banque Saudi Fransi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About SASE:1050

Banque Saudi Fransi

Provides banking and financial services for individuals and businesses in the Kingdom of Saudi Arabia and internationally.

Flawless balance sheet established dividend payer.