Investors in Qatar National Bank (Q.P.S.C.) (DSM:QNBK) have made a respectable return of 90% over the past five years

If you want to compound wealth in the stock market, you can do so by buying an index fund. But in our experience, buying the right stocks can give your wealth a significant boost. For example, the Qatar National Bank (Q.P.S.C.) (DSM:QNBK) share price is 62% higher than it was five years ago, which is more than the market average. Zooming in, the stock is actually down 3.0% in the last year.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

Our analysis indicates that QNBK is potentially undervalued!

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

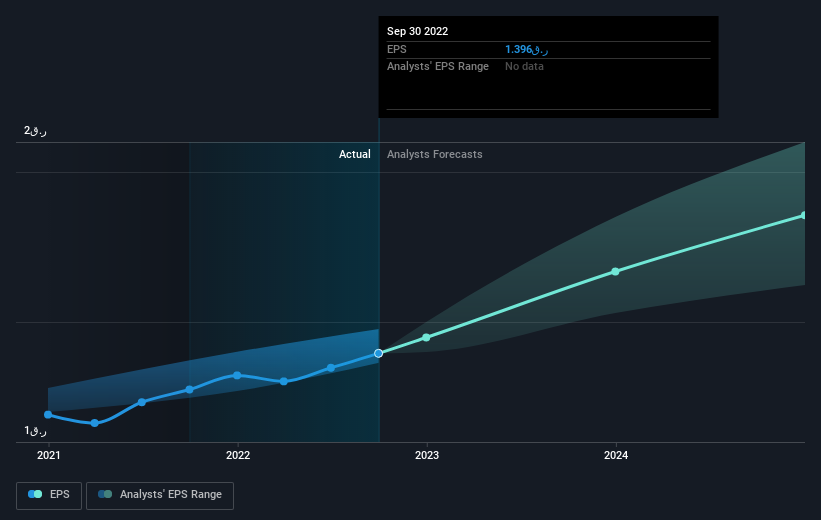

Over half a decade, Qatar National Bank (Q.P.S.C.) managed to grow its earnings per share at 0.6% a year. This EPS growth is slower than the share price growth of 10% per year, over the same period. This suggests that market participants hold the company in higher regard, these days. That's not necessarily surprising considering the five-year track record of earnings growth.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It might be well worthwhile taking a look at our free report on Qatar National Bank (Q.P.S.C.)'s earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Qatar National Bank (Q.P.S.C.) the TSR over the last 5 years was 90%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Investors in Qatar National Bank (Q.P.S.C.) had a tough year, with a total loss of 0.5% (including dividends), against a market gain of about 3.6%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 14% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Qatar National Bank (Q.P.S.C.) better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for Qatar National Bank (Q.P.S.C.) you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on QA exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Qatar National Bank (Q.P.S.C.) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DSM:QNBK

Qatar National Bank (Q.P.S.C.)

Provides conventional and Islamic banking products and services in Qatar, Europe, North America, rest of GCC countries, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success