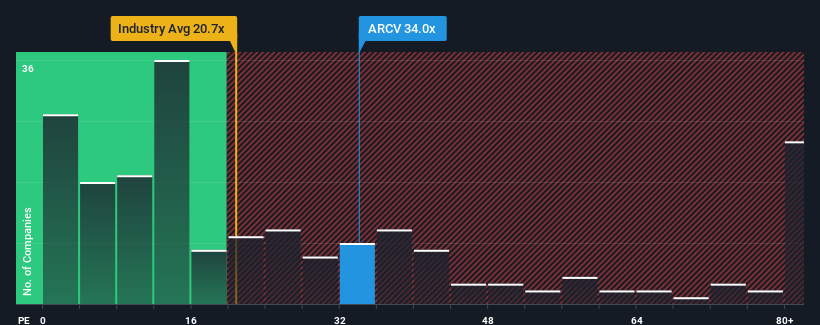

S.C. Imotrust S.A.'s (BVB:ARCV) price-to-earnings (or "P/E") ratio of 34x might make it look like a strong sell right now compared to the market in Romania, where around half of the companies have P/E ratios below 16x and even P/E's below 8x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

For example, consider that S.C. Imotrust's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

View our latest analysis for S.C. Imotrust

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as S.C. Imotrust's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 61% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 16% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for a contraction of 11% shows the market is even less attractive on an annualised basis.

With this information, it might not be hard to see why S.C. Imotrust is trading at a higher P/E in comparison. Nonetheless, there's no guarantee the P/E has found a floor yet with recent earnings going backwards, despite the market heading down even harder. There is potential for the P/E to fall to lower levels if the company doesn't improve its profitability, which would be difficult to do with the current market outlook.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of S.C. Imotrust revealed its narrower three-year contraction in earnings is contributing to its high P/E, given the market is set to shrink even more. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Our only concern is whether its earnings trajectory can keep outperforming under these tough market conditions. Although, if the company's relative performance doesn't change it will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for S.C. Imotrust you should be aware of, and 1 of them doesn't sit too well with us.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:ARCV

Solid track record with adequate balance sheet.

Market Insights

Community Narratives