- Romania

- /

- Electric Utilities

- /

- BVB:TEL

Undiscovered European Stock Gems To Explore In June 2025

Reviewed by Simply Wall St

As European markets navigate renewed uncertainty due to geopolitical tensions and fluctuating trade policies, the pan-European STOXX Europe 600 Index recently ended 1.57% lower, reflecting broader declines across major stock indexes like Germany's DAX and France's CAC 40. In this environment of volatility and cautious optimism, identifying promising stocks often involves looking for companies with strong fundamentals that can weather economic shifts while capitalizing on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 7.49% | 44.78% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

CNTEE Transelectrica (BVB:TEL)

Simply Wall St Value Rating: ★★★★★★

Overview: CNTEE Transelectrica SA operates as the transmission and system operator for Romania's national power system, with a market cap of RON3.70 billion.

Operations: Transelectrica generates revenue primarily from its Transmission and Dispatch segment, which amounted to RON7.33 billion. The company's financial performance is influenced by its net profit margin, which reflects the efficiency of its operations in converting revenue into profit.

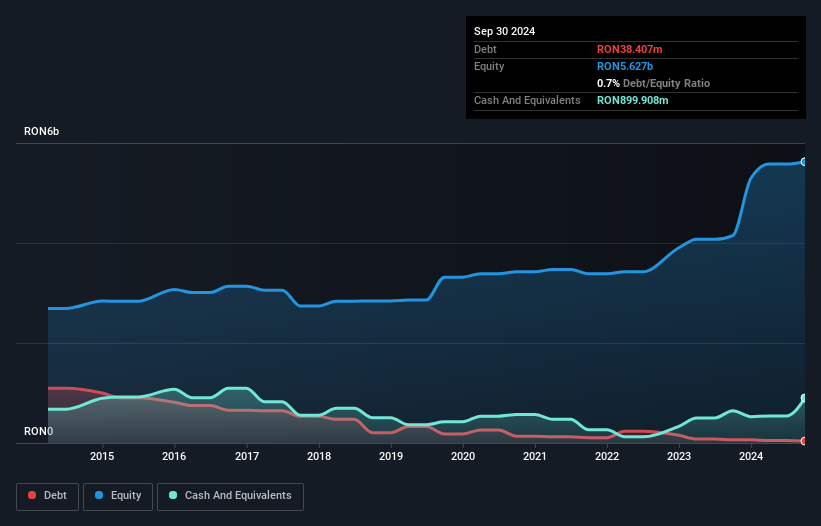

Transelectrica, a notable player in Romania's electric utilities sector, has demonstrated robust financial health with earnings growth of 163% over the past year, outpacing the industry average. The company's debt to equity ratio impressively decreased from 7.7 to 0.6 over five years, highlighting effective debt management. With EBIT covering interest payments by 448 times and trading at a value below its estimated fair value by about 28%, it seems undervalued and financially sound. Recent earnings reveal net income at RON 153 million compared to RON 104 million previously, suggesting strong operational performance despite reduced sales figures this quarter.

Mayr-Melnhof Karton (WBAG:MMK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Mayr-Melnhof Karton AG is a company that produces and distributes cartonboard and folding cartons across Germany, Austria, and international markets, with a market capitalization of approximately €1.48 billion.

Operations: Mayr-Melnhof Karton generates revenue primarily from MM Board & Paper (€1.98 billion), MM Food & Premium Packaging (€1.69 billion), and MM Pharma & Healthcare Packaging (€614.29 million).

Mayr-Melnhof Karton, a notable player in the packaging industry, has shown impressive earnings growth of 86.9% over the past year, significantly outpacing its sector's -21.8%. The company's strategic initiatives like closing a small recycled cartonboard mill and selling non-core businesses are likely to enhance operational efficiency and profitability. Despite a high net debt to equity ratio of 64.5%, MMK's interest payments are well covered with an EBIT coverage of 3.9x. Recent earnings revealed Q1 sales at €1 billion, up from €1 billion last year, with net income doubling to €20 million compared to the previous year's €10 million.

Nexus (XTRA:NXU)

Simply Wall St Value Rating: ★★★★★★

Overview: Nexus AG specializes in developing and selling software solutions for the healthcare sector across Germany, Switzerland, Liechtenstein, the Netherlands, Poland, France, Austria, and other international markets with a market cap of approximately €1.20 billion.

Operations: Nexus AG generates revenue primarily from three segments: NEXUS / DE (€89.91 million), NEXUS / DIS (€72.94 million), and NEXUS / ROE (€115.55 million). The company's net profit margin has shown notable trends over recent periods, reflecting its operational efficiency within the healthcare software market.

Nexus AG, a nimble player in the healthcare services sector, showcases impressive financial health with no debt and high-quality earnings. Over the past five years, its earnings have surged by 17.9% annually. Recent results for Q1 2025 reveal sales of €71.13 million and net income of €8.24 million, up from €64.08 million and €6.57 million respectively a year earlier. Basic earnings per share climbed to €0.48 from last year's €0.38, reflecting solid growth potential despite not outpacing industry peers recently at 28%. The company also announced an annual dividend increase to €0.23 per share payable in May 2025.

- Unlock comprehensive insights into our analysis of Nexus stock in this health report.

Gain insights into Nexus' past trends and performance with our Past report.

Key Takeaways

- Embark on your investment journey to our 333 European Undiscovered Gems With Strong Fundamentals selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:TEL

CNTEE Transelectrica

CNTEE Transelectrica SA acts as a transmission and system operator of the national power system.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives