- Romania

- /

- Telecom Services and Carriers

- /

- BVB:DIGI

Increases to CEO Compensation Might Be Put On Hold For Now at Digi Communications N.V. (BVB:DIGI)

Despite Digi Communications N.V.'s (BVB:DIGI) share price growing positively in the past few years, the per-share earnings growth has not grown to investors' expectations, suggesting that there could be other factors at play driving the share price. Some of these issues will occupy shareholders' minds as the AGM rolls around on 18 May 2021. It would also be an opportunity for them to influence management through exercising their voting power on company resolutions, including CEO and executive remuneration, which could impact on firm performance in the future. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

View our latest analysis for Digi Communications

Comparing Digi Communications N.V.'s CEO Compensation With the industry

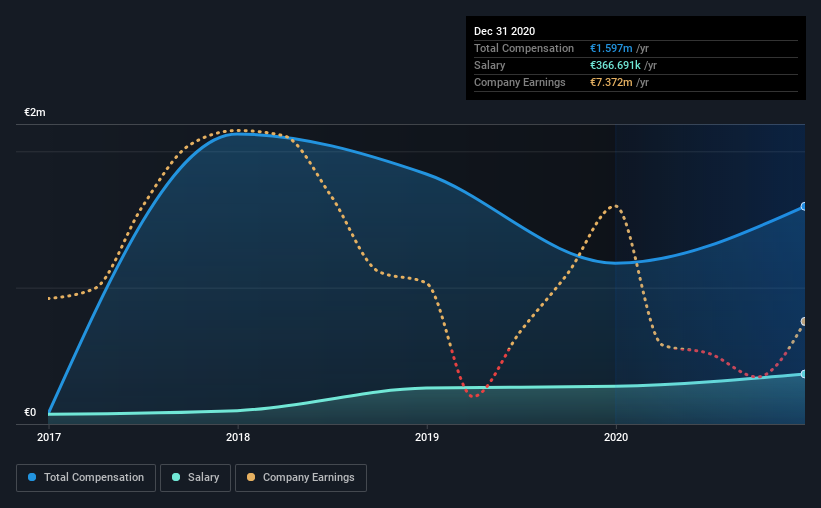

According to our data, Digi Communications N.V. has a market capitalization of RON3.5b, and paid its CEO total annual compensation worth €1.6m over the year to December 2020. We note that's an increase of 35% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at €367k.

For comparison, other companies in the same industry with market capitalizations ranging between RON1.6b and RON6.5b had a median total CEO compensation of €762k. This suggests that Serghei Bulgac is paid more than the median for the industry. Moreover, Serghei Bulgac also holds RON14m worth of Digi Communications stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | €367k | €276k | 23% |

| Other | €1.2m | €903k | 77% |

| Total Compensation | €1.6m | €1.2m | 100% |

Speaking on an industry level, nearly 47% of total compensation represents salary, while the remainder of 53% is other remuneration. Digi Communications sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Digi Communications N.V.'s Growth

Over the last three years, Digi Communications N.V. has shrunk its earnings per share by 50% per year. In the last year, its revenue is up 8.0%.

Few shareholders would be pleased to read that EPS have declined. And the modest revenue growth over 12 months isn't much comfort against the reduced EPS. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Digi Communications N.V. Been A Good Investment?

Digi Communications N.V. has served shareholders reasonably well, with a total return of 17% over three years. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

While it's true that shareholders have owned decent returns, it's hard to overlook the lack of earnings growth and this makes us question whether these returns will continue. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 3 warning signs for Digi Communications that investors should think about before committing capital to this stock.

Important note: Digi Communications is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BVB:DIGI

Digi Communications

Provides telecommunication services of cable TV, fixed internet and data, fixed-line telephony, mobile telephony and internet and direct to home television services in Romania and Spain and mobile telephony services in Italy.

Slightly overvalued with questionable track record.

Similar Companies

Market Insights

Community Narratives