- Romania

- /

- Consumer Durables

- /

- BVB:ELGS

S.C. Electroarges S.A.'s (BVB:ELGS) Prospects Need A Boost To Lift Shares

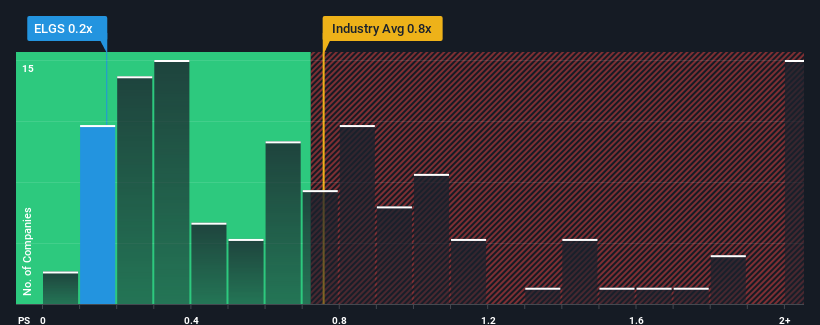

S.C. Electroarges S.A.'s (BVB:ELGS) price-to-sales (or "P/S") ratio of 0.2x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Consumer Durables industry in Romania have P/S ratios greater than 0.8x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for S.C. Electroarges

What Does S.C. Electroarges' P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at S.C. Electroarges over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on S.C. Electroarges will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

S.C. Electroarges' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 48%. As a result, revenue from three years ago have also fallen 31% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

This is in contrast to the rest of the industry, which is expected to decline by 4.9% over the next year, or less than the company's recent medium-term annualised revenue decline.

With this in consideration, it's no surprise that S.C. Electroarges' P/S falls short of its industry peers. Nonetheless, with revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. Even just maintaining these prices will be difficult to achieve as recent revenue trends are already weighing down the shares heavily.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of S.C. Electroarges confirms that the company's severe contraction in revenue over the past three-year years is a major contributor to its lower than industry P/S, given the industry is set to decline less. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. However, we're still cautious about the company's ability to prevent an acceleration of its recent medium-term course and resist even greater pain to its business from the broader industry turmoil. For now though, it's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with S.C. Electroarges, and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on S.C. Electroarges, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BVB:ELGS

Aeta

Engages in the manufacture and marketing of consumer electrical goods for industrial manufacturers.

Excellent balance sheet and good value.