Discovering TTS (Transport Trade Services) And 2 Other Noteworthy European Penny Stocks

Reviewed by Simply Wall St

As European markets experience a modest uplift, with the pan-European STOXX Europe 600 Index rising by 1.40% amid optimism for lower U.S. borrowing costs, investors are increasingly looking at diverse opportunities across the continent. While penny stocks might seem like an outdated term, they still represent a niche investment area that can yield significant growth potential when backed by solid financials. In this context, we explore several noteworthy European penny stocks that combine financial strength with promising long-term prospects, offering investors a chance to uncover hidden value in smaller or newer companies.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.56 | €1.58B | ✅ 4 ⚠️ 2 View Analysis > |

| Maps (BIT:MAPS) | €3.36 | €44.63M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €246.7M | ✅ 2 ⚠️ 2 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.498 | RON16.84M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €3.15 | €66.44M | ✅ 4 ⚠️ 2 View Analysis > |

| Euroland Société anonyme (ENXTPA:ALERO) | €3.00 | €9.52M | ✅ 2 ⚠️ 5 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.645 | €410.55M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.12 | €293.03M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.942 | €31.77M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 343 stocks from our European Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

TTS (Transport Trade Services) (BVB:TTS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: TTS (Transport Trade Services) S.A. is a Romanian company that offers freight forwarding services, with a market capitalization of RON896.40 million.

Operations: The company's revenue is primarily derived from forwarding services at RON461.75 million, river transport generating RON300.68 million, and port operations contributing RON140.69 million.

Market Cap: RON896.4M

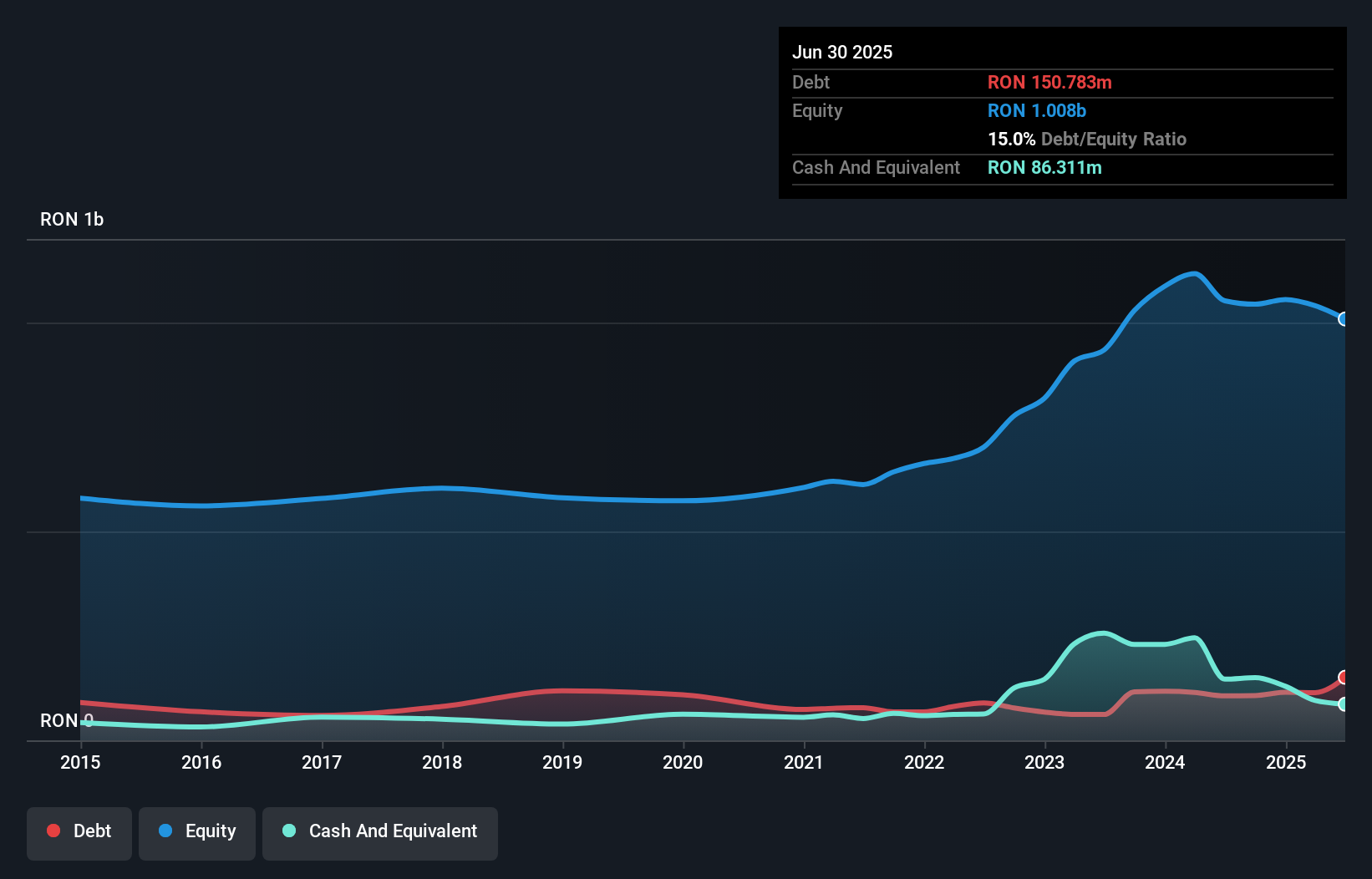

TTS (Transport Trade Services) S.A., a Romanian freight forwarding company, has faced challenges with declining sales in Q1 2025 to RON160.5 million from RON239.38 million the previous year, resulting in a net loss of RON13.51 million. Despite being unprofitable, it has managed to reduce losses by 14.3% annually over five years and forecasts suggest earnings growth of nearly 70% per year ahead. The company's debt management is prudent with a satisfactory net debt to equity ratio of 1.8%, and short-term assets comfortably cover both short- and long-term liabilities, reflecting financial stability amidst volatility concerns.

- Take a closer look at TTS (Transport Trade Services)'s potential here in our financial health report.

- Examine TTS (Transport Trade Services)'s earnings growth report to understand how analysts expect it to perform.

Freelance.com (ENXTPA:ALFRE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Freelance.com SA facilitates intermediation between companies and intellectual service providers across several countries, including France and Germany, with a market cap of €126 million.

Operations: The company generates revenue primarily from Business Services, amounting to €1.05 billion.

Market Cap: €126M

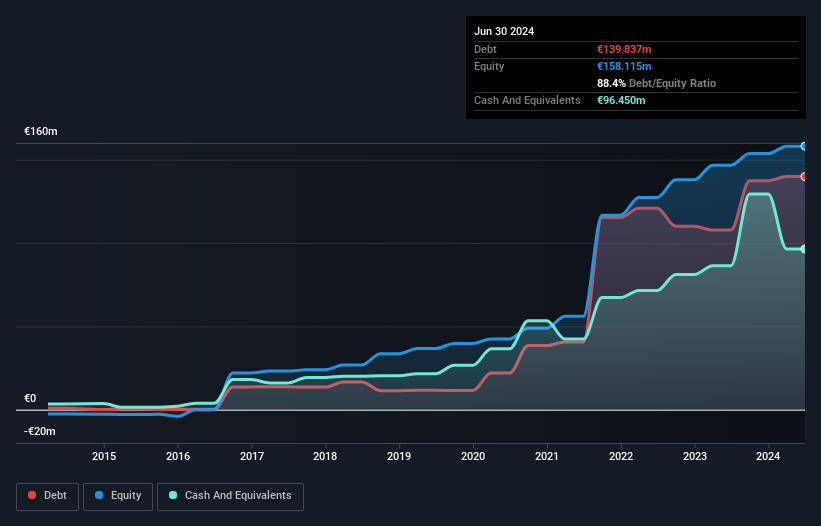

Freelance.com SA, with a market cap of €126 million, shows resilience in the penny stock space by generating €1.05 billion in revenue primarily from business services across Europe. The company's earnings have grown significantly at 21.7% annually over five years and outpaced industry growth last year. Despite a low return on equity of 10.8%, its debt management is satisfactory, as evidenced by short-term assets exceeding liabilities and interest payments well covered by EBIT. Trading at a significant discount to estimated fair value, Freelance.com presents good relative value compared to peers without meaningful shareholder dilution recently.

- Get an in-depth perspective on Freelance.com's performance by reading our balance sheet health report here.

- Evaluate Freelance.com's prospects by accessing our earnings growth report.

Tecnotree Oyj (HLSE:TEM1V)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tecnotree Oyj offers telecommunication IT solutions focused on charging, billing, customer care, and messaging and content services across Europe, the Americas, the Middle East, Africa, and the Asia Pacific with a market cap of €79.54 million.

Operations: The company's revenue is primarily derived from the MEA and APAC regions, contributing €52.03 million, while Europe and the Americas account for €18.73 million.

Market Cap: €79.54M

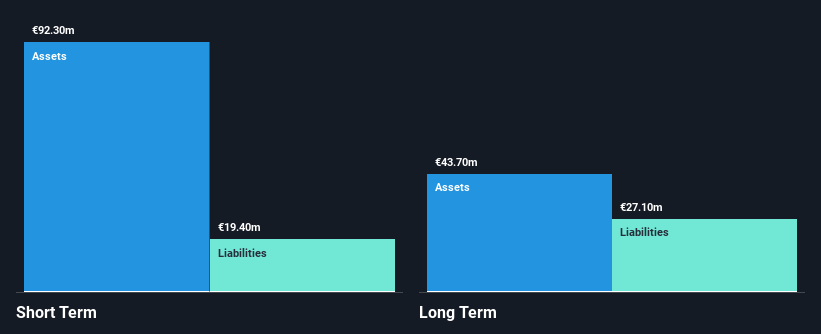

Tecnotree Oyj, with a market cap of €79.54 million, derives significant revenue from the MEA and APAC regions. Despite facing a decline in profit margins to 10.2% from 16% last year, the company maintains robust debt management with operating cash flow covering 50.6% of its debt and interest payments well covered by EBIT at 30.1x coverage. Recent strategic agreements, including a renewed framework with MTN Group and a €19.6 million deal with an MVNO in Europe, highlight growth potential in high-potential markets while trading below estimated fair value offers attractive relative value for investors seeking opportunities in this segment.

- Click here and access our complete financial health analysis report to understand the dynamics of Tecnotree Oyj.

- Assess Tecnotree Oyj's future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Dive into all 343 of the European Penny Stocks we have identified here.

- Searching for a Fresh Perspective? The latest GPUs need a type of rare earth metal called Neodymium and there are only 27 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tecnotree Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:TEM1V

Tecnotree Oyj

Provides telecommunication IT solutions for charging, billing, customer care, and messaging and content services in Europe, the Americas, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives