Subdued Growth No Barrier To SC IAMU SA (BVB:IAMU) With Shares Advancing 29%

SC IAMU SA (BVB:IAMU) shares have had a really impressive month, gaining 29% after a shaky period beforehand. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

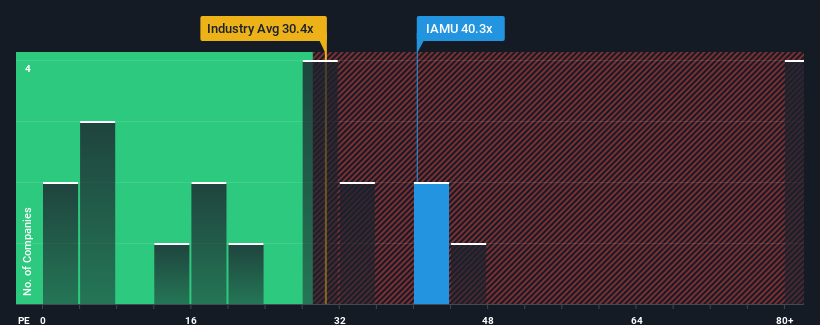

After such a large jump in price, given close to half the companies in Romania have price-to-earnings ratios (or "P/E's") below 16x, you may consider SC IAMU as a stock to avoid entirely with its 40.3x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

For instance, SC IAMU's receding earnings in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

Check out our latest analysis for SC IAMU

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as SC IAMU's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 69% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 49% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to decline by 11% over the next year, or less than the company's recent medium-term annualised earnings decline.

With this information, it's strange that SC IAMU is trading at a higher P/E in comparison. With earnings going quickly in reverse, it's not guaranteed that the P/E has found a floor yet. There's potential for the P/E to fall to lower levels if the company doesn't improve its profitability, which would be difficult to do with the current market outlook.

The Key Takeaway

The strong share price surge has got SC IAMU's P/E rushing to great heights as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that SC IAMU currently trades on a much higher than expected P/E since its recent three-year earnings are even worse than the forecasts for a struggling market. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is unlikely to support such positive sentiment for long. In addition, we would be concerned whether the company can even maintain its medium-term level of performance under these tough market conditions. Unless the company's relative performance improves markedly, it's very challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with SC IAMU (at least 2 which are potentially serious), and understanding these should be part of your investment process.

Of course, you might also be able to find a better stock than SC IAMU. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:IAMU

Slight risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.