Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that S.C. UAMT S.A. (BVB:UAM) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for S.C. UAMT

How Much Debt Does S.C. UAMT Carry?

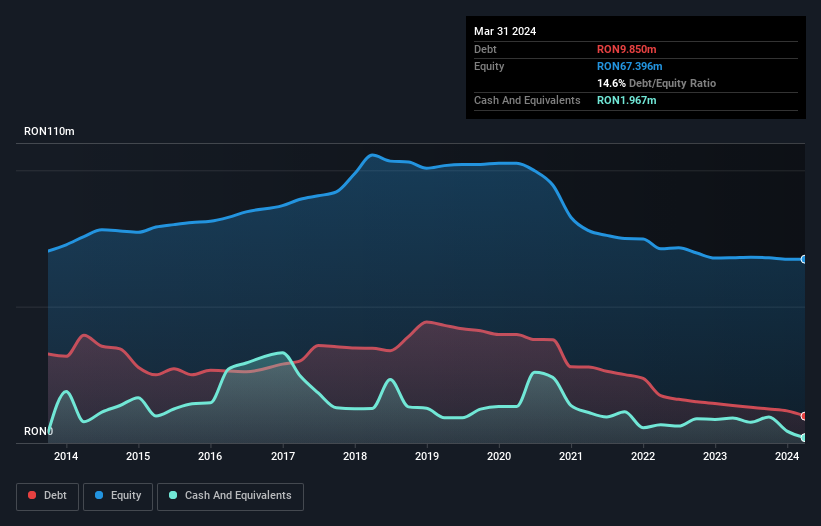

The image below, which you can click on for greater detail, shows that S.C. UAMT had debt of RON9.85m at the end of March 2024, a reduction from RON13.8m over a year. However, because it has a cash reserve of RON1.97m, its net debt is less, at about RON7.88m.

A Look At S.C. UAMT's Liabilities

According to the last reported balance sheet, S.C. UAMT had liabilities of RON12.0m due within 12 months, and liabilities of RON10.3m due beyond 12 months. On the other hand, it had cash of RON1.97m and RON8.29m worth of receivables due within a year. So its liabilities total RON12.1m more than the combination of its cash and short-term receivables.

This deficit isn't so bad because S.C. UAMT is worth RON23.1m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Even though S.C. UAMT's debt is only 1.7, its interest cover is really very low at 1.0. The main reason for this is that it has such high depreciation and amortisation. These charges may be non-cash, so they could be excluded when it comes to paying down debt. But the accounting charges are there for a reason -- some assets are seen to be losing value. In any case, it's safe to say the company has meaningful debt. Sadly, S.C. UAMT's EBIT actually dropped 8.2% in the last year. If earnings continue on that decline then managing that debt will be difficult like delivering hot soup on a unicycle. When analysing debt levels, the balance sheet is the obvious place to start. But it is S.C. UAMT's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Happily for any shareholders, S.C. UAMT actually produced more free cash flow than EBIT over the last two years. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

Neither S.C. UAMT's ability to cover its interest expense with its EBIT nor its EBIT growth rate gave us confidence in its ability to take on more debt. But its conversion of EBIT to free cash flow tells a very different story, and suggests some resilience. Looking at all the angles mentioned above, it does seem to us that S.C. UAMT is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for S.C. UAMT (2 are a bit concerning) you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:UAM

S.C. UAMT

Manufactures and sells other parts and accessories for motor vehicles and motor vehicle engines in Europe and internationally.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026