- Russia

- /

- Electric Utilities

- /

- MISX:MRKC

Should You Buy Interregional Distribution Grid Company of Centre, Public Joint Stock Company (MCX:MRKC) For Its Dividend?

Could Interregional Distribution Grid Company of Centre, Public Joint Stock Company (MCX:MRKC) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

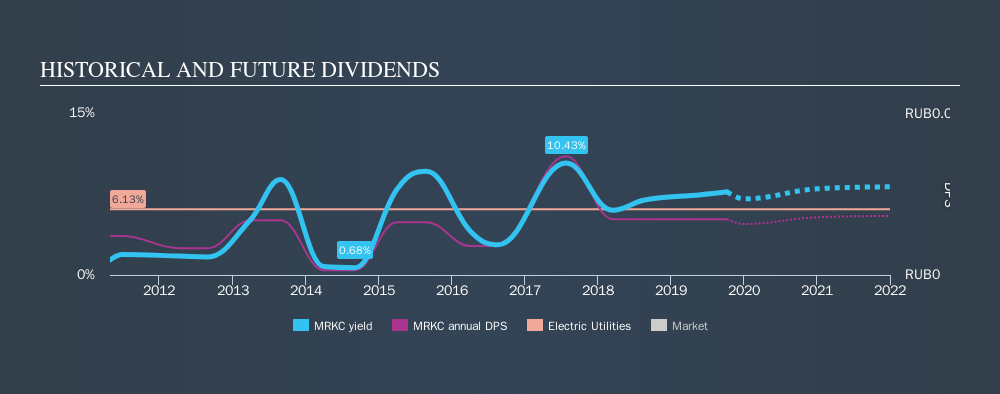

In this case, Interregional Distribution Grid Company of Centre likely looks attractive to dividend investors, given its 7.7% dividend yield and eight-year payment history. We'd agree the yield does look enticing. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. In the last year, Interregional Distribution Grid Company of Centre paid out 41% of its profit as dividends. A medium payout ratio strikes a good balance between paying dividends, and keeping enough back to invest in the business. Besides, if reinvestment opportunities dry up, the company has room to increase the dividend.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Last year, Interregional Distribution Grid Company of Centre paid a dividend while reporting negative free cash flow. While there may be an explanation, we think this behaviour is generally not sustainable.

Is Interregional Distribution Grid Company of Centre's Balance Sheet Risky?

As Interregional Distribution Grid Company of Centre has a meaningful amount of debt, we need to check its balance sheet to see if the company might have debt risks. A quick check of its financial situation can be done with two ratios: net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and net interest cover. Net debt to EBITDA measures total debt load relative to company earnings (lower = less debt), while net interest cover measures the ability to pay interest on the debt (higher = greater ability to pay interest costs). Interregional Distribution Grid Company of Centre has net debt of 2.44 times its EBITDA. Using debt can accelerate business growth, but also increases the risks.

Net interest cover can be calculated by dividing earnings before interest and tax (EBIT) by the company's net interest expense. Interest cover of 2.26 times its interest expense is starting to become a concern for Interregional Distribution Grid Company of Centre, and be aware that lenders may place additional restrictions on the company as well.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. The first recorded dividend for Interregional Distribution Grid Company of Centre, in the last decade, was eight years ago. It's good to see that Interregional Distribution Grid Company of Centre has been paying a dividend for a number of years. However, the dividend has been cut at least once in the past, and we're concerned that what has been cut once, could be cut again. During the past eight-year period, the first annual payment was ₽0.014 in 2011, compared to ₽0.021 last year. Dividends per share have grown at approximately 4.6% per year over this time. The growth in dividends has not been linear, but the CAGR is a decent approximation of the rate of change over this time frame.

Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

Dividend Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Interregional Distribution Grid Company of Centre has grown its earnings per share at 56% per annum over the past five years. Earnings per share have rocketed in recent times, and we like that the company is retaining more than half of its earnings to reinvest. However, always remember that very few companies can grow at double digit rates forever.

Conclusion

To summarise, shareholders should always check that Interregional Distribution Grid Company of Centre's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. Firstly, the company has a conservative payout ratio, although we'd note that its cashflow in the past year was substantially lower than its reported profit. Next, earnings growth has been good, but unfortunately the dividend has been cut at least once in the past. While we're not hugely bearish on it, overall we think there are potentially better dividend stocks than Interregional Distribution Grid Company of Centre out there.

See if management have their own wealth at stake, by checking insider shareholdings in Interregional Distribution Grid Company of Centre stock.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About MISX:MRKC

Rosseti Centre

Public Joint Stock Company Rosseti Centre operates as a power grid company in Russia.

Solid track record established dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion