- Romania

- /

- Healthcare Services

- /

- BVB:M

The Market Lifts Med Life S.A. (BVB:M) Shares 25% But It Can Do More

Med Life S.A. (BVB:M) shares have continued their recent momentum with a 25% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 12% is also fairly reasonable.

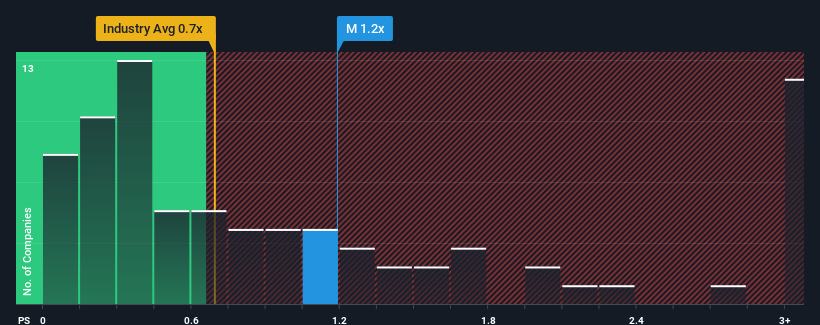

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Med Life's P/S ratio of 1.2x, since the median price-to-sales (or "P/S") ratio for the Healthcare industry in Romania is also close to 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Med Life

What Does Med Life's P/S Mean For Shareholders?

Med Life certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Med Life.Is There Some Revenue Growth Forecasted For Med Life?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Med Life's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 22% gain to the company's top line. Pleasingly, revenue has also lifted 101% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 9.6% over the next year. With the industry only predicted to deliver 5.3%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Med Life's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Med Life's P/S Mean For Investors?

Med Life's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Looking at Med Life's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 2 warning signs for Med Life (1 is a bit concerning!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BVB:M

Med Life

A private healthcare provider, engages in the provision of healthcare services through medical centers in Bucharest, Cluj, Braila, Timisoara, Iasi, Galati, Ploiesti, Constanta, and Targu Mures.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives