S.C. Caromet S.A. (BVB:ARMT) Stocks Shoot Up 29% But Its P/E Still Looks Reasonable

S.C. Caromet S.A. (BVB:ARMT) shareholders have had their patience rewarded with a 29% share price jump in the last month. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

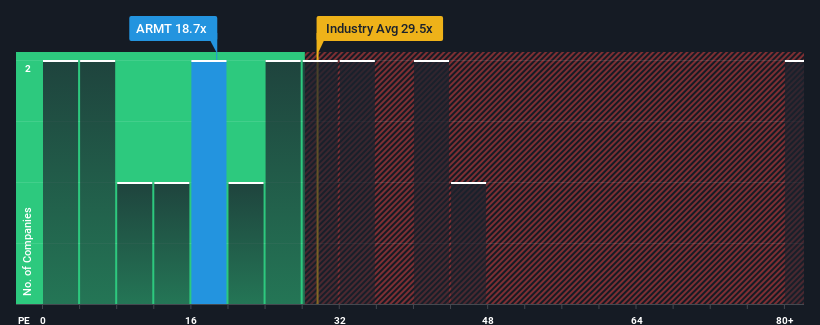

Following the firm bounce in price, S.C. Caromet's price-to-earnings (or "P/E") ratio of 18.7x might make it look like a sell right now compared to the market in Romania, where around half of the companies have P/E ratios below 16x and even P/E's below 8x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

For example, consider that S.C. Caromet's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

View our latest analysis for S.C. Caromet

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like S.C. Caromet's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 25%. Still, the latest three year period has seen an excellent 576% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Weighing the recent medium-term upward earnings trajectory against the broader market's one-year forecast for contraction of 11% shows it's a great look while it lasts.

In light of this, it's understandable that S.C. Caromet's P/E sits above the majority of other companies. Investors are willing to pay more for a stock they hope will buck the trend of the broader market going backwards. However, its current earnings trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

The Key Takeaway

S.C. Caromet's P/E is getting right up there since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of S.C. Caromet revealed its growing earnings over the medium-term are contributing to its high P/E, given the market is set to shrink. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. Our only concern is whether its earnings trajectory can keep outperforming under these tough market conditions. Although, if the company's relative performance doesn't change it will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 4 warning signs for S.C. Caromet (2 can't be ignored!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:ARMT

S.C. Caromet

Manufactures and sells railway rolling stocks, hydro-mechanical equipment, and welded assemblies in Romania.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives