- Qatar

- /

- Oil and Gas

- /

- DSM:QFLS

There May Be Reason For Hope In Qatar Fuel Company Q.P.S.C. (WOQOD)'s (DSM:QFLS) Disappointing Earnings

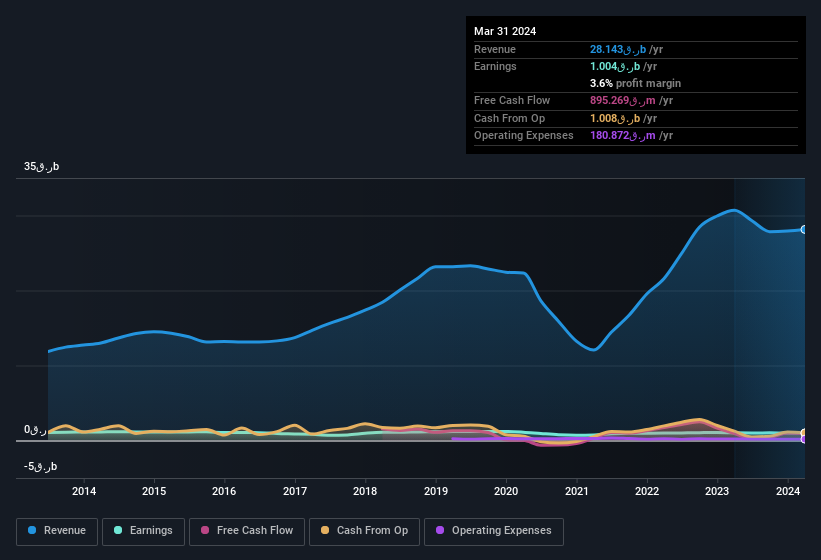

The subdued market reaction suggests that Qatar Fuel Company Q.P.S.C. ("WOQOD")'s (DSM:QFLS) recent earnings didn't contain any surprises. Our analysis suggests that along with soft profit numbers, investors should be aware of some other underlying weaknesses in the numbers.

View our latest analysis for Qatar Fuel Company Q.P.S.C. (WOQOD)

Our Take On Qatar Fuel Company Q.P.S.C. (WOQOD)'s Profit Performance

Therefore, it seems possible to us that Qatar Fuel Company Q.P.S.C. (WOQOD)'s true underlying earnings power is actually less than its statutory profit. If you want to do dive deeper into Qatar Fuel Company Q.P.S.C. (WOQOD), you'd also look into what risks it is currently facing. For example - Qatar Fuel Company Q.P.S.C. (WOQOD) has 2 warning signs we think you should be aware of.

Our examination of Qatar Fuel Company Q.P.S.C. (WOQOD) has focussed on certain factors that can make its earnings look better than they are. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Qatar Fuel Company Q.P.S.C. (WOQOD) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DSM:QFLS

Qatar Fuel Company Q.P.S.C. (WOQOD)

Sells, markets, and distributes oil, gas, and refined petroleum products in State of Qatar.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.