- Germany

- /

- Commercial Services

- /

- XTRA:FPH

Uncovering Potential: Penny Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets navigate a mixed start to the year, with U.S. stocks closing out 2024 on a high note despite recent fluctuations, investors are exploring diverse opportunities to capitalize on potential gains. Penny stocks, often associated with smaller or newer companies, remain relevant as they offer unique growth prospects at lower price points. This article examines three penny stocks that stand out due to their solid financials and potential for significant returns, highlighting the ongoing relevance of this investment area in today's market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.535 | MYR2.66B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$141.28M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.57 | A$66.23M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.405 | MYR1.13B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £1.984 | £747.6M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.70 | HK$40.74B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.895 | £471.86M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £152.06M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.47 | £66.18M | ★★★★☆☆ |

Click here to see the full list of 5,821 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Bittnet Systems (BVB:BNET)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Bittnet Systems SA offers IT training and integration solutions in Romania, with a market cap of RON111.48 million.

Operations: The company generates revenue from several segments, including Education (RON13.74 million), BA & Software (RON30.09 million), Cybersecurity (RON13.97 million), and Digital Infrastructure (RON362.64 million).

Market Cap: RON111.48M

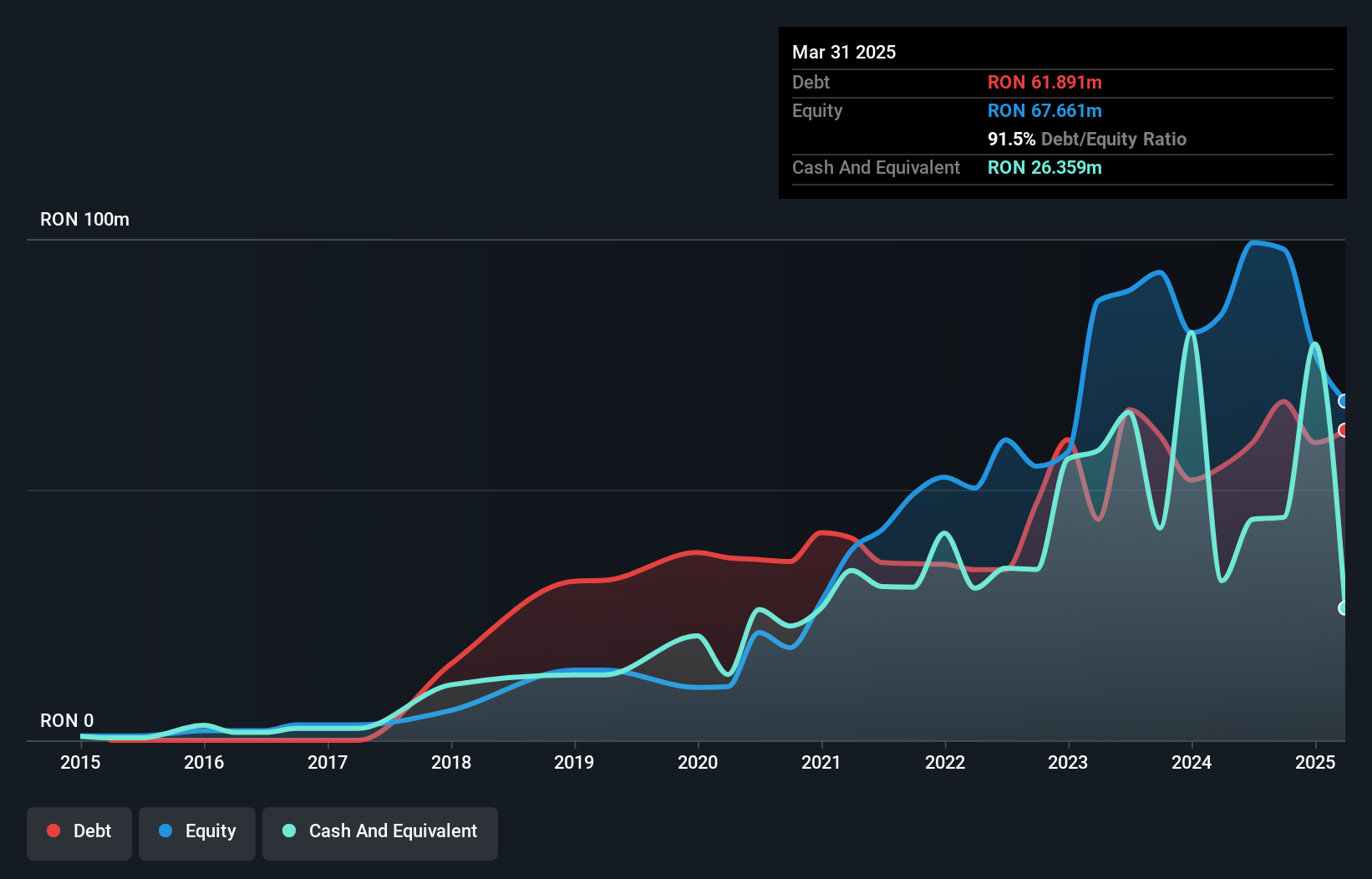

Bittnet Systems SA, with a market cap of RON111.48 million, has demonstrated revenue growth to RON308.15 million for the nine months ending September 2024, up from RON278.1 million the previous year. However, it remains unprofitable with a net loss of RON7 million and declining earnings over five years by 33.1% annually. Despite this, its short-term assets cover both long-term and short-term liabilities comfortably, and its debt level is satisfactory with a net debt to equity ratio of 23.6%. The management team is experienced with an average tenure of 4.3 years, but profitability challenges persist amidst stable volatility levels.

- Dive into the specifics of Bittnet Systems here with our thorough balance sheet health report.

- Evaluate Bittnet Systems' historical performance by accessing our past performance report.

3D Medicines (SEHK:1244)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: 3D Medicines Inc. is a biopharmaceutical company focused on researching, developing, and commercializing oncology products for cancer treatment in Mainland China, with a market cap of approximately HK$0.85 billion.

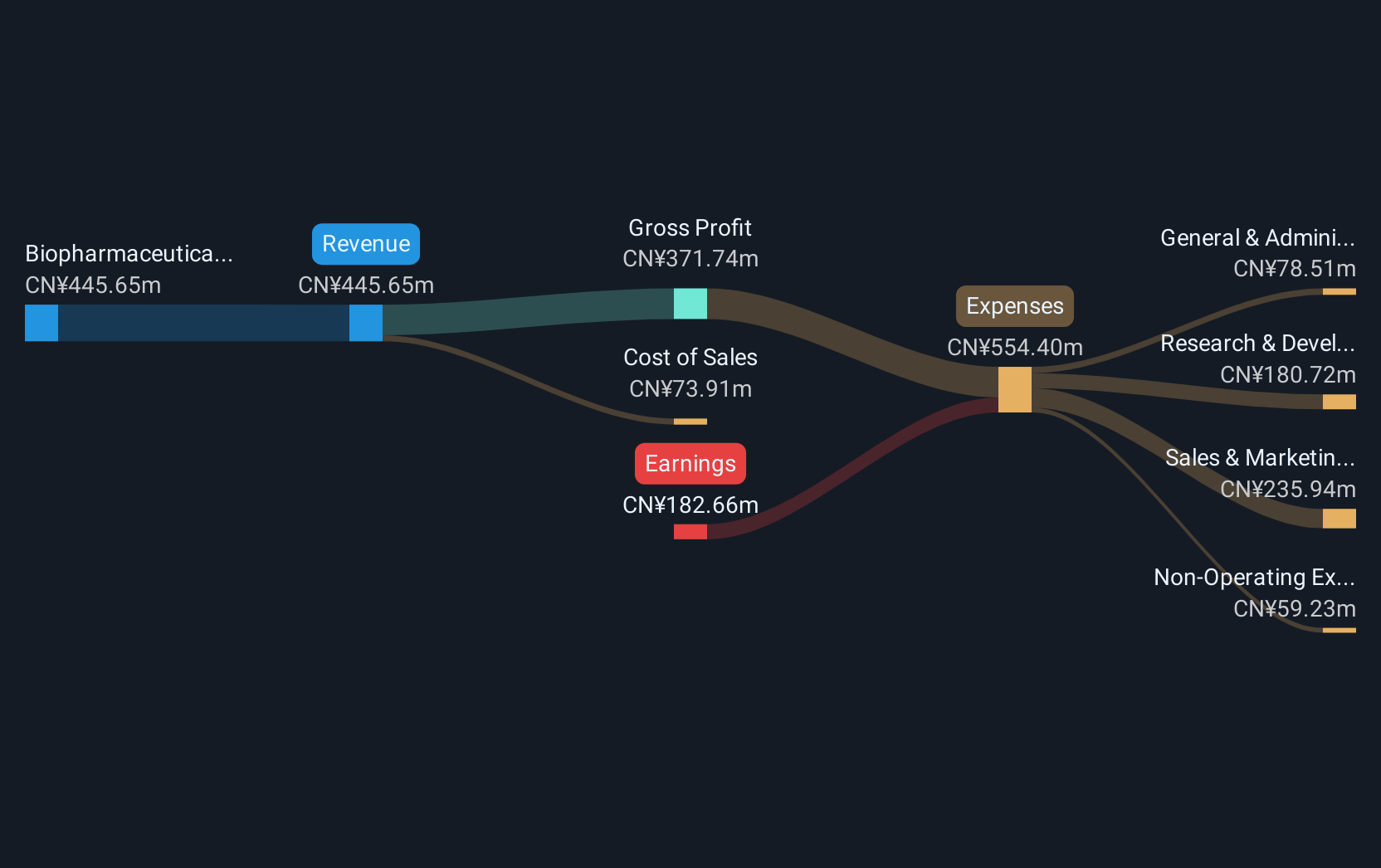

Operations: The company generates revenue from its Biopharmaceutical Research and Development segment, amounting to CN¥488.82 million.

Market Cap: HK$850.3M

3D Medicines Inc., with a market cap of approximately HK$0.85 billion, is pre-revenue and currently unprofitable, facing shareholder dilution as shares outstanding grew by 8.1% last year. Despite this, the company has more cash than total debt and maintains a sufficient cash runway for over three years based on current free cash flow. Its short-term assets of CN¥1 billion exceed both short-term and long-term liabilities, indicating solid financial positioning to support ongoing operations. The management team is experienced with an average tenure of 4.3 years, though high volatility remains a concern for investors in this sector.

- Click to explore a detailed breakdown of our findings in 3D Medicines' financial health report.

- Review our historical performance report to gain insights into 3D Medicines' track record.

Francotyp-Postalia Holding (XTRA:FPH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Francotyp-Postalia Holding AG offers business mail and digital solutions to businesses and authorities both in Germany and internationally, with a market cap of €38.43 million.

Operations: The company's revenue is primarily derived from Mailing, Shipping & Office Solutions at €148.09 million and Digital Business Solutions at €26.35 million.

Market Cap: €38.43M

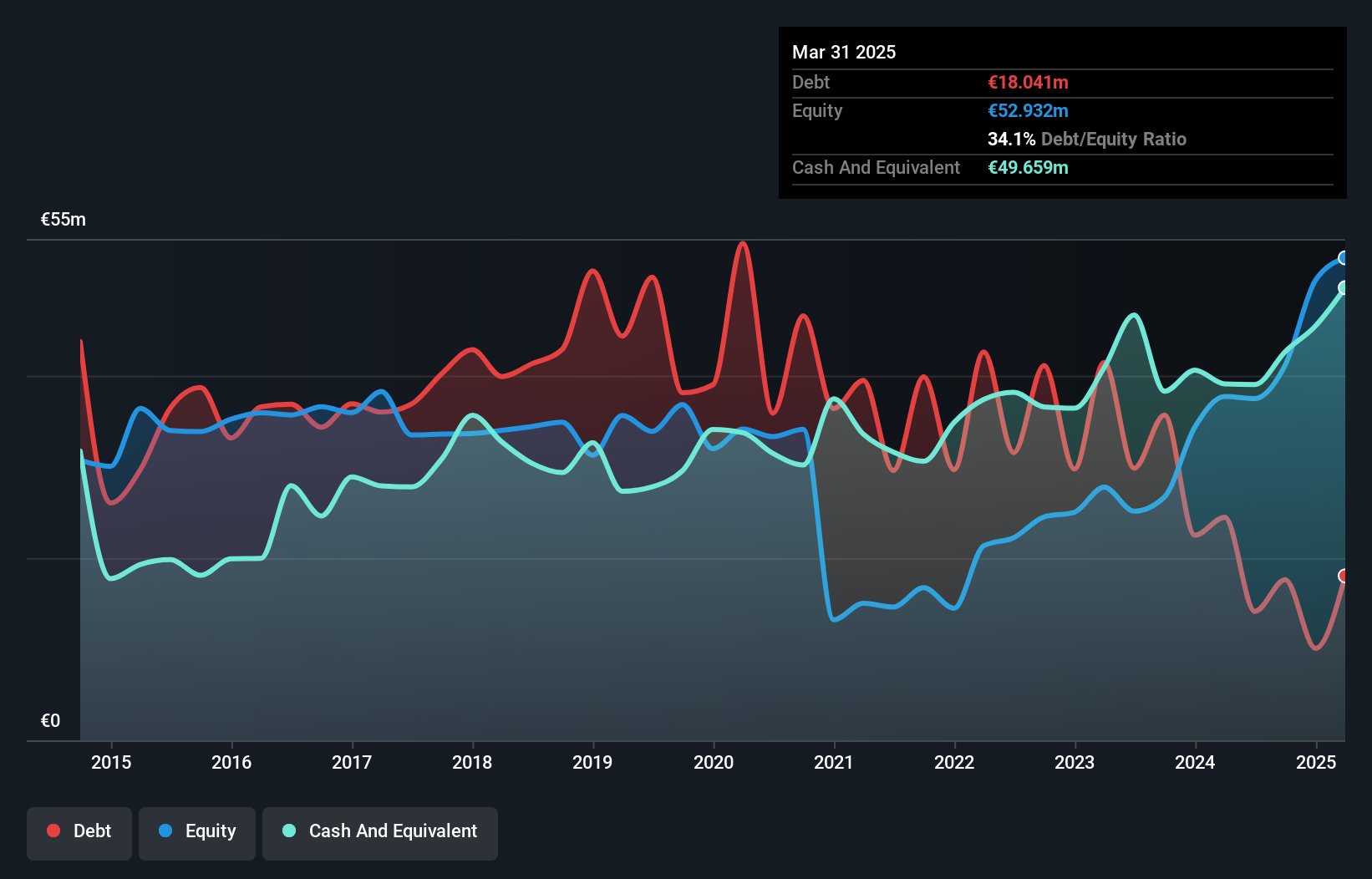

Francotyp-Postalia Holding AG, with a market cap of €38.43 million, demonstrates strong financial health and growth potential in the penny stock sector. The company has a robust balance sheet, as its cash exceeds total debt, and short-term assets cover both short-term and long-term liabilities. Recent earnings show significant improvement; net income for Q3 2024 was €4.88 million compared to €1.14 million the previous year, driven by enhanced profit margins and high return on equity at 31.8%. However, future earnings are expected to decline by an average of 29.8% annually over the next three years according to consensus estimates.

- Get an in-depth perspective on Francotyp-Postalia Holding's performance by reading our balance sheet health report here.

- Gain insights into Francotyp-Postalia Holding's future direction by reviewing our growth report.

Taking Advantage

- Take a closer look at our Penny Stocks list of 5,821 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:FPH

Francotyp-Postalia Holding

Develops, produces, and sells office products and solutions in Germany, the United States, the United Kingdom, Sweden, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion