Aeroflot - Russian Airlines' (MCX:AFLT) Stock Price Has Reduced 48% In The Past Three Years

Public Joint Stock Company Aeroflot - Russian Airlines (MCX:AFLT) shareholders should be happy to see the share price up 26% in the last quarter. But that doesn't change the fact that the returns over the last three years have been less than pleasing. Truth be told the share price declined 48% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

Check out our latest analysis for Aeroflot - Russian Airlines

Given that Aeroflot - Russian Airlines didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, Aeroflot - Russian Airlines saw its revenue grow by 0.6% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. Indeed, the stock dropped 14% over the last three years. If revenue growth accelerates, we might see the share price bounce. But ultimately the key will be whether the company can become profitability.

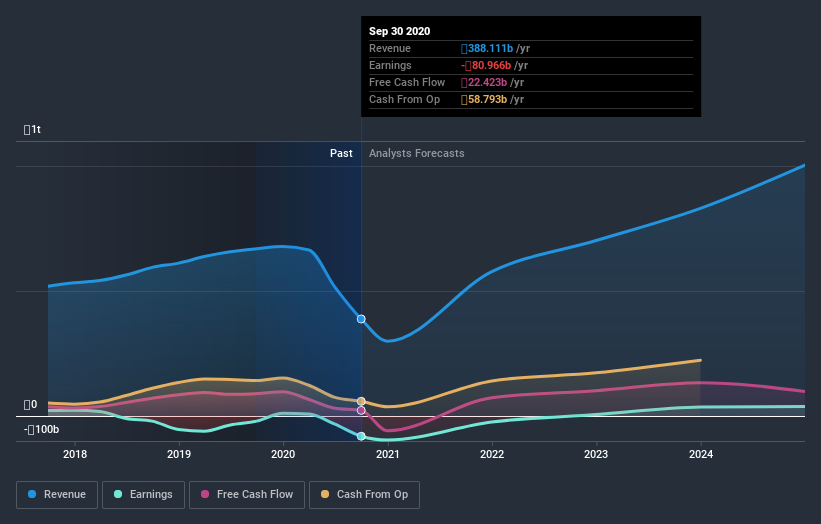

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Aeroflot - Russian Airlines is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Aeroflot - Russian Airlines stock, you should check out this free report showing analyst consensus estimates for future profits.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Aeroflot - Russian Airlines, it has a TSR of -41% for the last 3 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market gained around 5.7% in the last year, Aeroflot - Russian Airlines shareholders lost 32% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 12% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for Aeroflot - Russian Airlines (1 doesn't sit too well with us) that you should be aware of.

We will like Aeroflot - Russian Airlines better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on RU exchanges.

When trading Aeroflot - Russian Airlines or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About MISX:AFLT

Aeroflot - Russian Airlines

Public Joint Stock Company Aeroflot - Russian Airlines, together with its subsidiaries, provides passenger and cargo air transportation services in Russia and internationally.

Good value slight.

Similar Companies

Market Insights

Community Narratives