- Romania

- /

- Consumer Durables

- /

- BVB:EMAI

S.C. Emailul S.A. (BVB:EMAI) Investors Are Less Pessimistic Than Expected

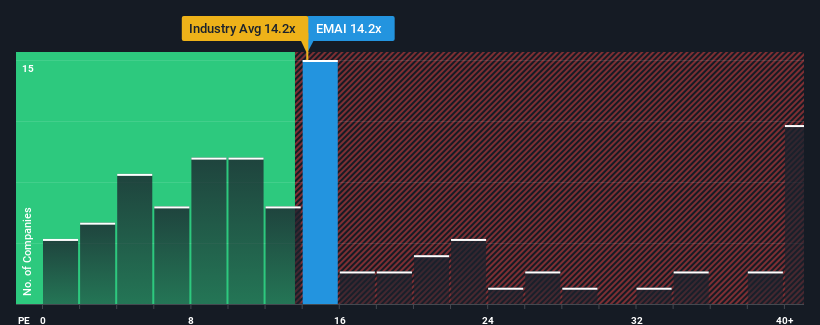

With a median price-to-earnings (or "P/E") ratio of close to 12x in Romania, you could be forgiven for feeling indifferent about S.C. Emailul S.A.'s (BVB:EMAI) P/E ratio of 14.2x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

For example, consider that S.C. Emailul's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for S.C. Emailul

How Is S.C. Emailul's Growth Trending?

The only time you'd be comfortable seeing a P/E like S.C. Emailul's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 42% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 63% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to decline by 7.6% over the next year, or less than the company's recent medium-term annualised earnings decline.

With this information, it's perhaps strange that S.C. Emailul is trading at a fairly similar P/E in comparison. In general, when earnings shrink rapidly the P/E often shrinks too, which could set up shareholders for future disappointment. There's potential for the P/E to fall to lower levels if the company doesn't improve its profitability, which would be difficult to do with the current market outlook.

What We Can Learn From S.C. Emailul's P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of S.C. Emailul revealed its sharp three-year contraction in earnings isn't impacting its P/E as much as we would have predicted, given the market is set to shrink less severely. When we see below average earnings, we suspect the share price is at risk of declining, sending the moderate P/E lower. In addition, we would be concerned whether the company can even maintain its medium-term level of performance under these tough market conditions. This would place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 4 warning signs for S.C. Emailul you should be aware of, and 3 of them are a bit unpleasant.

If these risks are making you reconsider your opinion on S.C. Emailul, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BVB:EMAI

S.C. Emailul

Manufactures and markets household enamel pots and enamel non-stick pots.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.