Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, S.C. Bermas S.A. (BVB:BRM) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for S.C. Bermas

What Is S.C. Bermas's Debt?

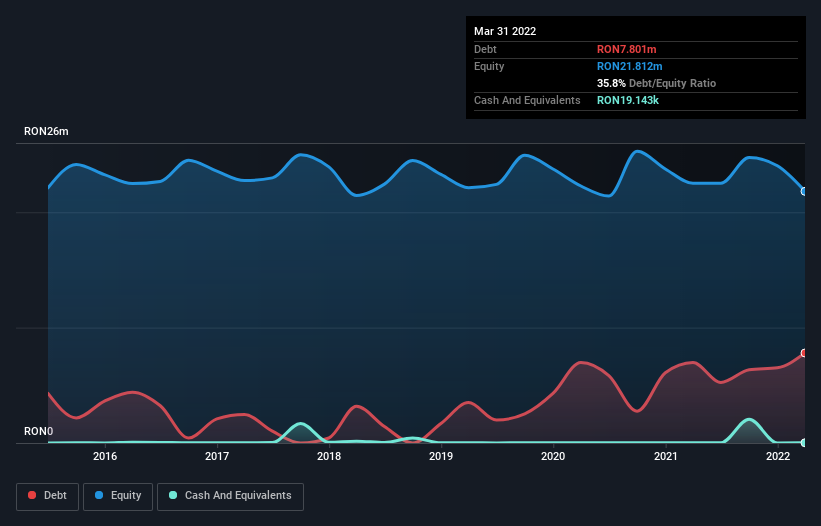

As you can see below, at the end of March 2022, S.C. Bermas had RON7.80m of debt, up from RON6.98m a year ago. Click the image for more detail. And it doesn't have much cash, so its net debt is about the same.

A Look At S.C. Bermas' Liabilities

The latest balance sheet data shows that S.C. Bermas had liabilities of RON10.6m due within a year, and liabilities of RON1.10m falling due after that. Offsetting these obligations, it had cash of RON19.1k as well as receivables valued at RON2.43m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by RON9.27m.

Of course, S.C. Bermas has a market capitalization of RON53.0m, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

We'd say that S.C. Bermas's moderate net debt to EBITDA ratio ( being 1.9), indicates prudence when it comes to debt. And its strong interest cover of 27.2 times, makes us even more comfortable. Shareholders should be aware that S.C. Bermas's EBIT was down 23% last year. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since S.C. Bermas will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. In the last three years, S.C. Bermas created free cash flow amounting to 2.4% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

S.C. Bermas's EBIT growth rate and conversion of EBIT to free cash flow definitely weigh on it, in our esteem. But the good news is it seems to be able to cover its interest expense with its EBIT with ease. Taking the abovementioned factors together we do think S.C. Bermas's debt poses some risks to the business. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example S.C. Bermas has 4 warning signs (and 2 which are a bit unpleasant) we think you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BVB:BRM

S.C. Bermas

Produces, markets, and sells beer, malt, other alcoholic and soft drinks, derivatives, and its by-products in Romania.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.