- Romania

- /

- Metals and Mining

- /

- BVB:SATU

Take Care Before Jumping Onto S.C. Saturn S.A. Alba Iulia (BVB:SATU) Even Though It's 38% Cheaper

S.C. Saturn S.A. Alba Iulia (BVB:SATU) shareholders that were waiting for something to happen have been dealt a blow with a 38% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 64% loss during that time.

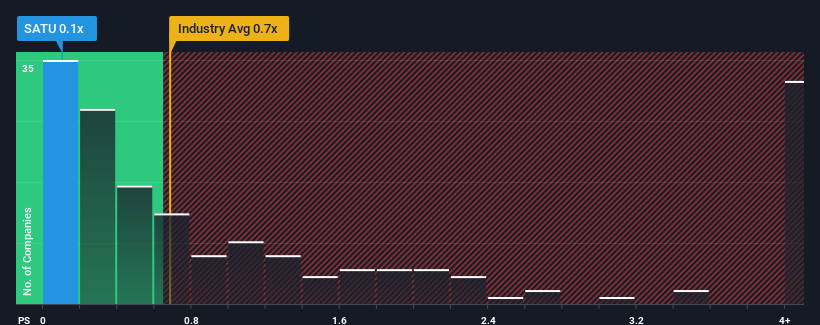

After such a large drop in price, considering around half the companies operating in Romania's Metals and Mining industry have price-to-sales ratios (or "P/S") above 0.6x, you may consider S.C. Saturn Alba Iulia as an solid investment opportunity with its 0.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for S.C. Saturn Alba Iulia

What Does S.C. Saturn Alba Iulia's Recent Performance Look Like?

For example, consider that S.C. Saturn Alba Iulia's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for S.C. Saturn Alba Iulia, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

S.C. Saturn Alba Iulia's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 33% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 41% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 1.5% shows it's noticeably more attractive.

With this information, we find it odd that S.C. Saturn Alba Iulia is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

The southerly movements of S.C. Saturn Alba Iulia's shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We're very surprised to see S.C. Saturn Alba Iulia currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 2 warning signs for S.C. Saturn Alba Iulia you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BVB:SATU

Flawless balance sheet and good value.

Market Insights

Community Narratives