- Russia

- /

- Telecom Services and Carriers

- /

- MISX:TTLK

Despite shrinking by ₽3.6b in the past week, Tattelecom (MCX:TTLK) shareholders are still up 275% over 5 years

The last three months have been tough on Tattelecom Public Joint-Stock Company (MCX:TTLK) shareholders, who have seen the share price decline a rather worrying 30%. But that doesn't change the fact that the returns over the last five years have been very strong. Indeed, the share price is up an impressive 161% in that time. Generally speaking the long term returns will give you a better idea of business quality than short periods can. The more important question is whether the stock is too cheap or too expensive today.

In light of the stock dropping 29% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

Check out our latest analysis for Tattelecom

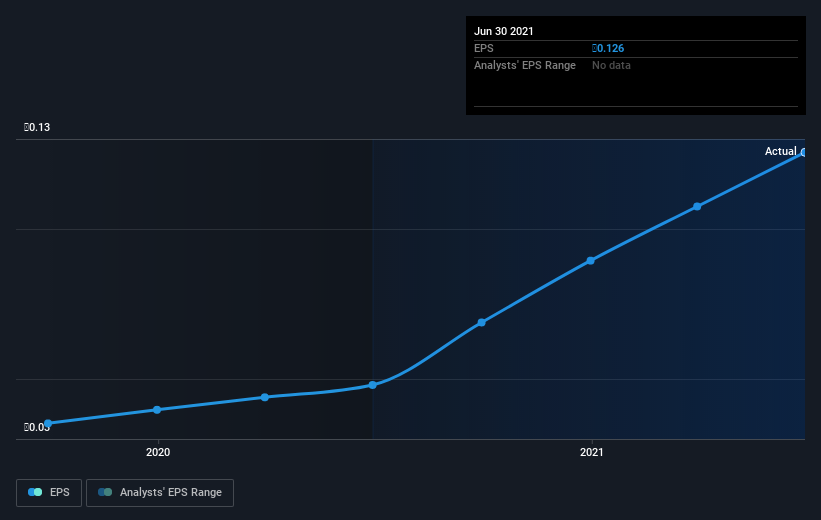

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the five years of share price growth, Tattelecom moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. We can see that the Tattelecom share price is up 108% in the last three years. In the same period, EPS is up 116% per year. This EPS growth is higher than the 28% average annual increase in the share price over the same three years. So you might conclude the market is a little more cautious about the stock, these days. This unenthusiastic sentiment is reflected in the stock's reasonably modest P/E ratio of 3.36.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It might be well worthwhile taking a look at our free report on Tattelecom's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Tattelecom, it has a TSR of 275% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While it's never nice to take a loss, Tattelecom shareholders can take comfort that , including dividends,their trailing twelve month loss of 9.5% wasn't as bad as the market loss of around 27%. Longer term investors wouldn't be so upset, since they would have made 30%, each year, over five years. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. It's always interesting to track share price performance over the longer term. But to understand Tattelecom better, we need to consider many other factors. To that end, you should be aware of the 3 warning signs we've spotted with Tattelecom .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on RU exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Tattelecom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About MISX:TTLK

Tattelecom

Tattelecom Public Joint-Stock Company provides telecommunications services for business and home clients in the Republic of Tatarstan.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives