The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Bittnet Systems SA (BVB:BNET) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Bittnet Systems

How Much Debt Does Bittnet Systems Carry?

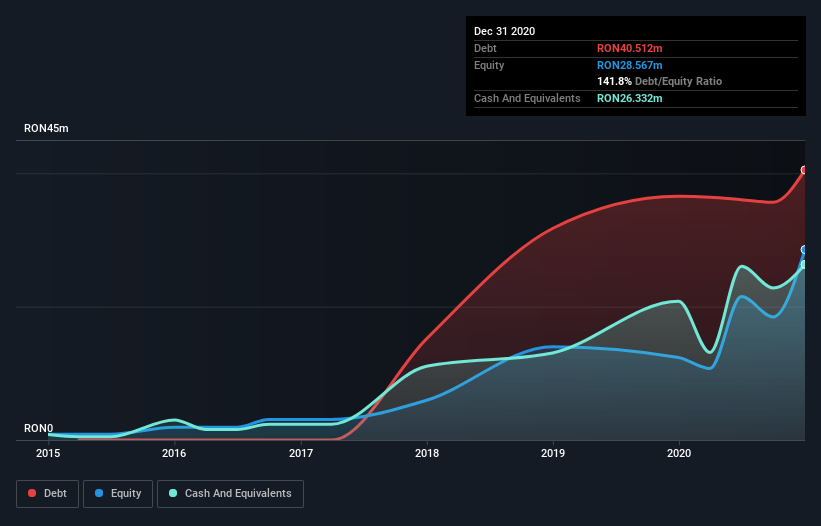

You can click the graphic below for the historical numbers, but it shows that as of December 2020 Bittnet Systems had RON40.5m of debt, an increase on RON36.6m, over one year. However, it also had RON26.3m in cash, and so its net debt is RON14.2m.

How Strong Is Bittnet Systems' Balance Sheet?

We can see from the most recent balance sheet that Bittnet Systems had liabilities of RON36.4m falling due within a year, and liabilities of RON36.1m due beyond that. On the other hand, it had cash of RON26.3m and RON30.2m worth of receivables due within a year. So its liabilities total RON16.0m more than the combination of its cash and short-term receivables.

Since publicly traded Bittnet Systems shares are worth a total of RON181.5m, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While we wouldn't worry about Bittnet Systems's net debt to EBITDA ratio of 3.0, we think its super-low interest cover of 1.1 times is a sign of high leverage. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. However, the silver lining was that Bittnet Systems achieved a positive EBIT of RON2.8m in the last twelve months, an improvement on the prior year's loss. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Bittnet Systems can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Over the last year, Bittnet Systems actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

Bittnet Systems's interest cover was a real negative on this analysis, although the other factors we considered were considerably better. There's no doubt that its ability to to convert EBIT to free cash flow is pretty flash. Considering this range of data points, we think Bittnet Systems is in a good position to manage its debt levels. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Be aware that Bittnet Systems is showing 3 warning signs in our investment analysis , and 2 of those are a bit unpleasant...

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bittnet Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BVB:BNET

Bittnet Systems

Provides IT training and integration solutions in Romania.

Adequate balance sheet and fair value.

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

#1 Silver Play with Positive Cashflow Gold Miner (Top Notch Team)

Near-Restart Producer Mexico Silver Miner

Nevada 1st-Tier 30 Baggers Silver Play Potential

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I wrote the latest analysis on DSV, all I can say this is my #1 stock pick, my largest hold. Latest : https://simplywall.st/community/narratives/ca/materials/tsx-dsv/discovery-silver-shares/ha9axhmi-1-silver-play-with-positive-cashflow-gold-miner-top-notch-team-moui/updates/5-discovery-silver-corp-tsx-dsv-discovery-silver-is-now?utm_source=share&utm_medium=web