- Qatar

- /

- Basic Materials

- /

- DSM:QIGD

Returns On Capital At Qatari Investors Group Q.S.C (DSM:QIGD) Paint A Concerning Picture

Ignoring the stock price of a company, what are the underlying trends that tell us a business is past the growth phase? A business that's potentially in decline often shows two trends, a return on capital employed (ROCE) that's declining, and a base of capital employed that's also declining. Trends like this ultimately mean the business is reducing its investments and also earning less on what it has invested. In light of that, from a first glance at Qatari Investors Group Q.S.C (DSM:QIGD), we've spotted some signs that it could be struggling, so let's investigate.

What is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Qatari Investors Group Q.S.C is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.037 = ر.ق155m ÷ (ر.ق4.7b - ر.ق501m) (Based on the trailing twelve months to December 2020).

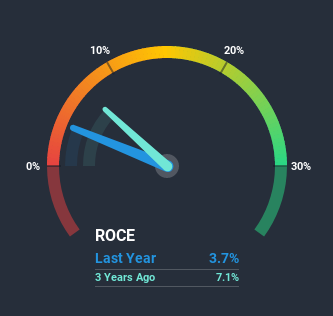

So, Qatari Investors Group Q.S.C has an ROCE of 3.7%. Ultimately, that's a low return and it under-performs the Basic Materials industry average of 9.2%.

View our latest analysis for Qatari Investors Group Q.S.C

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Qatari Investors Group Q.S.C's past further, check out this free graph of past earnings, revenue and cash flow.

How Are Returns Trending?

There is reason to be cautious about Qatari Investors Group Q.S.C, given the returns are trending downwards. About five years ago, returns on capital were 6.7%, however they're now substantially lower than that as we saw above. On top of that, it's worth noting that the amount of capital employed within the business has remained relatively steady. This combination can be indicative of a mature business that still has areas to deploy capital, but the returns received aren't as high due potentially to new competition or smaller margins. So because these trends aren't typically conducive to creating a multi-bagger, we wouldn't hold our breath on Qatari Investors Group Q.S.C becoming one if things continue as they have.

What We Can Learn From Qatari Investors Group Q.S.C's ROCE

In summary, it's unfortunate that Qatari Investors Group Q.S.C is generating lower returns from the same amount of capital. Investors haven't taken kindly to these developments, since the stock has declined 47% from where it was five years ago. With underlying trends that aren't great in these areas, we'd consider looking elsewhere.

Qatari Investors Group Q.S.C does have some risks, we noticed 4 warning signs (and 2 which are concerning) we think you should know about.

While Qatari Investors Group Q.S.C may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

If you’re looking to trade Qatari Investors Group Q.S.C, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Qatari Investors Group Q.P.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About DSM:QIGD

Qatari Investors Group Q.P.S.C

Operates as a diversified conglomerate company in Qatar.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026