- Russia

- /

- Electric Utilities

- /

- MISX:SLEN

Does Sakhalinenergo's (MCX:SLEN) Share Price Gain of 34% Match Its Business Performance?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

If you want to compound wealth in the stock market, you can do so by buying an index fund. But if you pick the right individual stocks, you could make more than that. To wit, the Public Joint Stock Company "Sakhalinenergo" (MCX:SLEN) share price is 34% higher than it was a year ago, much better than the market return of around 15% (not including dividends) in the same period. So that should have shareholders smiling. We'll need to follow Sakhalinenergo for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

Check out our latest analysis for Sakhalinenergo

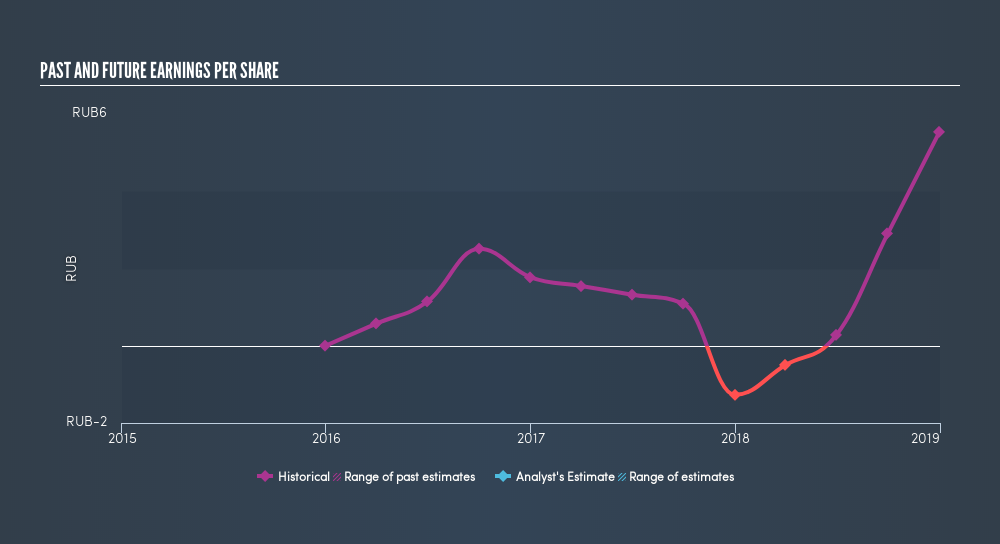

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year Sakhalinenergo grew its earnings per share, moving from a loss to a profit. We think the growth looks very prospective, so we're not surprised the market liked it too. Inflection points like this can be a great time to take a closer look at a company.

It might be well worthwhile taking a look at our free report on Sakhalinenergo's earnings, revenue and cash flow.

A Different Perspective

Sakhalinenergo boasts a total shareholder return of 34% for the last year. We regret to report that the share price is down 1.0% over ninety days. Shorter term share price moves often don't signify much about the business itself. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on RU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About MISX:SLEN

Sakhalinenergo

Public Joint Stock Company “Sakhalinenergo” engages in the production, transmission, marketing, and supply of electricity in Sakhalin Island, Russia.

Imperfect balance sheet with weak fundamentals.

Market Insights

Community Narratives