- Russia

- /

- Metals and Mining

- /

- MISX:VSMO

public stock company VSMPO-AVISMA Corporation's (MCX:VSMO) On An Uptrend But Financial Prospects Look Pretty Weak: Is The Stock Overpriced?

public stock company VSMPO-AVISMA (MCX:VSMO) has had a great run on the share market with its stock up by a significant 20% over the last month. We, however wanted to have a closer look at its key financial indicators as the markets usually pay for long-term fundamentals, and in this case, they don't look very promising. Specifically, we decided to study public stock company VSMPO-AVISMA's ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

See our latest analysis for public stock company VSMPO-AVISMA

How Do You Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for public stock company VSMPO-AVISMA is:

3.6% = ₽7.0b ÷ ₽195b (Based on the trailing twelve months to June 2020).

The 'return' is the amount earned after tax over the last twelve months. One way to conceptualize this is that for each RUB1 of shareholders' capital it has, the company made RUB0.04 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

public stock company VSMPO-AVISMA's Earnings Growth And 3.6% ROE

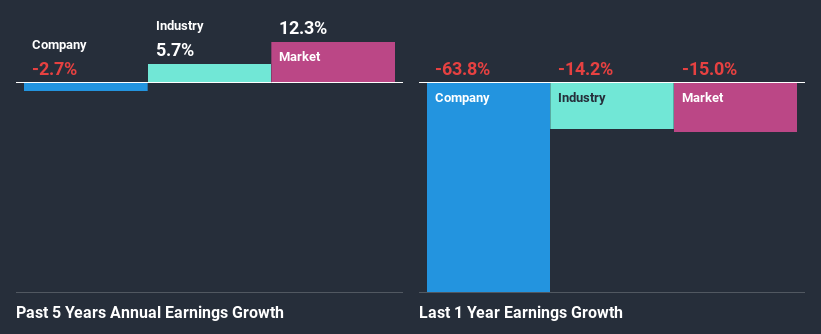

It is quite clear that public stock company VSMPO-AVISMA's ROE is rather low. Not just that, even compared to the industry average of 9.0%, the company's ROE is entirely unremarkable. For this reason, public stock company VSMPO-AVISMA's five year net income decline of 2.7% is not surprising given its lower ROE. We believe that there also might be other aspects that are negatively influencing the company's earnings prospects. For instance, the company has a very high payout ratio, or is faced with competitive pressures.

So, as a next step, we compared public stock company VSMPO-AVISMA's performance against the industry and were disappointed to discover that while the company has been shrinking its earnings, the industry has been growing its earnings at a rate of 5.7% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about public stock company VSMPO-AVISMA's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is public stock company VSMPO-AVISMA Using Its Retained Earnings Effectively?

While the company did payout a portion of its dividend in the past, it currently doesn't pay a dividend. This implies that potentially all of its profits are being reinvested in the business.

Conclusion

In total, we would have a hard think before deciding on any investment action concerning public stock company VSMPO-AVISMA. Particularly, its ROE is a huge disappointment, not to mention its lack of proper reinvestment into the business. As a result its earnings growth has also been quite disappointing. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. You can do your own research on public stock company VSMPO-AVISMA and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

If you decide to trade public stock company VSMPO-AVISMA, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About MISX:VSMO

public stock company VSMPO-AVISMA

public stock company VSMPO-AVISMA Corporation produces and sells titanium in Russia and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives