- Russia

- /

- Metals and Mining

- /

- MISX:ELTZ

Electrozink (MCX:ELTZ) Has Debt But No Earnings; Should You Worry?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Electrozink Open Joint-Stock Company (MCX:ELTZ) does carry debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Electrozink

What Is Electrozink's Debt?

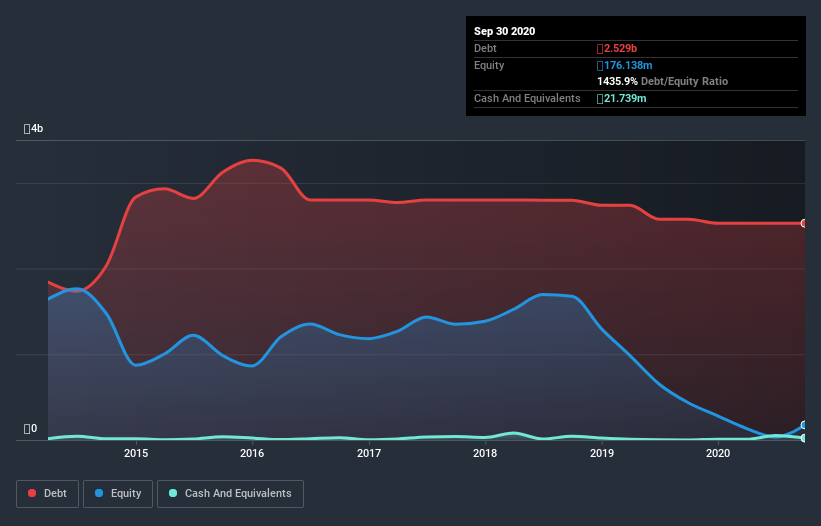

The chart below, which you can click on for greater detail, shows that Electrozink had ₽2.53b in debt in September 2020; about the same as the year before. And it doesn't have much cash, so its net debt is about the same.

A Look At Electrozink's Liabilities

According to the last reported balance sheet, Electrozink had liabilities of ₽3.40b due within 12 months, and liabilities of ₽49.0m due beyond 12 months. Offsetting this, it had ₽21.7m in cash and ₽323.5m in receivables that were due within 12 months. So its liabilities total ₽3.10b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the ₽239.4m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Electrozink would likely require a major re-capitalisation if it had to pay its creditors today. There's no doubt that we learn most about debt from the balance sheet. But it is Electrozink's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Electrozink wasn't profitable at an EBIT level, but managed to grow its revenue by 43%, to ₽1.9b. Shareholders probably have their fingers crossed that it can grow its way to profits.

Caveat Emptor

Even though Electrozink managed to grow its top line quite deftly, the cold hard truth is that it is losing money on the EBIT line. Indeed, it lost a very considerable ₽414m at the EBIT level. When you combine this with the very significant balance sheet liabilities mentioned above, we are so wary of it that we are basically at a loss for the right words. Like every long-shot we're sure it has a glossy presentation outlining its blue-sky potential. But the reality is that it is low on liquid assets relative to liabilities, and it lost ₽258m in the last year. So we think buying this stock is risky. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Electrozink , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Electrozink, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Electrozink might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About MISX:ELTZ

Electrozink

Electrozink Public Joint-Stock Company produces and sells various non-ferrous metallurgy products in Russia.

Good value with worrying balance sheet.

Market Insights

Community Narratives