- Japan

- /

- Professional Services

- /

- TSE:2163

Three Top Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

In the current global market landscape, U.S. stocks have faced downward pressure due to tariff uncertainties and cooling job growth, while European markets have shown resilience despite similar concerns. Amid these fluctuating conditions, dividend stocks can provide a measure of stability and income for investors by offering regular payouts even when market volatility is high.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.83% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.88% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.33% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.55% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.12% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.90% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.20% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.84% | ★★★★★★ |

| Archer-Daniels-Midland (NYSE:ADM) | 4.46% | ★★★★★★ |

Click here to see the full list of 1966 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

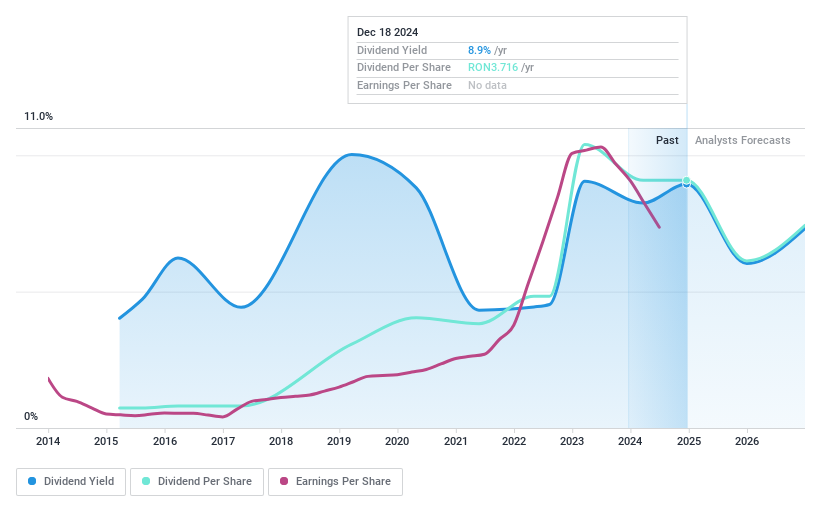

S.N. Nuclearelectrica (BVB:SNN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: S.N. Nuclearelectrica S.A. is involved in the production and transmission of electricity and thermal energy in Romania, with a market cap of RON12.59 billion.

Operations: S.N. Nuclearelectrica S.A.'s revenue primarily comes from its non-regulated utility segment, generating RON5.93 billion.

Dividend Yield: 8.9%

S.N. Nuclearelectrica offers a stable dividend yield of 8.9%, ranking in the top 25% of Romanian dividend payers, though it is not well covered by free cash flow due to a high cash payout ratio of 115%. Despite trading at a favorable price-to-earnings ratio (6.2x) relative to the market, earnings are expected to decline by an average of 32.1% annually over the next three years, raising concerns about future dividend sustainability.

- Unlock comprehensive insights into our analysis of S.N. Nuclearelectrica stock in this dividend report.

- In light of our recent valuation report, it seems possible that S.N. Nuclearelectrica is trading behind its estimated value.

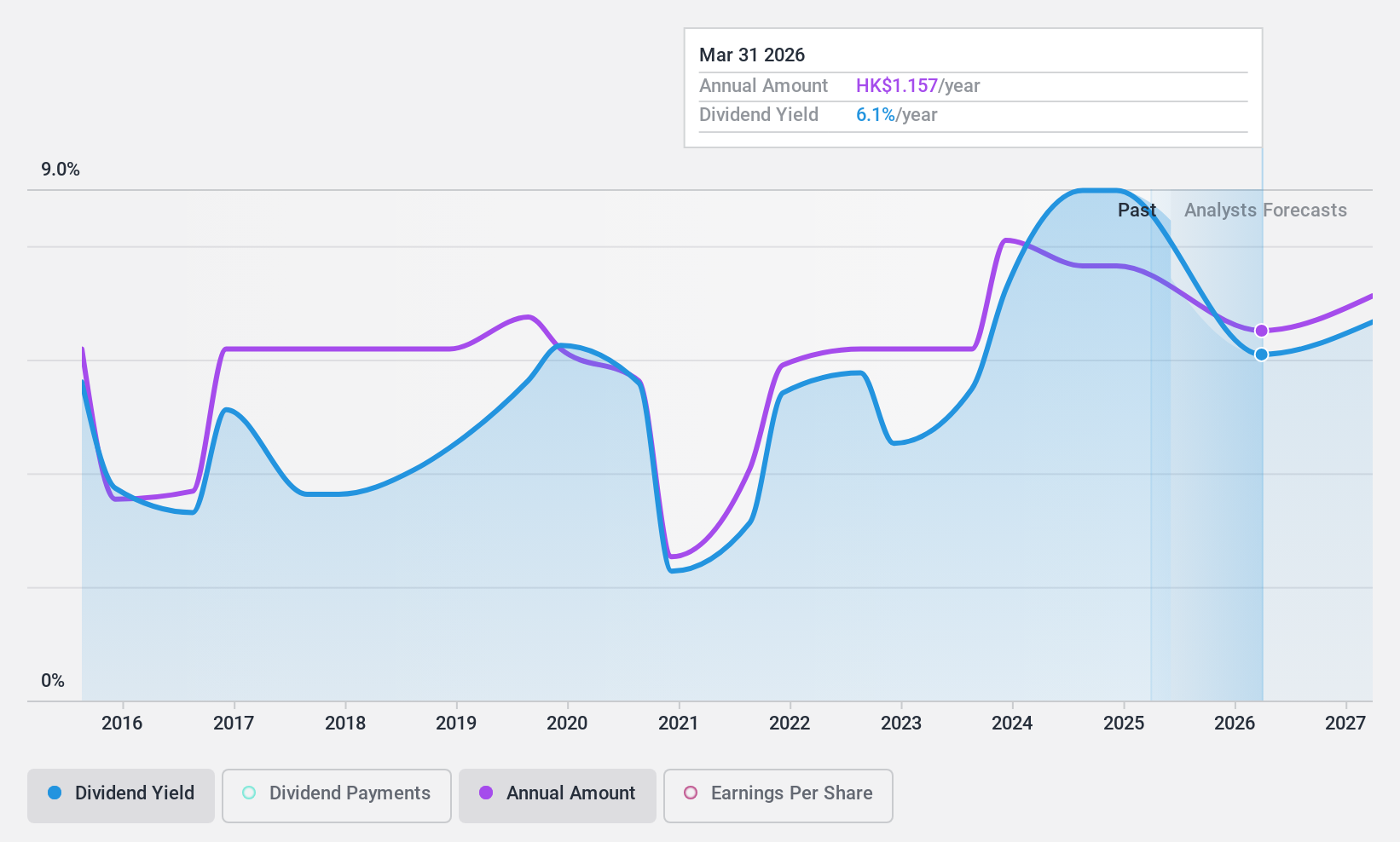

Luk Fook Holdings (International) (SEHK:590)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Luk Fook Holdings (International) Limited is an investment holding company involved in sourcing, designing, wholesaling, trademark licensing, and retailing gold and platinum jewelry as well as gem-set jewelry products, with a market cap of approximately HK$8.44 billion.

Operations: Luk Fook Holdings (International) Limited generates revenue from several segments, including Licensing (HK$892.75 million), Retailing in Mainland China (HK$2.81 billion), Wholesaling in Hong Kong (HK$2.06 billion), Wholesaling in Mainland China (HK$1.08 billion), and Retailing across Hong Kong, Macau, and Overseas markets (HK$8.66 billion).

Dividend Yield: 9.5%

Luk Fook Holdings (International) offers a dividend yield in the top 25% of Hong Kong payers, supported by a payout ratio of 55.5% and cash payout ratio of 42%, indicating coverage by earnings and cash flows. However, dividends have been volatile over the past decade. Recent sales performance shows improvement in Mainland China but continued challenges in Hong Kong and Macau, with overall retailing revenue dropping 9% YoY for Q3 FY2025 amidst shop closures.

- Delve into the full analysis dividend report here for a deeper understanding of Luk Fook Holdings (International).

- The analysis detailed in our Luk Fook Holdings (International) valuation report hints at an deflated share price compared to its estimated value.

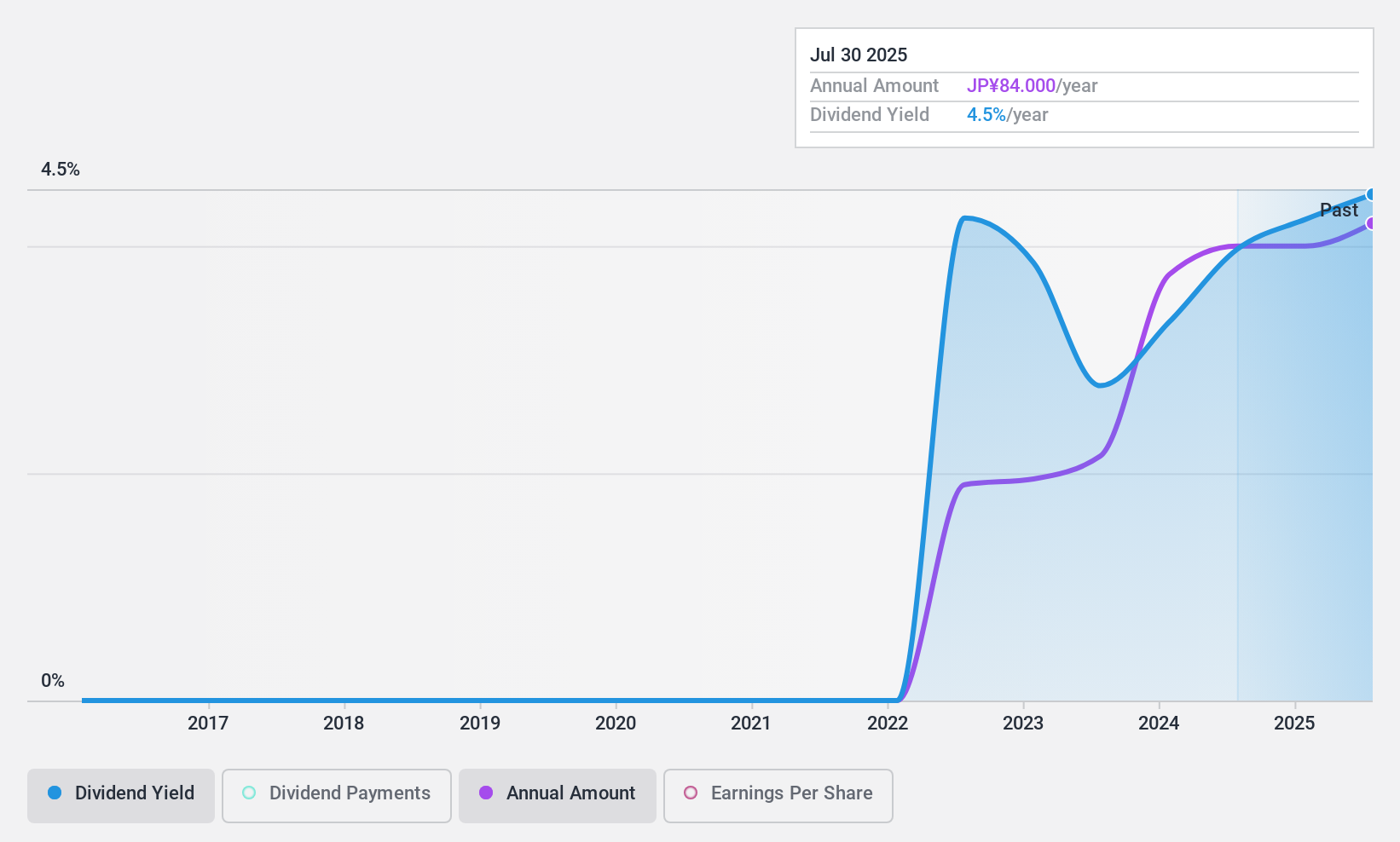

ArtnerLtd (TSE:2163)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Artner Co., Ltd. offers worker dispatching and employment placement services both in Japan and internationally, with a market cap of ¥19.66 billion.

Operations: Artner Co., Ltd. generates revenue through its worker dispatching and employment placement services across domestic and international markets.

Dividend Yield: 4.3%

Artner Ltd. offers a dividend yield of 4.32%, placing it in the top quartile of Japanese dividend payers, supported by a payout ratio of 69.6% and cash payout ratio of 83.5%, suggesting coverage by earnings and cash flows. Despite only three years of payments, dividends have been stable with growth and minimal volatility. Recent earnings grew by 11.4%, enhancing sustainability prospects ahead of its Q3 FY2025 earnings call scheduled for December 11, 2024.

- Get an in-depth perspective on ArtnerLtd's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that ArtnerLtd is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Unlock our comprehensive list of 1966 Top Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2163

Artner

Engages in the engineer dispatching and contracting businesses in Japan and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)