- Qatar

- /

- Telecom Services and Carriers

- /

- DSM:ORDS

Ooredoo Q.P.S.C. (DSM:ORDS) Third-Quarter Results: Here's What Analysts Are Forecasting For Next Year

Ooredoo Q.P.S.C. (DSM:ORDS) came out with its quarterly results last week, and we wanted to see how the business is performing and what industry forecasters think of the company following this report. Results were roughly in line with estimates, with revenues of ر.ق5.9b and statutory earnings per share of ر.ق0.94. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

See our latest analysis for Ooredoo Q.P.S.C

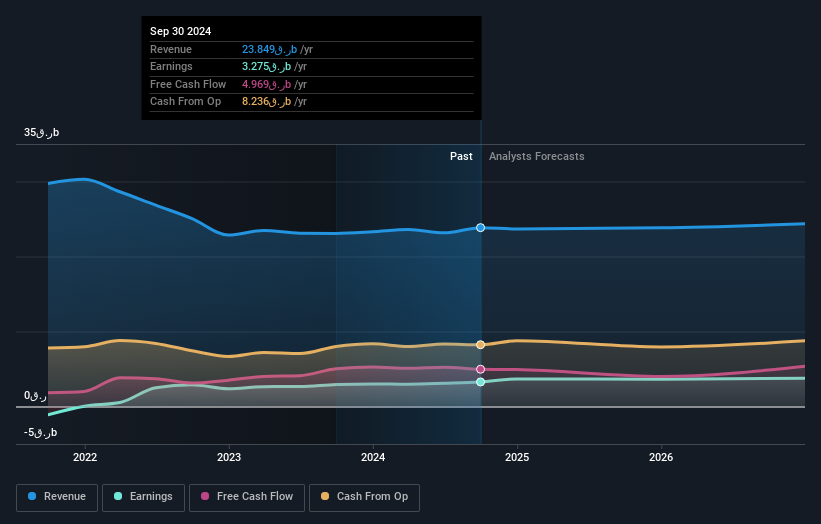

Taking into account the latest results, Ooredoo Q.P.S.C's four analysts currently expect revenues in 2025 to be ر.ق23.8b, approximately in line with the last 12 months. Per-share earnings are expected to expand 11% to ر.ق1.13. In the lead-up to this report, the analysts had been modelling revenues of ر.ق23.7b and earnings per share (EPS) of ر.ق1.13 in 2025. The consensus analysts don't seem to have seen anything in these results that would have changed their view on the business, given there's been no major change to their estimates.

The analysts reconfirmed their price target of ر.ق13.68, showing that the business is executing well and in line with expectations. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on Ooredoo Q.P.S.C, with the most bullish analyst valuing it at ر.ق14.70 and the most bearish at ر.ق13.00 per share. With such a narrow range of valuations, the analysts apparently share similar views on what they think the business is worth.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. We would also point out that the forecast 0.1% annualised revenue decline to the end of 2025 is better than the historical trend, which saw revenues shrink 6.6% annually over the past five years Compare this against analyst estimates for companies in the broader industry, which suggest that revenues (in aggregate) are expected to grow 4.0% annually. So while a broad number of companies are forecast to grow, unfortunately Ooredoo Q.P.S.C is expected to see its revenue affected worse than other companies in the industry.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with the analysts reconfirming that the business is performing in line with their previous earnings per share estimates. Fortunately, the analysts also reconfirmed their revenue estimates, suggesting that it's tracking in line with expectations. Although our data does suggest that Ooredoo Q.P.S.C's revenue is expected to perform worse than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that in mind, we wouldn't be too quick to come to a conclusion on Ooredoo Q.P.S.C. Long-term earnings power is much more important than next year's profits. We have estimates - from multiple Ooredoo Q.P.S.C analysts - going out to 2026, and you can see them free on our platform here.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Ooredoo Q.P.S.C that you need to be mindful of.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DSM:ORDS

Ooredoo Q.P.S.C

Provides telecommunications services in Qatar, rest of the Middle East, Asia, and North Africa region.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion