- Romania

- /

- Electric Utilities

- /

- BVB:SNN

European Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As European markets show mixed returns, with the STOXX Europe 600 Index remaining relatively flat and major indices like France's CAC 40 and Italy's FTSE MIB posting modest gains, investors are keenly observing the region's economic indicators such as inflation rates and labor market stability. In this context, dividend stocks can offer a reliable income stream, making them an attractive consideration for enhancing portfolios amidst fluctuating market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.47% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.28% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.59% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.80% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.81% | ★★★★★★ |

| Holcim (SWX:HOLN) | 5.10% | ★★★★★★ |

| ERG (BIT:ERG) | 5.39% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.01% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.68% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.41% | ★★★★★★ |

Click here to see the full list of 231 stocks from our Top European Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

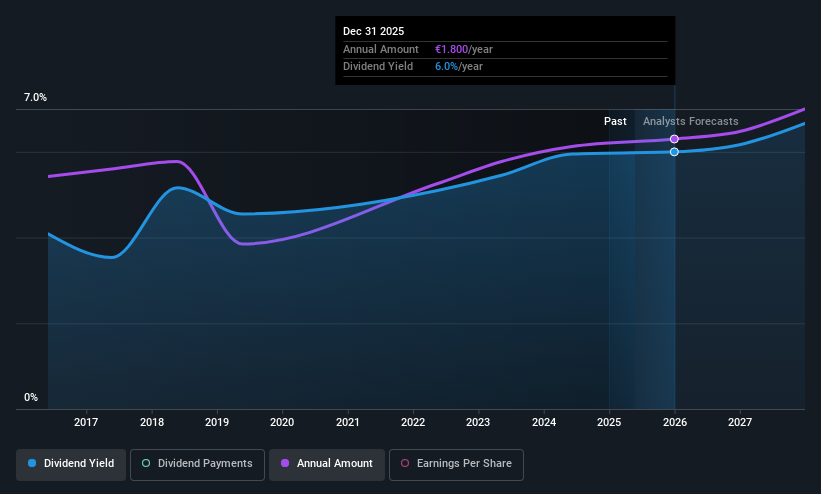

S.N. Nuclearelectrica (BVB:SNN)

Simply Wall St Dividend Rating: ★★★☆☆☆

Overview: S.N. Nuclearelectrica S.A. is involved in the production and transmission of electricity and thermal energy in Romania, with a market cap of RON12.91 billion.

Operations: S.N. Nuclearelectrica S.A.'s revenue segment primarily consists of its non-regulated utility operations, generating RON5.14 billion.

Dividend Yield: 6.3%

S.N. Nuclearelectrica offers a dividend yield of 6.31%, slightly below the top 25% in Romania, and its dividends have been volatile over the past decade, with periods of significant drops. The dividend is not well covered by free cash flow due to a high cash payout ratio (147.6%), though earnings coverage is reasonable with a payout ratio of 49.1%. Recent earnings showed increased sales but declined net income year-over-year, highlighting potential challenges ahead.

- Navigate through the intricacies of S.N. Nuclearelectrica with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that S.N. Nuclearelectrica is trading beyond its estimated value.

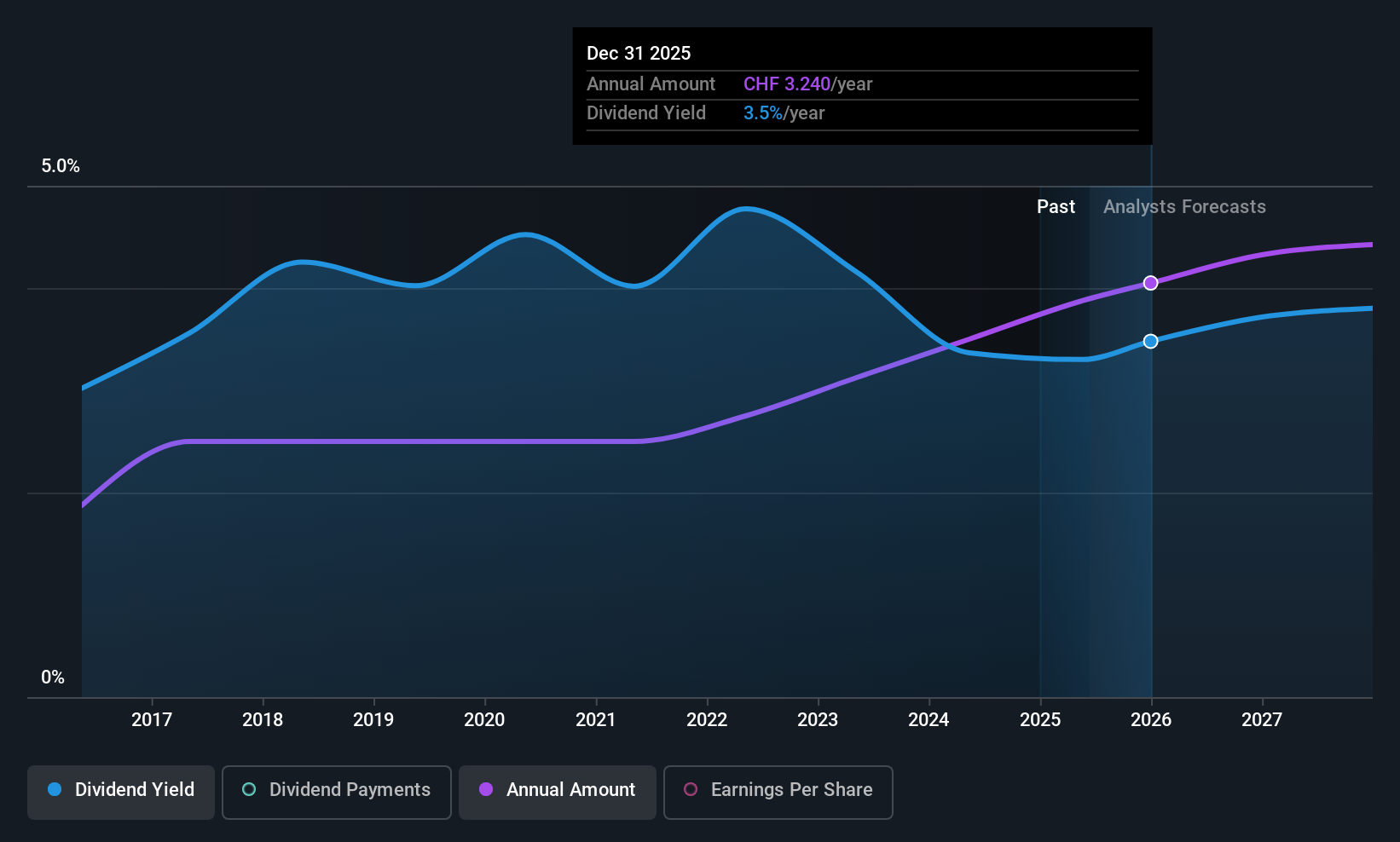

Holcim (SWX:HOLN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Holcim AG, with a market cap of CHF33.47 billion, operates globally through its subsidiaries to offer building materials and solutions.

Operations: Holcim AG generates revenue through its key segments: Cement at CHF13.16 billion, Aggregates at CHF4.34 billion, Ready-Mix Concrete at CHF5.60 billion, and Solution & Products at CHF5.94 billion.

Dividend Yield: 5.1%

Holcim's recent 11% dividend increase to CHF 3.10 per share underscores its commitment to rewarding shareholders, supported by a sustainable payout ratio of 59.2% and a cash payout ratio of 42.5%. This positions Holcim among the top dividend payers in Switzerland with a yield of 5.1%. While dividends have been stable over the past decade, recent business expansions like the EUR 400 million OLYMPUS project in Greece may impact future cash flows amidst expected earnings declines.

- Delve into the full analysis dividend report here for a deeper understanding of Holcim.

- The analysis detailed in our Holcim valuation report hints at an deflated share price compared to its estimated value.

PWO (XTRA:PWO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PWO AG is a company that develops, produces, and sells metal components and systems for the mobility industry across Germany, Czechia, Canada, Mexico, Serbia, and China with a market cap of €93.13 million.

Operations: PWO AG's revenue is primarily derived from its Auto Parts & Accessories segment, which generated €545.76 million.

Dividend Yield: 5.9%

PWO AG's dividend of €1.75 per share reflects a payout ratio of 50.1%, indicating dividends are covered by earnings, while the cash payout ratio stands at 51.4%. Despite being among Germany's top dividend payers with a yield of 5.87%, PWO has an unstable dividend history marked by volatility and unreliability over the past decade. Recent financial results show declining revenue and net income, potentially impacting future payouts despite historical growth in dividends over ten years.

- Click to explore a detailed breakdown of our findings in PWO's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of PWO shares in the market.

Seize The Opportunity

- Dive into all 231 of the Top European Dividend Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:SNN

S.N. Nuclearelectrica

Engages in the production and transmission of electricity and thermal energy in Romania.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives