I Built A List Of Growing Companies And QLM Life & Medical Insurance Company Q.P.S.C (DSM:QLMI) Made The Cut

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like QLM Life & Medical Insurance Company Q.P.S.C (DSM:QLMI). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for QLM Life & Medical Insurance Company Q.P.S.C

QLM Life & Medical Insurance Company Q.P.S.C's Improving Profits

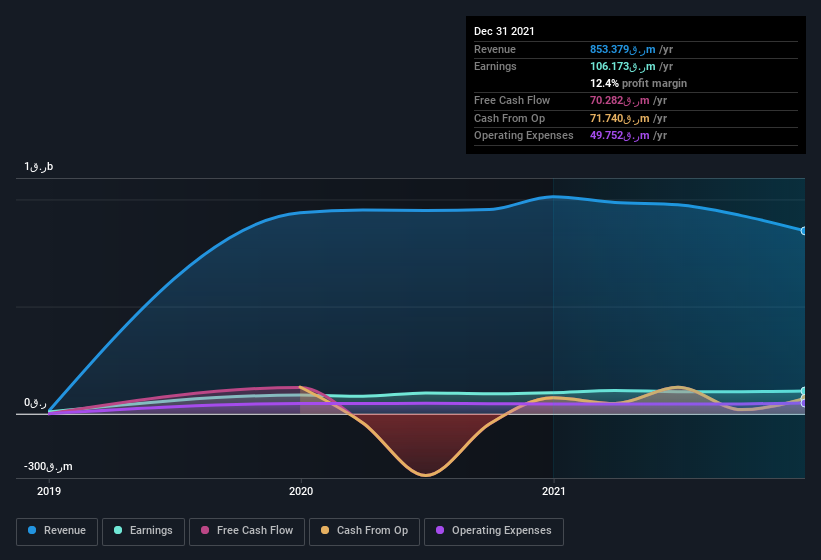

Over the last three years, QLM Life & Medical Insurance Company Q.P.S.C has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Over twelve months, QLM Life & Medical Insurance Company Q.P.S.C increased its EPS from ر.ق0.28 to ر.ق0.30. That's a modest gain of 8.3%.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Unfortunately, QLM Life & Medical Insurance Company Q.P.S.C's revenue dropped 16% last year, but the silver lining is that EBIT margins improved from 10% to 13%. That's not ideal.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check QLM Life & Medical Insurance Company Q.P.S.C's balance sheet strength, before getting too excited.

Are QLM Life & Medical Insurance Company Q.P.S.C Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that QLM Life & Medical Insurance Company Q.P.S.C insiders have a significant amount of capital invested in the stock. Indeed, they hold ر.ق106m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 5.0% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Is QLM Life & Medical Insurance Company Q.P.S.C Worth Keeping An Eye On?

One positive for QLM Life & Medical Insurance Company Q.P.S.C is that it is growing EPS. That's nice to see. If that's not enough on its own, there is also the rather notable levels of insider ownership. That combination appeals to me, for one. So yes, I do think the stock is worth keeping an eye on. Still, you should learn about the 3 warning signs we've spotted with QLM Life & Medical Insurance Company Q.P.S.C (including 2 which are a bit unpleasant) .

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if QLM Life & Medical Insurance Company Q.P.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DSM:QLMI

QLM Life & Medical Insurance Company Q.P.S.C

QLM Life & Medical Insurance Company Q.P.S.C.

Excellent balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.