The 16% return this week takes Human Stem Cells Institute's (MCX:ISKJ) shareholders three-year gains to 1,049%

Investing can be hard but the potential fo an individual stock to pay off big time inspires us. You won't get it right every time, but when you do, the returns can be truly splendid. Take, for example, the Public Joint-Stock Company "Human Stem Cells Institute" (MCX:ISKJ) share price, which skyrocketed 1,049% over three years. Also pleasing for shareholders was the 158% gain in the last three months. We love happy stories like this one. The company should be really proud of that performance!

Since it's been a strong week for Human Stem Cells Institute shareholders, let's have a look at trend of the longer term fundamentals.

See our latest analysis for Human Stem Cells Institute

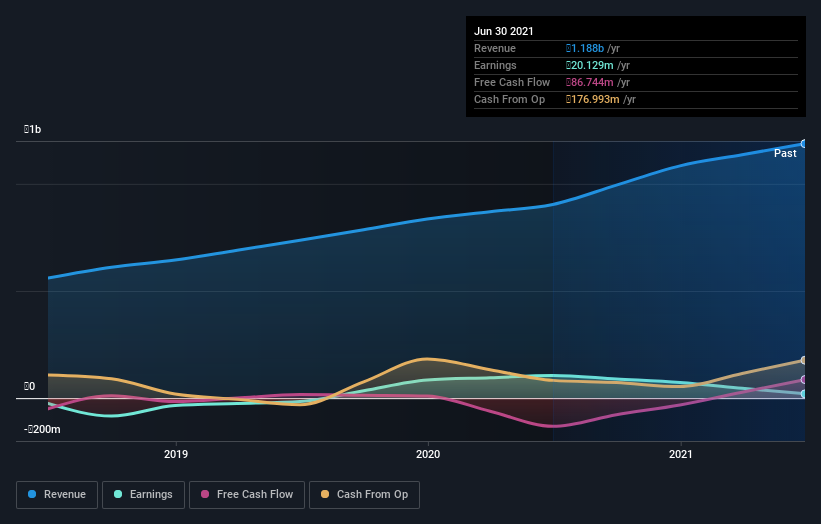

Given that Human Stem Cells Institute only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over the last three years Human Stem Cells Institute has grown its revenue at 24% annually. That's much better than most loss-making companies. In light of this attractive revenue growth, it seems somewhat appropriate that the share price has been rocketing, boasting a gain of 126% per year, over the same period. Despite the strong run, top performers like Human Stem Cells Institute have been known to go on winning for decades. So we'd recommend you take a closer look at this one, or even put it on your watchlist.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Human Stem Cells Institute's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Human Stem Cells Institute shareholders have received a total shareholder return of 190% over one year. That's better than the annualised return of 42% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 5 warning signs for Human Stem Cells Institute (of which 1 is potentially serious!) you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on RU exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Human Stem Cells Institute might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About MISX:ISKJ

Human Stem Cells Institute

Public Joint-Stock Company ‘Human Stem Cells Institute’ operates as a biotech company primarily in Russia.

Good value with mediocre balance sheet.

Market Insights

Community Narratives