- Romania

- /

- Construction

- /

- BVB:EEAI

S.C. Electroconstructia Elco Alba Iulia S.A. (BVB:EEAI) Could Be Riskier Than It Looks

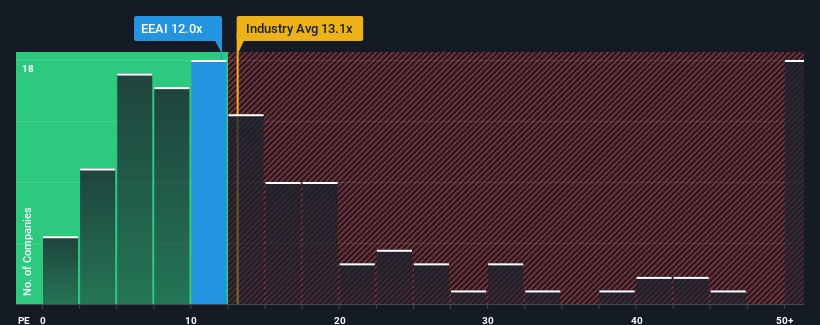

When close to half the companies in Romania have price-to-earnings ratios (or "P/E's") above 17x, you may consider S.C. Electroconstructia Elco Alba Iulia S.A. (BVB:EEAI) as an attractive investment with its 12x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

S.C. Electroconstructia Elco Alba Iulia certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for S.C. Electroconstructia Elco Alba Iulia

Is There Any Growth For S.C. Electroconstructia Elco Alba Iulia?

There's an inherent assumption that a company should underperform the market for P/E ratios like S.C. Electroconstructia Elco Alba Iulia's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 124% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 1,642% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to decline by 11% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this information, we find it very odd that S.C. Electroconstructia Elco Alba Iulia is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On S.C. Electroconstructia Elco Alba Iulia's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of S.C. Electroconstructia Elco Alba Iulia revealed its growing earnings over the medium-term aren't contributing to its P/E anywhere near as much as we would have predicted, given the market is set to shrink. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader market turmoil. It appears many are indeed anticipating earnings instability, because this relative performance should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 4 warning signs for S.C. Electroconstructia Elco Alba Iulia you should be aware of, and 2 of them don't sit too well with us.

If you're unsure about the strength of S.C. Electroconstructia Elco Alba Iulia's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:EEAI

S.C. Electroconstructia Elco Alba Iulia

S.C. Electroconstructia Elco Alba Iulia S.A.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026