- Norway

- /

- Energy Services

- /

- OB:DFENS

3 European Penny Stocks With Market Caps Up To €200M

Reviewed by Simply Wall St

The European market has recently experienced a downturn, with the STOXX Europe 600 Index falling amid renewed uncertainty about U.S. trade policy and escalating geopolitical tensions in the Middle East. Despite these challenges, investors continue to seek opportunities that may offer growth potential beyond traditional stocks. Penny stocks, often representing smaller or newer companies, remain an area of interest for those looking to uncover hidden value. By focusing on companies with strong financial health and growth prospects, investors can find promising opportunities within this niche segment of the market.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Angler Gaming (NGM:ANGL) | SEK3.77 | SEK282.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.95 | €62.22M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.41 | €16.49M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.06 | PLN10.94M | ✅ 2 ⚠️ 4 View Analysis > |

| Libertas 7 (BME:LIB) | €1.78 | €37.93M | ✅ 3 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.37 | SEK2.27B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.74 | SEK227.54M | ✅ 2 ⚠️ 2 View Analysis > |

| High (ENXTPA:HCO) | €3.80 | €74.66M | ✅ 1 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.065 | €285.1M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €1.00 | €33.72M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 451 stocks from our European Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

TTS (Transport Trade Services) (BVB:TTS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: TTS (Transport Trade Services) S.A. is a Romanian company specializing in freight forwarding services with a market capitalization of RON775.80 million.

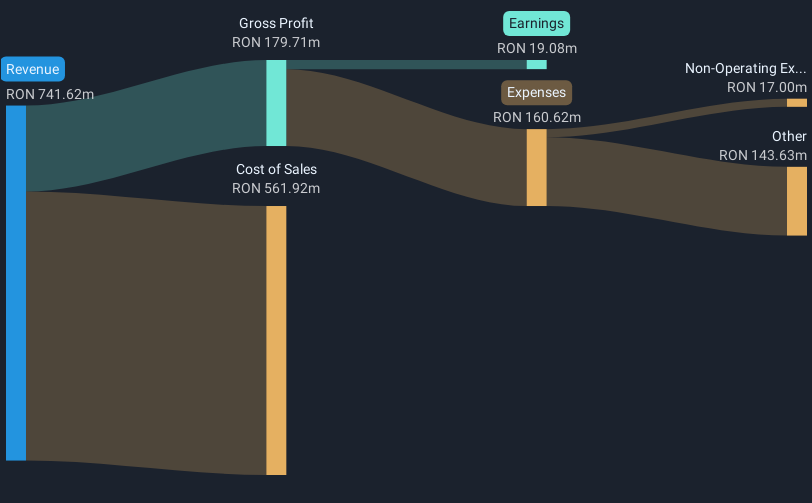

Operations: The company generates revenue primarily from forwarding services (RON461.75 million), river transport (RON300.68 million), and port operations (RON140.69 million).

Market Cap: RON775.8M

TTS (Transport Trade Services) S.A. has faced challenges with its recent performance, reporting a net loss of RON 13.51 million in Q1 2025 compared to a profit the previous year. Despite this, the company's debt is well-covered by operating cash flow at 50.4%, and it maintains a satisfactory net debt to equity ratio of 1.3%. Short-term assets exceed both short and long-term liabilities, providing some financial stability amidst volatility in earnings. Although currently unprofitable with negative return on equity, TTS has managed to reduce losses over five years while maintaining stable weekly volatility at 5%.

- Click to explore a detailed breakdown of our findings in TTS (Transport Trade Services)'s financial health report.

- Understand TTS (Transport Trade Services)'s earnings outlook by examining our growth report.

Groupe OKwind Société anonyme (ENXTPA:ALOKW)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Groupe OKwind Société anonyme designs, manufactures, sells, and installs green energy solutions in France with a market cap of €18.96 million.

Operations: The company's revenue is derived from two main segments: B to B, contributing €50.11 million, and B to C, generating €6.96 million.

Market Cap: €18.96M

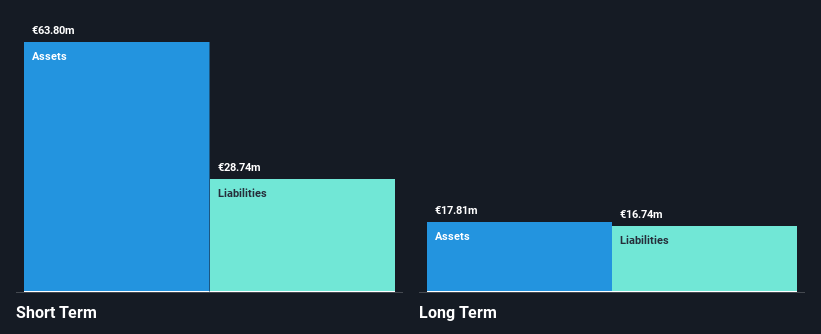

Groupe OKwind Société anonyme recently launched AutonoMEA, a comprehensive energy solution integrating photovoltaic production and intelligent storage, aiming to enhance customer energy independence amidst volatile electricity prices. Despite reporting a net loss of €3.6 million in 2024 against prior profitability, the company maintains strong liquidity with short-term assets exceeding liabilities. It has reduced losses over five years by 11.4% annually and its debt is well-covered by operating cash flow at 44.8%. The management team is experienced with an average tenure of 6.4 years, supporting strategic initiatives like AutonoMEA to drive future growth prospects.

- Click here to discover the nuances of Groupe OKwind Société anonyme with our detailed analytical financial health report.

- Explore Groupe OKwind Société anonyme's analyst forecasts in our growth report.

Aquila Holdings (OB:AQUIL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aquila Holdings ASA operates a seismic ocean bottom node multi-client data library with assets in Norway, Egypt, and the United States and has a market cap of NOK237.36 million.

Operations: Aquila Holdings ASA's revenue segments include investments totaling -$1.45 million, adjusted by segment adjustments of $1.65 million.

Market Cap: NOK237.36M

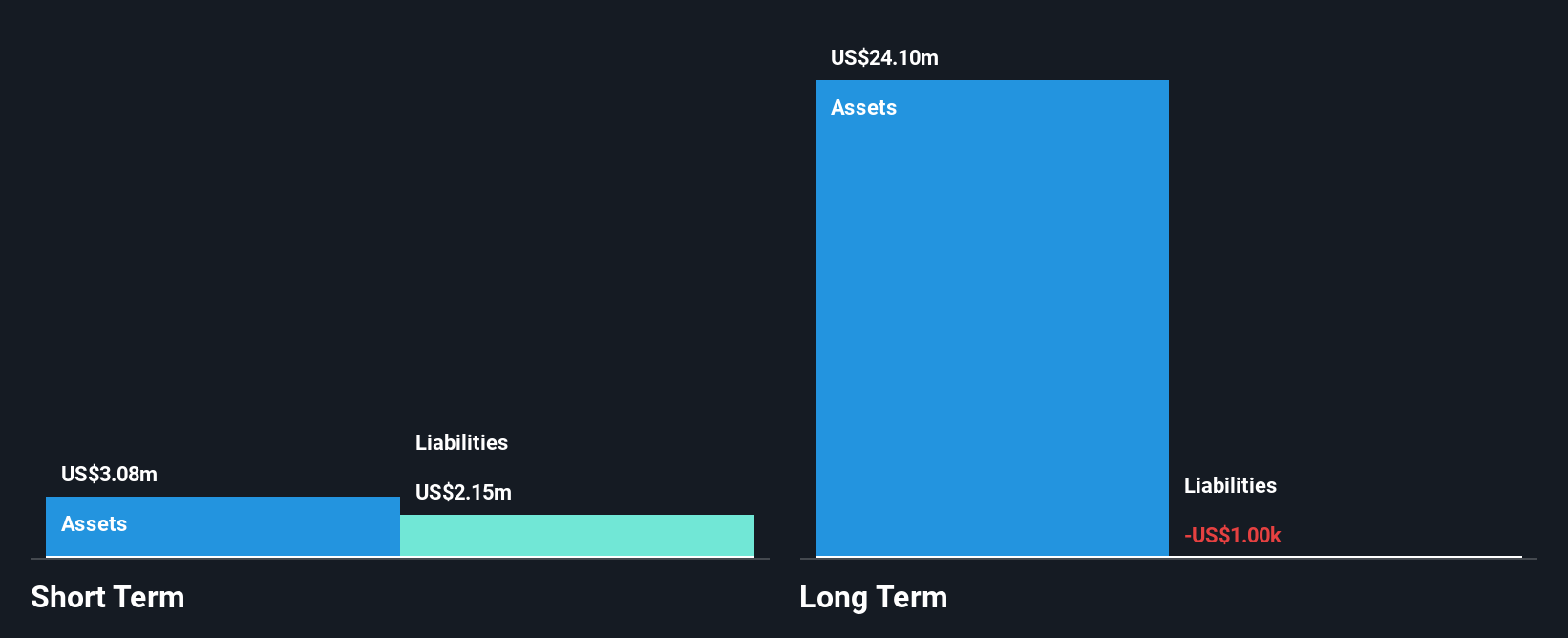

Aquila Holdings ASA, with a market cap of NOK237.36 million, is currently pre-revenue, generating less than US$1 million. Its short-term assets of $3.1M surpass its short-term liabilities but fall short against long-term obligations. The company remains unprofitable yet has managed to reduce losses by 29.7% annually over five years and is debt-free now compared to a 75.1% debt-to-equity ratio earlier. Recent strategic moves include acquiring Fjord Defence AS and repositioning as a defense compounder, alongside discussions on share capital adjustments at an extraordinary meeting scheduled for June 20, 2025, highlighting potential growth avenues amidst volatility concerns.

- Get an in-depth perspective on Aquila Holdings' performance by reading our balance sheet health report here.

- Understand Aquila Holdings' track record by examining our performance history report.

Summing It All Up

- Reveal the 451 hidden gems among our European Penny Stocks screener with a single click here.

- Want To Explore Some Alternatives? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:DFENS

Fjord Defence Group

A defence compounder, acquires and develops companies in the defence, security, and related segments.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives