- Romania

- /

- Consumer Durables

- /

- BVB:MELE

Is It Worth Considering Societatea Comerciala Metal Lemn SA (BVB:MELE) For Its Upcoming Dividend?

Societatea Comerciala Metal Lemn SA (BVB:MELE) stock is about to trade ex-dividend in two days. The ex-dividend date is usually set to be two business days before the record date, which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Therefore, if you purchase Societatea Comerciala Metal Lemn's shares on or after the 8th of December, you won't be eligible to receive the dividend, when it is paid on the 23rd of December.

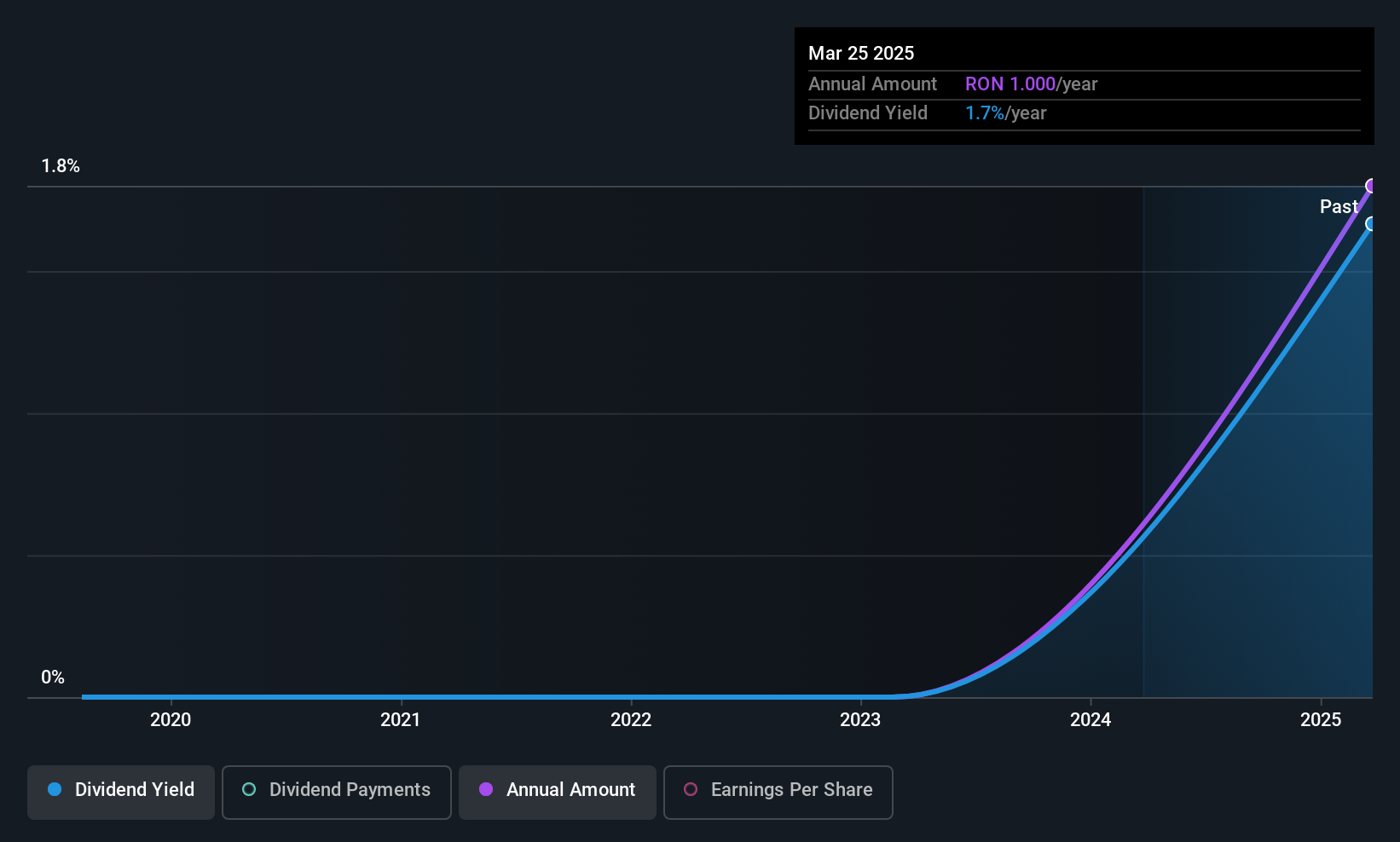

The company's next dividend payment will be RON01.00 per share, on the back of last year when the company paid a total of RON1.00 to shareholders. Based on the last year's worth of payments, Societatea Comerciala Metal Lemn has a trailing yield of 1.7% on the current stock price of RON060.00. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. We need to see whether the dividend is covered by earnings and if it's growing.

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Societatea Comerciala Metal Lemn is paying out an acceptable 52% of its profit, a common payout level among most companies.

Check out our latest analysis for Societatea Comerciala Metal Lemn

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. With that in mind, we're encouraged by the steady growth at Societatea Comerciala Metal Lemn, with earnings per share up 7.1% on average over the last five years.

Unfortunately Societatea Comerciala Metal Lemn has only been paying a dividend for a year or so, so there's not much of a history to draw insight from.

To Sum It Up

From a dividend perspective, should investors buy or avoid Societatea Comerciala Metal Lemn? Societatea Comerciala Metal Lemn has been generating some growth in earnings per share while paying out more than half of its earnings to shareholders in the form of dividends. It doesn't appear an outstanding opportunity, but could be worth a closer look.

If you're not too concerned about Societatea Comerciala Metal Lemn's ability to pay dividends, you should still be mindful of some of the other risks that this business faces. To help with this, we've discovered 3 warning signs for Societatea Comerciala Metal Lemn (1 shouldn't be ignored!) that you ought to be aware of before buying the shares.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BVB:MELE

Societatea Comerciala Metal Lemn

Manufactures and sells body furniture and small wooden furniture in Romania and internationally.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026