Widam Food Company Q.P.S.C.'s (DSM:WDAM) Fundamentals Look Pretty Strong: Could The Market Be Wrong About The Stock?

It is hard to get excited after looking at Widam Food Company Q.P.S.C's (DSM:WDAM) recent performance, when its stock has declined 12% over the past month. But if you pay close attention, you might find that its key financial indicators look quite decent, which could mean that the stock could potentially rise in the long-term given how markets usually reward more resilient long-term fundamentals. In this article, we decided to focus on Widam Food Company Q.P.S.C's ROE.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Put another way, it reveals the company's success at turning shareholder investments into profits.

Check out our latest analysis for Widam Food Company Q.P.S.C

How To Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Widam Food Company Q.P.S.C is:

21% = ر.ق85m ÷ ر.ق407m (Based on the trailing twelve months to September 2020).

The 'return' is the income the business earned over the last year. That means that for every QAR1 worth of shareholders' equity, the company generated QAR0.21 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of Widam Food Company Q.P.S.C's Earnings Growth And 21% ROE

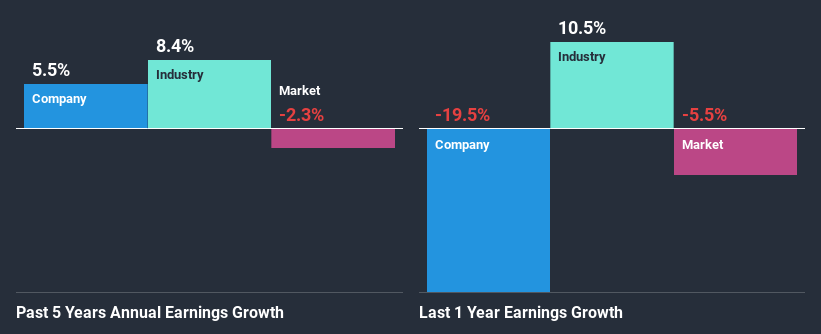

To begin with, Widam Food Company Q.P.S.C seems to have a respectable ROE. Especially when compared to the industry average of 9.2% the company's ROE looks pretty impressive. This certainly adds some context to Widam Food Company Q.P.S.C's decent 5.5% net income growth seen over the past five years.

As a next step, we compared Widam Food Company Q.P.S.C's net income growth with the industry and were disappointed to see that the company's growth is lower than the industry average growth of 7.1% in the same period.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. Is WDAM fairly valued? This infographic on the company's intrinsic value has everything you need to know.

Is Widam Food Company Q.P.S.C Using Its Retained Earnings Effectively?

The high three-year median payout ratio of 59% (or a retention ratio of 41%) for Widam Food Company Q.P.S.C suggests that the company's growth wasn't really hampered despite it returning most of its income to its shareholders.

Moreover, Widam Food Company Q.P.S.C is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years. Our latest analyst data shows that the future payout ratio of the company over the next three years is expected to be approximately 61%. As a result, Widam Food Company Q.P.S.C's ROE is not expected to change by much either, which we inferred from the analyst estimate of 22% for future ROE.

Summary

On the whole, we do feel that Widam Food Company Q.P.S.C has some positive attributes. Its earnings growth is decent, and the high ROE does contribute to that growth. However, investors could have benefitted even more from the high ROE, had the company been reinvesting more of its earnings. Up till now, we've only made a short study of the company's growth data. So it may be worth checking this free detailed graph of Widam Food Company Q.P.S.C's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

If you’re looking to trade Widam Food Company Q.P.S.C, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Widam Food Company Q.P.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About DSM:WDAM

Widam Food Company Q.P.S.C

Imports and trades in livestock, meat, and feed products in the State of Qatar and the Republic of Tanzania.

Moderate risk and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026