- Qatar

- /

- Construction

- /

- DSM:IGRD

The one-year decline in earnings for Estithmar Holding Q.P.S.C DSM:IGRD) isn't encouraging, but shareholders are still up 22% over that period

The simplest way to invest in stocks is to buy exchange traded funds. But you can significantly boost your returns by picking above-average stocks. To wit, the Estithmar Holding Q.P.S.C. (DSM:IGRD) share price is 22% higher than it was a year ago, much better than the market decline of around 13% (not including dividends) in the same period. So that should have shareholders smiling. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

Although Estithmar Holding Q.P.S.C has shed ر.ق592m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for Estithmar Holding Q.P.S.C

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the last twelve months, Estithmar Holding Q.P.S.C actually shrank its EPS by 0.6%.

The mild decline in EPS may be a result of the fact that the company is more focused on other aspects of the business, right now. It makes sense to check some of the other fundamental data for an explanation of the share price rise.

However the year on year revenue growth of 54% would help. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

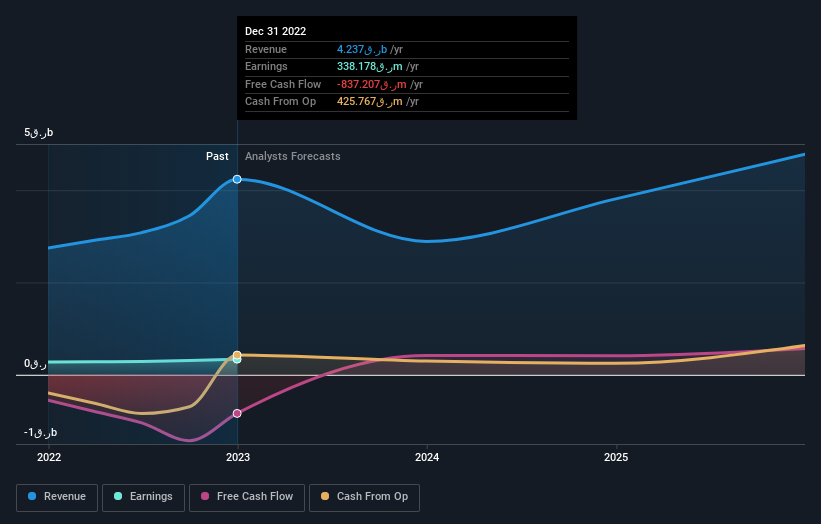

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Estithmar Holding Q.P.S.C's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Estithmar Holding Q.P.S.C shareholders have gained 22% over the last year. A substantial portion of that gain has come in the last three months, with the stock up 14% in that time. This suggests the company is continuing to win over new investors. It's always interesting to track share price performance over the longer term. But to understand Estithmar Holding Q.P.S.C better, we need to consider many other factors. Take risks, for example - Estithmar Holding Q.P.S.C has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Qatari exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Estithmar Holding Q.P.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DSM:IGRD

Estithmar Holding Q.P.S.C

Engages in contracting services in Qatar and internationally.

Proven track record with mediocre balance sheet.

Market Insights

Community Narratives