Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Public Joint-Stock Company TNS energo Nizhny Novgorod (MCX:NNSB) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for TNS energo Nizhny Novgorod

How Much Debt Does TNS energo Nizhny Novgorod Carry?

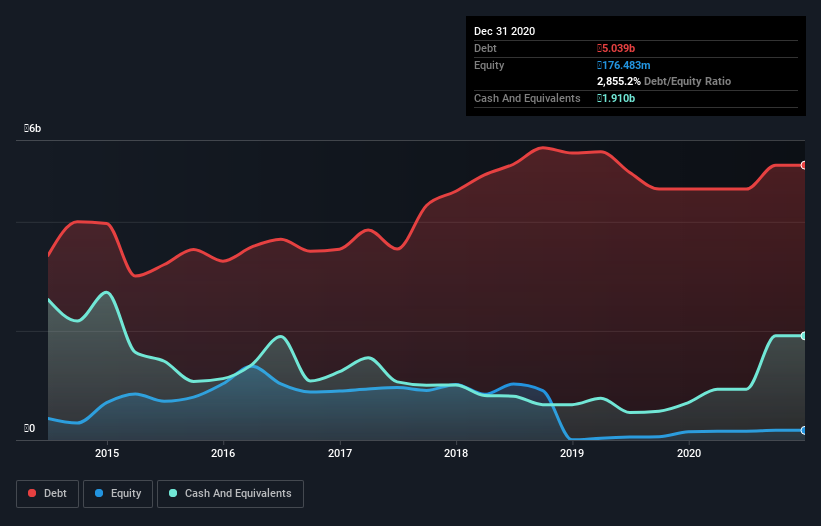

You can click the graphic below for the historical numbers, but it shows that as of December 2020 TNS energo Nizhny Novgorod had ₽5.04b of debt, an increase on ₽4.60b, over one year. On the flip side, it has ₽1.91b in cash leading to net debt of about ₽3.13b.

A Look At TNS energo Nizhny Novgorod's Liabilities

According to the last reported balance sheet, TNS energo Nizhny Novgorod had liabilities of ₽21.6b due within 12 months, and liabilities of ₽506.9m due beyond 12 months. On the other hand, it had cash of ₽1.91b and ₽18.7b worth of receivables due within a year. So its liabilities total ₽1.48b more than the combination of its cash and short-term receivables.

Given TNS energo Nizhny Novgorod has a market capitalization of ₽8.88b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Weak interest cover of 0.80 times and a disturbingly high net debt to EBITDA ratio of 7.2 hit our confidence in TNS energo Nizhny Novgorod like a one-two punch to the gut. The debt burden here is substantial. Worse, TNS energo Nizhny Novgorod's EBIT was down 44% over the last year. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. When analysing debt levels, the balance sheet is the obvious place to start. But it is TNS energo Nizhny Novgorod's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last two years, TNS energo Nizhny Novgorod produced sturdy free cash flow equating to 70% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Both TNS energo Nizhny Novgorod's EBIT growth rate and its interest cover were discouraging. But on the brighter side of life, its conversion of EBIT to free cash flow leaves us feeling more frolicsome. We should also note that Electric Utilities industry companies like TNS energo Nizhny Novgorod commonly do use debt without problems. When we consider all the factors discussed, it seems to us that TNS energo Nizhny Novgorod is taking some risks with its use of debt. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 4 warning signs we've spotted with TNS energo Nizhny Novgorod (including 2 which don't sit too well with us) .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

When trading TNS energo Nizhny Novgorod or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TNS energo Nizhny Novgorod might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About MISX:NNSB

TNS energo Nizhny Novgorod

Public Joint-Stock Company TNS energo Nizhny Novgorod purchases and sells electricity in the Nizhny Novgorod region.

Questionable track record with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.