- Netherlands

- /

- Aerospace & Defense

- /

- ENXTAM:THEON

3 European Stocks Estimated To Be Trading At Up To 45.6% Below Intrinsic Value

Reviewed by Simply Wall St

As European markets navigate a complex landscape of monetary policy decisions and mixed economic signals, the pan-European STOXX Europe 600 Index recently ended the week slightly lower, reflecting investor caution. In this environment, identifying stocks that may be undervalued can provide opportunities for investors seeking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Witted Megacorp Oyj (HLSE:WITTED) | €1.395 | €2.68 | 48% |

| Talenom Oyj (HLSE:TNOM) | €3.70 | €7.20 | 48.6% |

| Rheinmetall (XTRA:RHM) | €1940.00 | €3793.95 | 48.9% |

| Micro Systemation (OM:MSAB B) | SEK61.60 | SEK121.94 | 49.5% |

| LINK Mobility Group Holding (OB:LINK) | NOK30.80 | NOK59.82 | 48.5% |

| Lingotes Especiales (BME:LGT) | €5.70 | €11.16 | 48.9% |

| Green Oleo (BIT:GRN) | €0.79 | €1.52 | 48% |

| E-Globe (BIT:EGB) | €0.68 | €1.32 | 48.3% |

| cyan (XTRA:CYR) | €2.26 | €4.39 | 48.5% |

| Atea (OB:ATEA) | NOK143.60 | NOK279.28 | 48.6% |

Let's uncover some gems from our specialized screener.

SNGN Romgaz (BVB:SNG)

Overview: SNGN Romgaz SA is a Romanian company involved in the exploration, production, and supply of natural gas, with a market cap of RON31.72 billion.

Operations: The company's revenue segments include RON7.79 billion from upstream activities, RON589.22 million from storage, and RON548.74 million from electricity.

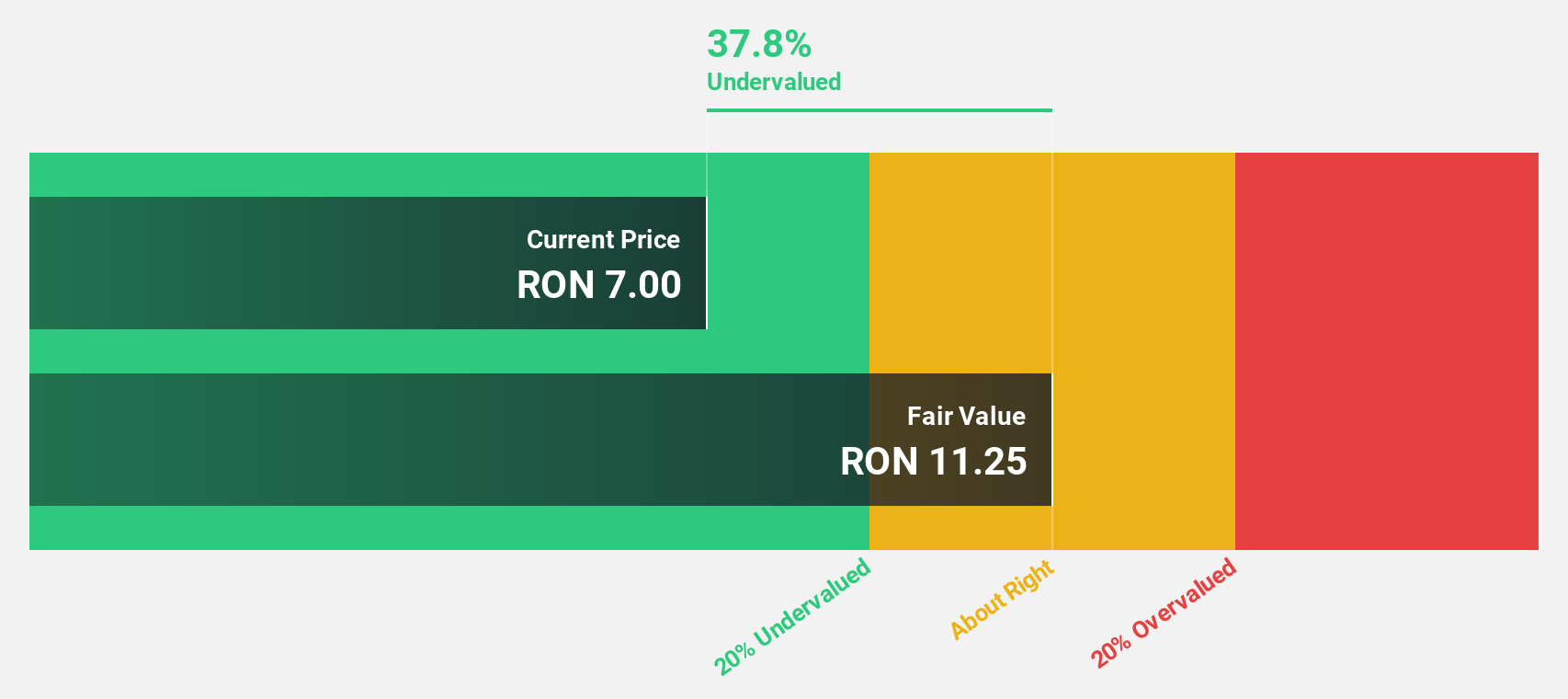

Estimated Discount To Fair Value: 37.8%

SNGN Romgaz is trading at RON 8.23, significantly below its estimated fair value of RON 13.23, indicating it is undervalued based on discounted cash flow analysis. The company's earnings are forecast to grow at 12.5% annually, outpacing the Romanian market average of 5.5%. Recent strategic partnerships with Electrica for renewable energy projects enhance its growth prospects and regional market position, potentially adding value beyond current cash flow assessments.

- Our comprehensive growth report raises the possibility that SNGN Romgaz is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of SNGN Romgaz.

Theon International (ENXTAM:THEON)

Overview: Theon International Plc specializes in the development and manufacturing of customizable night vision, thermal imaging, and electro-optical ISR systems for military and security applications globally, with a market cap of €2.07 billion.

Operations: The company's revenue is primarily derived from its optronics segment, which generated €383.71 million.

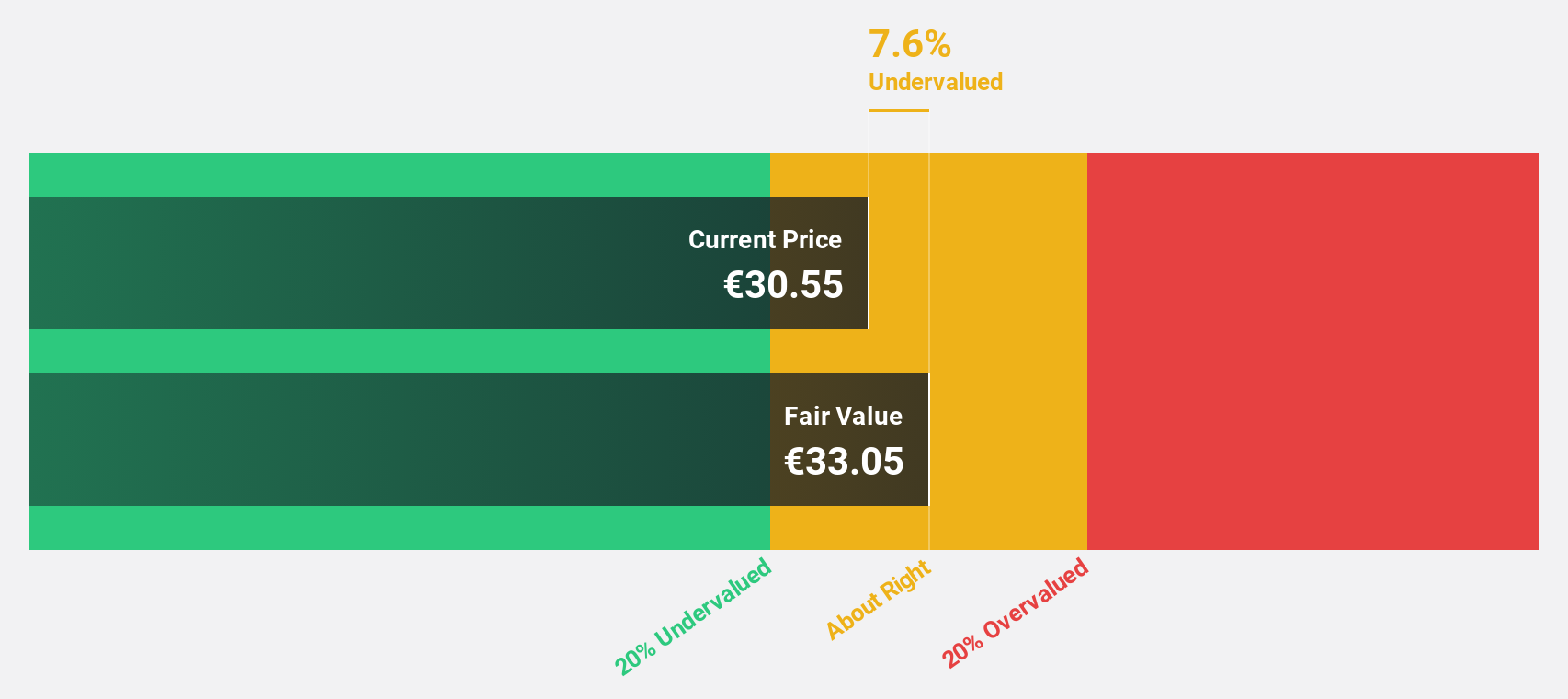

Estimated Discount To Fair Value: 11.4%

Theon International is trading at €29.5, slightly below its fair value of €33.28, suggesting it is undervalued based on cash flows. Earnings are projected to grow 19.92% annually, surpassing the Dutch market's growth rate of 11%. Recent product launches, like the NYX-BiNOD for the U.S. Army, and a strong order intake bolster revenue forecasts between €410 million and €430 million for 2025, supporting its robust cash flow outlook despite share price volatility.

- Upon reviewing our latest growth report, Theon International's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Theon International with our detailed financial health report.

Verallia Société Anonyme (ENXTPA:VRLA)

Overview: Verallia Société Anonyme is a global manufacturer and seller of glass packaging products for beverages and food, with a market cap of €2.79 billion.

Operations: The company's revenue is derived from three main segments: Southern and Western Europe (€2.27 billion), Northern and Eastern Europe (€739.40 million), and Latin America (€413.90 million).

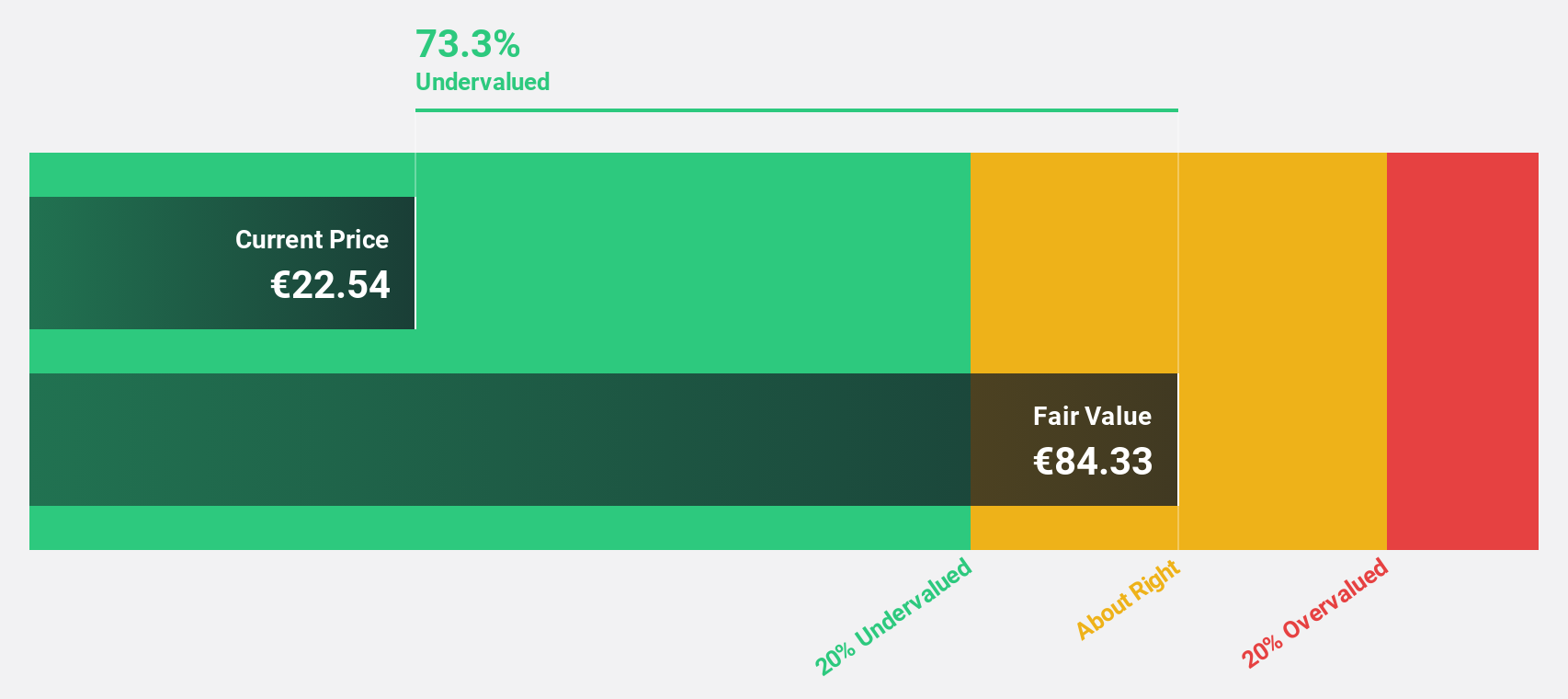

Estimated Discount To Fair Value: 45.6%

Verallia Société Anonyme is trading at €23.7, significantly below its estimated fair value of €43.58, highlighting its undervaluation based on cash flows. Despite a high debt level and recent earnings decline to €67.5 million from €124.1 million last year, Verallia's forecasted annual earnings growth of 23.45% suggests strong future potential, outpacing the French market average of 12.1%. Recent sustainability commitments further enhance its long-term strategic position in the glass packaging industry.

- The growth report we've compiled suggests that Verallia Société Anonyme's future prospects could be on the up.

- Take a closer look at Verallia Société Anonyme's balance sheet health here in our report.

Taking Advantage

- Click this link to deep-dive into the 213 companies within our Undervalued European Stocks Based On Cash Flows screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Theon International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:THEON

Theon International

Develops and manufactures customizable night vision, thermal imaging, and electro-optical ISR systems for military and security applications in Europe and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives