- Qatar

- /

- Construction

- /

- DSM:IGRD

Estithmar Holding Q.P.S.C.'s (DSM:IGRD) Popularity With Investors Is Under Threat From Overpricing

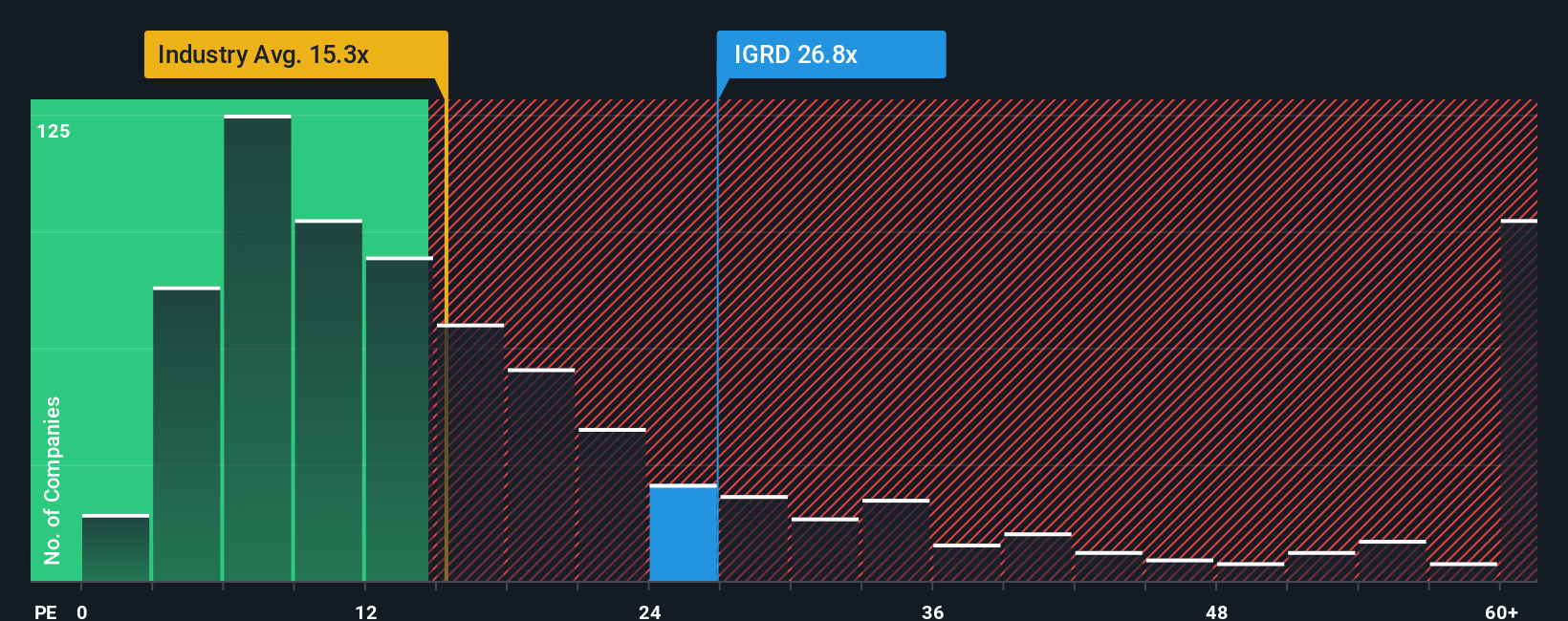

Estithmar Holding Q.P.S.C.'s (DSM:IGRD) price-to-earnings (or "P/E") ratio of 26.8x might make it look like a strong sell right now compared to the market in Qatar, where around half of the companies have P/E ratios below 13x and even P/E's below 11x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times have been quite advantageous for Estithmar Holding Q.P.S.C as its earnings have been rising very briskly. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Estithmar Holding Q.P.S.C

How Is Estithmar Holding Q.P.S.C's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Estithmar Holding Q.P.S.C's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 30%. The latest three year period has also seen a 27% overall rise in EPS, aided extensively by its short-term performance. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 7.7% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised earnings results.

In light of this, it's curious that Estithmar Holding Q.P.S.C's P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than recent times would indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as a continuation of recent earnings trends would weigh down the share price eventually.

What We Can Learn From Estithmar Holding Q.P.S.C's P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Estithmar Holding Q.P.S.C currently trades on a higher than expected P/E since its recent three-year growth is only in line with the wider market forecast. When we see average earnings with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Plus, you should also learn about this 1 warning sign we've spotted with Estithmar Holding Q.P.S.C.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Estithmar Holding Q.P.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DSM:IGRD

Estithmar Holding Q.P.S.C

Engages in contracting services in Qatar and internationally.

Solid track record with mediocre balance sheet.

Market Insights

Community Narratives